Decentralized finance (DeFi) exercise on Ethereum is choosing up momentum primarily based primarily on how gasoline charges have been trending within the first three weeks of November, information from Kaiko shows. Even so, regardless of Uniswap (UNI) spearheading the revival, trying on the gasoline attributed to its actions over this era, UNI costs stay stagnant under $5.6, with bulls failing to edge greater, breaking to new 2023 highs.

Ethereum Fuel Charges Rising, DeFi Revival?

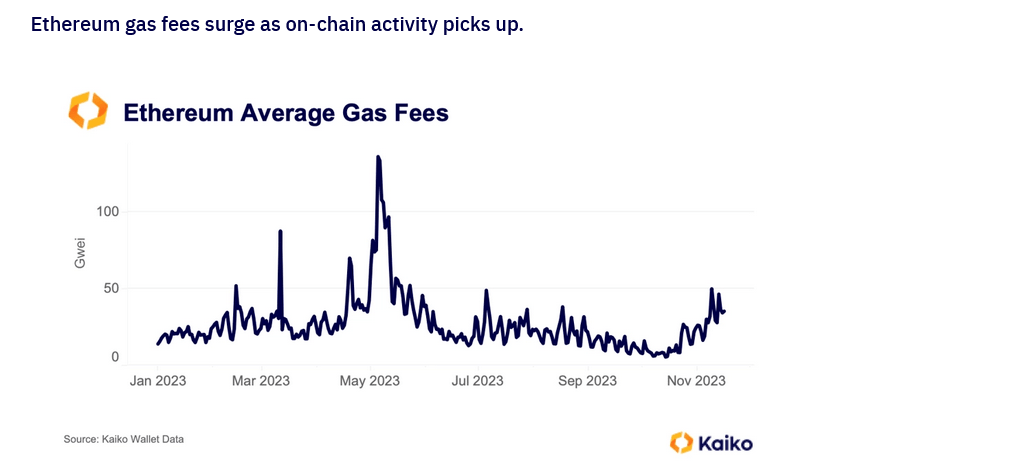

In line with Kaiko, a blockchain analytics platform, the typical gasoline charges on Ethereum hit multi-month highs final week. The platform expressly notes that the first driver has been Uniswap’s actions, studying from the rising transaction volumes from meme cash, together with GROK. This, in flip, pushed block house demand greater, rising gasoline charges.

Fuel charges stay risky however typically greater within the first three weeks of November. As of November 20, Ycharts data reveals that the typical value of sending a transaction stood at 45.13 Gwei, almost 100% from November 19, when it was at 24.84 Gwei. This can be a vital bounce from 17.66 Gwei in late October 2023.

Fuel charges and the way ETH and DeFi token costs react are immediately correlated as DeFi and different on-chain actions like non-fungible token (NFT) minting and buying and selling rise; gasoline charges normally increase in trending markets.

Accordingly, the current growth in gasoline charges might counsel that the markets might be getting ready for a leg up, and tokens of vital protocols, together with Uniswap or Aave, may gain advantage.

DeFi TVL Rising, However Uniswap Is Caught Beneath $5.6

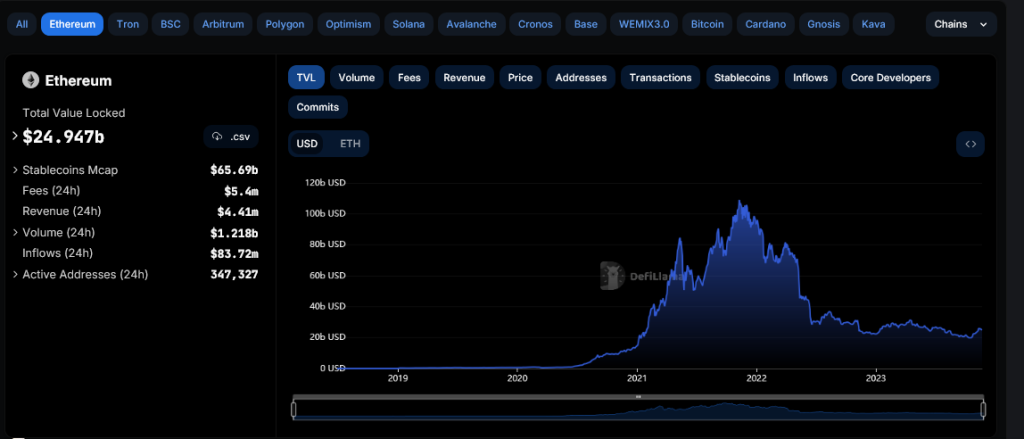

As of writing, the overall worth locked (TVL) throughout all DeFi protocols stands at over $46.6 billion as of November 21, based on DeFiLlama. This improve is sort of $5 billion greater than in early November and up from $37 billion in mid-October.

Ethereum stays a selection platform for deploying DeFi apps regardless of the comparatively gasoline charges pinned to mainnet scaling challenges. The pioneer good contract blockchain manages $25.4 billion in TVL, whereas Uniswap is without doubt one of the largest protocols with $3.216 billion in TVL.

UNI costs are up 30% from mid-October when writing on November 21. Nevertheless, bulls have been unable to interrupt above the November highs at round $5.6. From the each day chart, buying and selling quantity, and thus participation, has been tapering although costs have been edging greater.

This formation means that the uptrend was behind low momentum and sustainability. Technically, there might be extra beneficial properties if there’s a strong shut above November highs with increasing volumes. In that case, UNI might increase, retesting 2023 highs of round $7.2.

Function picture from Canva, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site completely at your individual danger.