The Bitcoin (BTC) value has skilled a big downturn over the previous 24 hours, falling under the essential $70,000 threshold. After reaching a peak of $73,620 on Tuesday, the cryptocurrency has declined by roughly 5.7%, hitting a low of $68,830 on Friday. Analysts level to a number of key elements behind this decline:

#1 Danger-Off Sentiment Forward of US Election

The timing of Bitcoin’s value drop coincides with a narrowing lead for former President Donald Trump over Democratic candidate Vice President Kamala Harris in prediction markets corresponding to Polymarket and Kalshi, the place customers guess on election outcomes. Bitcoin has been thought-about a “Trump hedge” because of the former president’s robust advocacy for the cryptocurrency sector.

Donald Trump has proposed establishing a “strategic Bitcoin reserve” in america if re-elected. Talking on the Bitcoin 2024 Convention, he outlined plans to retain all Bitcoin at present held or acquired by the US authorities as a part of this reserve. This initiative is a core ingredient of his marketing campaign to strengthen the US as a frontrunner, aiming to make the nation the “crypto capital of the planet.”

Associated Studying

Earlier within the week, when Trump’s lead over Harris was extra substantial, Bitcoin neared its all-time excessive of $73,777. The shrinking of Trump’s lead seems to have prompted traders to undertake a risk-off stance, contributing to the value decline.

Crypto analyst HornHairs noted that derisking earlier than elections has precedent. “Derisking into the election 5-6 days earlier than it takes place occurred in each 2020 and 2016. Value then went on to by no means retest the lows set the week earlier than the election ever once more. Watch out what you promote right here,” he remarked through X.

#2 S&P 500 Loses 3-Month Trendline

The correlation between Bitcoin and conventional monetary markets might have additionally influenced BTC’s value motion. The S&P 500 has fallen to its lowest stage since October 9, doubtlessly affecting investor sentiment within the crypto house.

Analysts from The Kobeissi Letter noticed that regardless of main tech corporations like Apple reporting robust earnings, their inventory costs have declined. “One more tech big to beat earnings however commerce decrease,” they noted, including that know-how shares confronted widespread promoting at the same time as Meta, Amazon, and Apple exceeded earnings expectations. They added, It seems that markets are de-risking forward of the election subsequent week. Brace for volatility.”

Associated Studying

Crypto dealer Marco Johanning highlighted issues concerning the S&P 500 shedding its three-month trendline. “On condition that the S&P 500 misplaced the 3-months trendline yesterday, it seems to be extra like a possible selloff earlier than the US election on Tuesday and decrease costs within the brief time period. The right bounce stage is the 7-month trendline (blue). I don’t need to see costs under the POC/key stage round 63k (crimson),” he wrote through X.

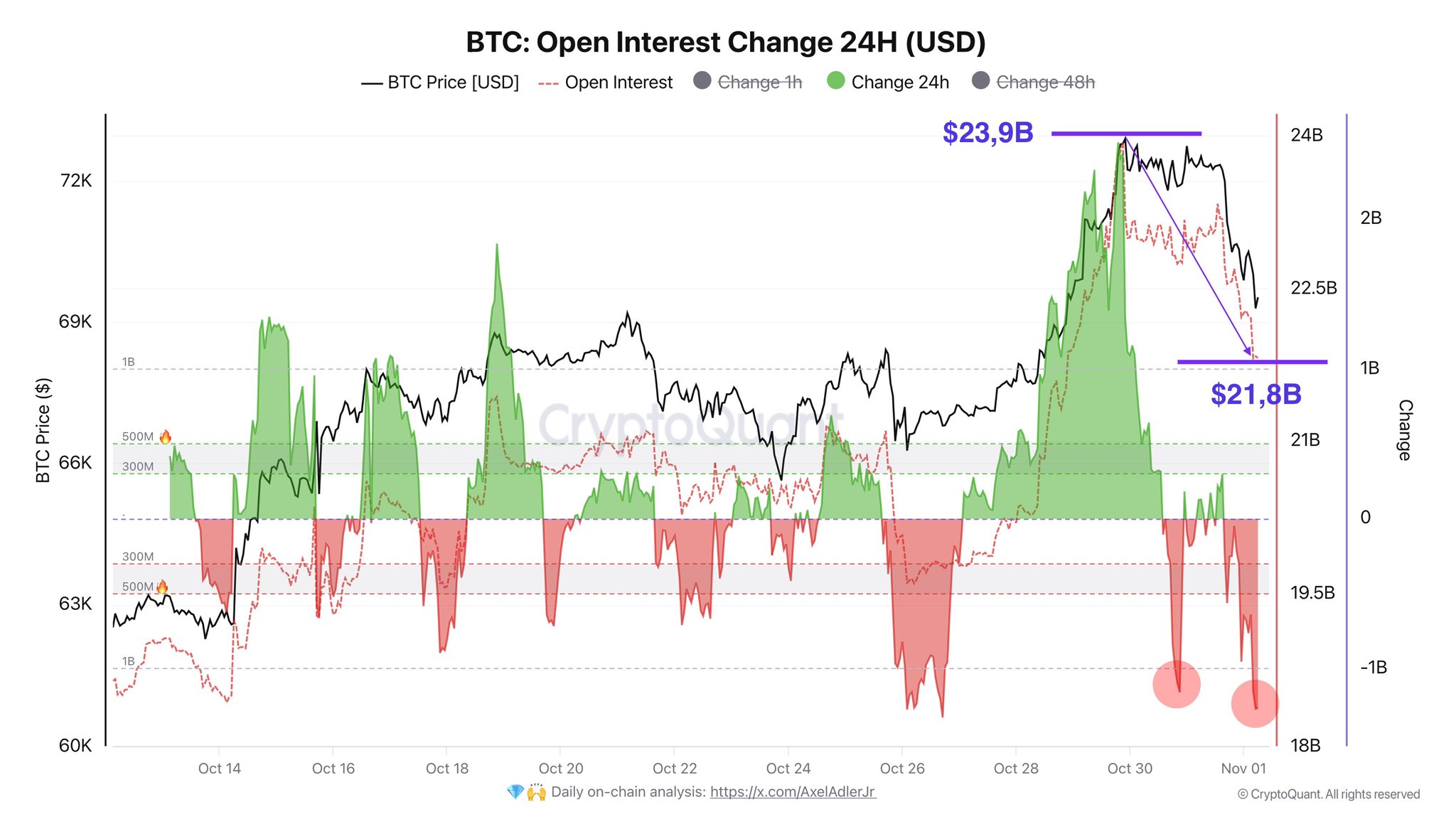

#3 Leverage Flush Out

A big unwinding of leveraged positions within the markets has additionally contributed to Bitcoin’s value decline. The market correction seems to be a wholesome response to an overextension pushed by leverage.

Famend crypto analyst Miles Deutscher famous: “This pullback is regular (and anticipated). Market was trying overextended the previous few days, and largely pushed by leverage. Nonetheless not shopping for heavy because it isn’t a full cascade but—will watch for a kind of days across the election. Not a nasty DCA day for sure cash tho.”

Austin Reid, International Head of Income & Enterprise at crypto prime brokerage agency FalconX, identified that the crypto derivatives market was “on hearth” forward of the election, with futures open curiosity for BTC, ETH, and SOL crossing the $50 billion mark for the primary time.

On-chain analyst Axel Adler Jr reported that open curiosity was reduced by $2.1 billion, implying a big leverage flush out.

In keeping with data from Coinglass, over the previous 24 hours, 93,864 merchants had been liquidated, with complete liquidations amounting to $286.73 million. The most important single liquidation order occurred on Binance’s BTCUSDT pair, valued at $11.26 million. For Bitcoin alone, $81.38 million in lengthy positions had been liquidated—the biggest quantity since October 1.

At press time, BTC traded at $69,446.

Featured picture created with DALL.E, chart from TradingView.com