Bitcoin Spot Exchange-Traded Funds (ETFs) have as soon as once more garnered the eye of crypto fans and traders because the merchandise have witnessed a whopping $10 billion in whole buying and selling quantity within the first three days of buying and selling.

Bitcoin Spot ETF Sees Vital Uptick In Day 3 Buying and selling

The event was revealed by Bloomberg Intelligence analyst James Seyffart on the social media platform X (previously Twitter). The knowledge shared by the analyst demonstrates a agency need for publicity to digital property through regulated monetary markets.

Seyffart’s X submit delves in on the info from the “Bitcoin ETF Cointucky Derby.” In keeping with the analyst, “ETFs traded virtually $10 billion in whole over the previous 3 days.”

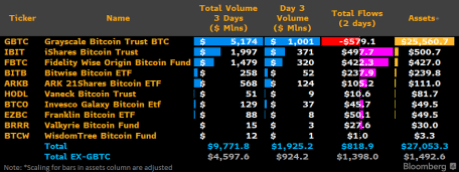

The analyst additionally offered a digital report of the info to additional elaborate on the substantial buying and selling quantity. With a complete quantity of over $5 billion, Grayscale Bitcoin Trust (GBTC) stands out as the highest performer among the many notable monetary corporations.

In the meantime, iShares Bitcoin Belief (IBIT) and Constancy Smart Origin Bitcoin Fund (FBTC) come subsequent in line. The information exhibits that the monetary corporations witnessed an general buying and selling quantity of $1.997 billion and $1.479 billion, respectively.

ARK’s 21Shares ETF (ARKB) and Bitwise Bitcoin ETF (BTTB) adopted behind with a considerable whole buying and selling quantity of $568 million and $258 million, respectively. This spike in buying and selling quantity signifies that each institutional and particular person traders are rising extra comfortable using conventional funding engines to commerce BTC.

Though Grayscale’s Bitcoin fund continues to realize the very best general buying and selling quantity, the fund has seen important withdrawals from traders looking for to decrease their publicity.

There have been withdrawals totaling greater than $579 million since Grayscale began buying and selling on January 11. At present, Grayscale remains to be thought of the “Liquidity King” of the Bitcoin spot ETFs.

Nevertheless, Bloomberg analyst Eric Balchunas anticipates that Blackrock would possibly oversee Grayscale to assert the title. “IBIT preserving result in be one almost definitely to overhaul GBTC as Liquidity King,” he said.

3-Day Buying and selling Surpassed 500 ETFs In 2023

Following the report, Eric Balchunas has provided a context for the huge surge of those merchandise. The analyst did so by evaluating the buying and selling quantity of BTC ETFs to all of the ETFs that have been launched in 2023.

“Let me put into context how insane $10b in quantity is within the first 3 days. There have been 500 ETFs launched in 2023,” Balchunas said. In keeping with him, the five hundred ETFs accomplished a $450 million mixed quantity as we speak, and the very best one did $45 million.

As well as, Balchunas highlighted that Blackrock‘s BTC ETF demonstrates a greater efficiency than the five hundred ETFs. “IBIT alone is seeing extra exercise than your entire ’23 Freshman Class,” he said. It’s noteworthy that half of the ETFs launched in 2023 recorded an general buying and selling quantity of “lower than $1 million” as we speak.

Balchunas additionally careworn the issue in buying quantity, noting that it’s more durable than flows and property. It is because the amount has to return genuinely within the market, which provides an “ETF lasting energy.”

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site completely at your individual threat.