On-chain information means that whales are accumulating massive quantities of Maker (MKR) and Aave (AAVE), two main decentralized finance (DeFi) tokens. This accumulation development coincides with a broader cooling-off interval within the crypto scene days after america Securities and Alternate Fee (SEC) accredited 11 spot Bitcoin ETFs.

Whales Accumulate MKR And AAVE

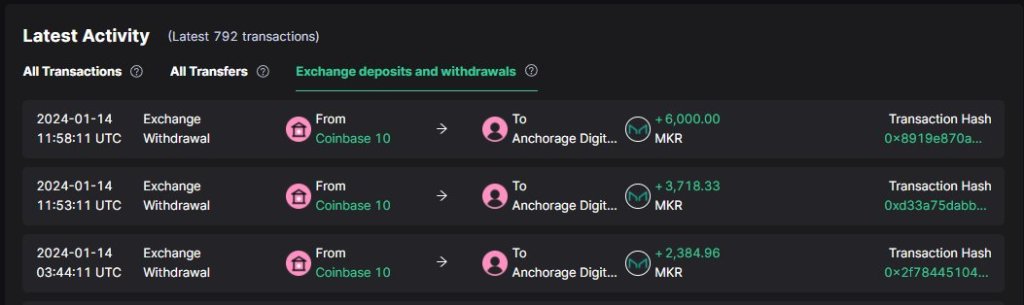

In line with ScopeScan data, Anchorage Digital, a digital asset custody agency, bought a major quantity of MKR on January 15. The agency acquired 12,103 MKR tokens, valued at roughly $24.7 million, from Coinbase, a number one crypto trade in america.

Two whales, “0xbb5f” and “0x4a7,” additionally gathered massive portions of MKR and AAVE. Particularly, “0xbb5f” purchased 50,000 AAVE and a pair of,452 MKR value round $5.03 million and $4.95 million from Binance, a number one cryptocurrency trade. In the meantime, 0x4a7 bought 39,000 AAVE and a pair of,350 MKR, valued at roughly $3.95 million and $4.75 million, additionally from Binance.

These whale purchases sign a robust perception within the long-term potential of MKR and AAVE. Maker and Aave are two of the world’s main decentralized lending and borrowing protocols throughout DeFi. MKR serves because the governance token for MakerDAO, which additionally manages the DAI decentralized stablecoin. However, AAVE is the governance token of Aave, a prime decentralized lending platform.

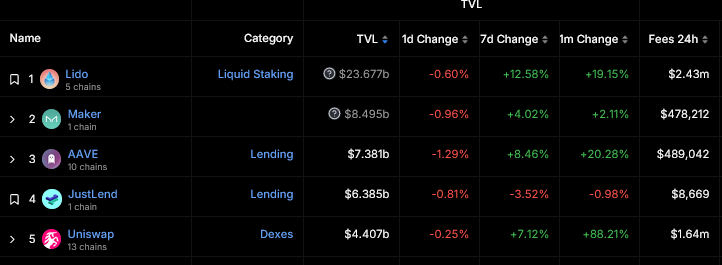

In line with the newest DeFiLlama data, Maker and Aave have whole worth locked (TVL) of over $8.4 billion and $7.3 billion, respectively.

Notably, whales are accumulating MKR and AAVE when the DeFi scene is recovering following the sharp contraction from 2022. The trade manages over $56 billion, with Ethereum internet hosting extra liquid DeFi protocols, together with Lido DAO when writing in mid-January 2024.

Will Maker and Aave Rally To New 2024 Highs On Recovering DeFi?

Final yr, MKR and AAVE have been among the many top-performing DeFi tokens, with MKR rising by over 200% and AAVE appreciating by greater than 150%. Protocol-specific fundamentals, together with the launch of Spark in Maker, partly drove this sturdy efficiency.

Aave launched the GHO stablecoin and the Lens protocol on the Ethereum sidechain, Polygon. Furthermore, expectations of the spot Bitcoin ETF compelled aggressive merchants to contemplate prime DeFi protocols, lifting altcoins.

As whales accumulate, there’s extra headroom for these tokens to develop. Presently, AAVE and MKR are decrease, based mostly on their respective efficiency within the every day chart. Nevertheless, overly, the uptrend stays. For example, MKR is inside a bullish breakout formation with a essential assist degree of round $1,560. Any surge previous $2,300 would possibly ignite demand, lifting the token to new 2024 highs.

Characteristic picture from Canva, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal threat.