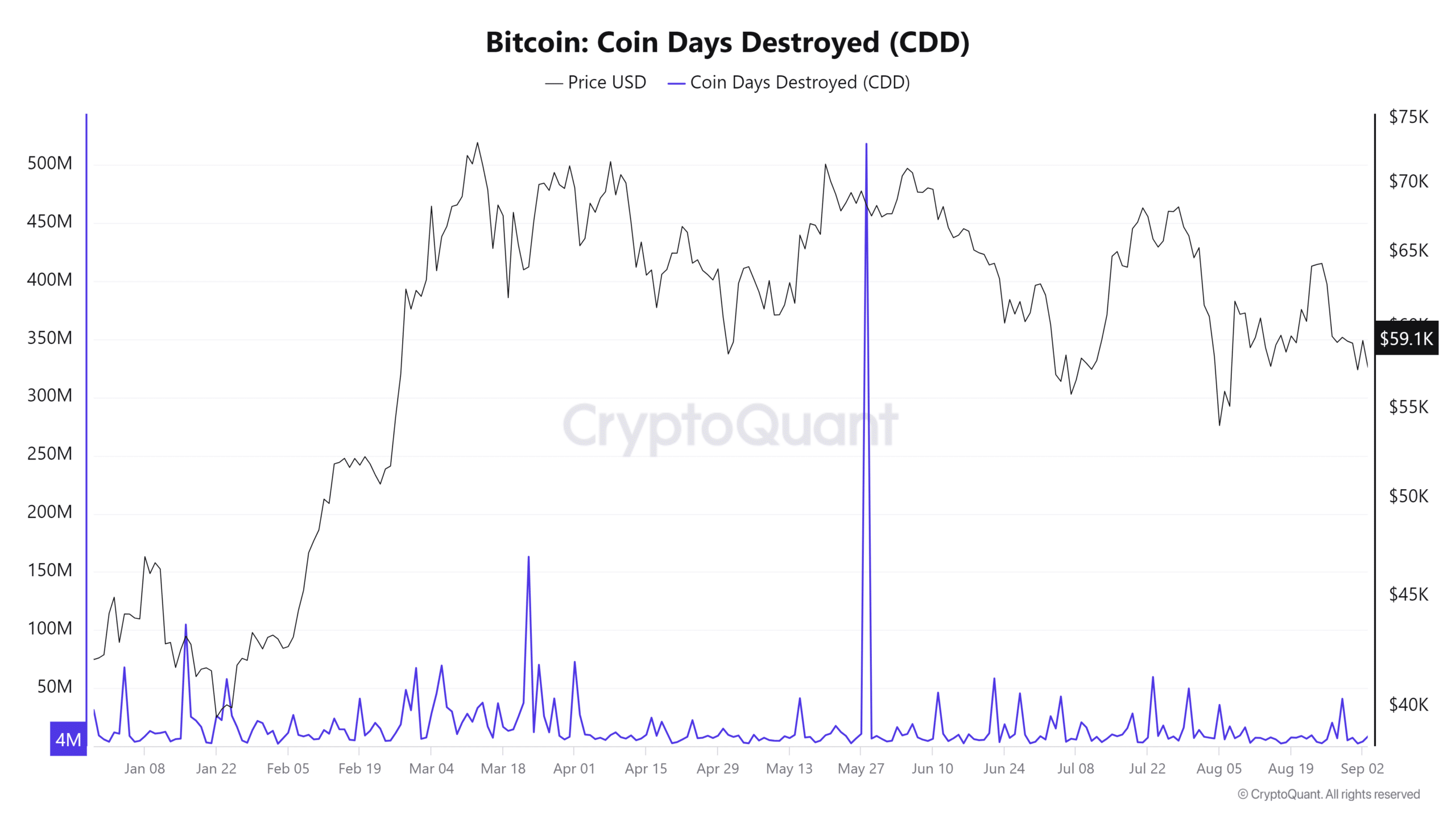

- The BTC CDD recommended that the development was nonetheless beneath essential ranges

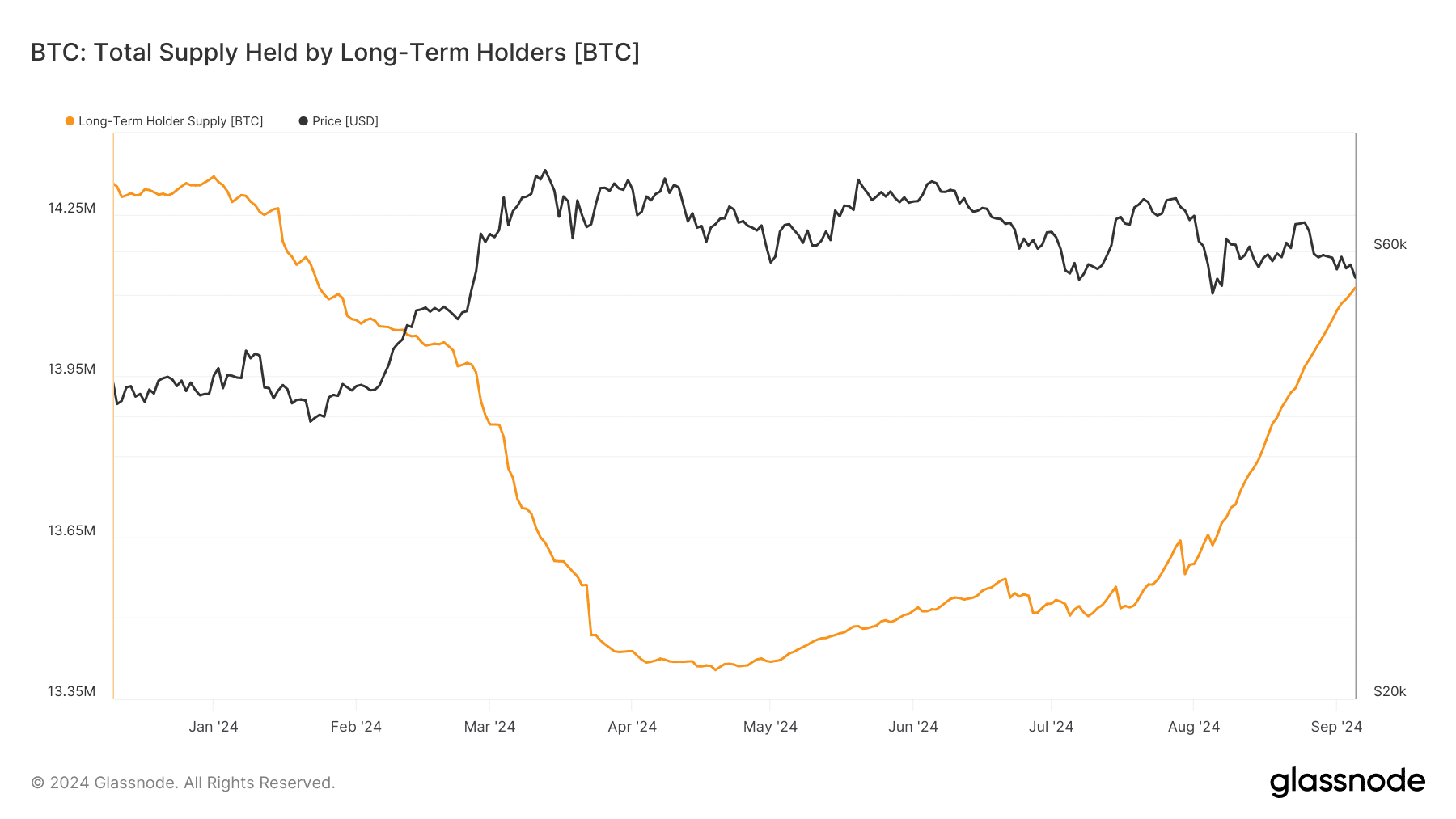

- Lengthy-term holders have amassed round 1 million BTC since July

In March 2024, Bitcoin hit a brand new all-time excessive. It has since sparked debates amongst traders about whether or not this marked the height of the bull market or not. Now, whereas some argue this could possibly be the ultimate prime, on-chain information suggests in any other case.

In reality, metrics like Coin Days Destroyed (CDD) appeared to point that the market should still have room for additional upside.

Bitcoin’s prime in but?

In March 2024, Bitcoin noticed a notable spike within the Coin Days Destroyed (CDD) metric, signaling that some long-term holders took income across the all-time excessive. Nevertheless, further analysis revealed that the CDD has not but reached the essential “crimson zone.” This zone sometimes indicators the ultimate market prime.

What this implies is that whereas the March peak represented a major interim excessive, it seemingly wasn’t the last word peak of the present cycle. By extension, the development within the CDD metric indicated that there’s nonetheless potential for additional value hikes within the coming months.

CDD is a vital on-chain metric that tracks the motion of older, long-held Bitcoin. It gives insights into when long-term holders are promoting, giving a clearer image of the market’s maturity and attainable future traits.

The truth that the CDD is but to succeed in its peak implies that the bull market should still have room to develop. Particularly with long-term holders displaying warning however not absolutely exiting.

Lengthy-term holders proceed to build up Bitcoin

An evaluation of Bitcoin Lengthy-term Holders (LTH) provide information from Glassnode additionally revealed a optimistic sentiment that aligns with the development noticed within the Coin Days Destroyed (CDD) metric.

In response to the identical, these long-term holders started rising their accumulation in July, when Bitcoin’s value began to say no.

Between 19 July and 06 September, the provision of Bitcoin held by long-term holders has grown considerably, rising from roughly 13.5 million BTC to over 14.1 million BTC. This accumulation development means that long-term holders keep confidence in Bitcoin’s long-term prospects, regardless of the latest value drop, and usually are not exiting their positions.

This rising provide is an indication that long-term holders are capitalizing on the decrease costs, reinforcing the idea that the market nonetheless has room for additional upside. Particularly as these key traders proceed to carry and accumulate, moderately than promote.

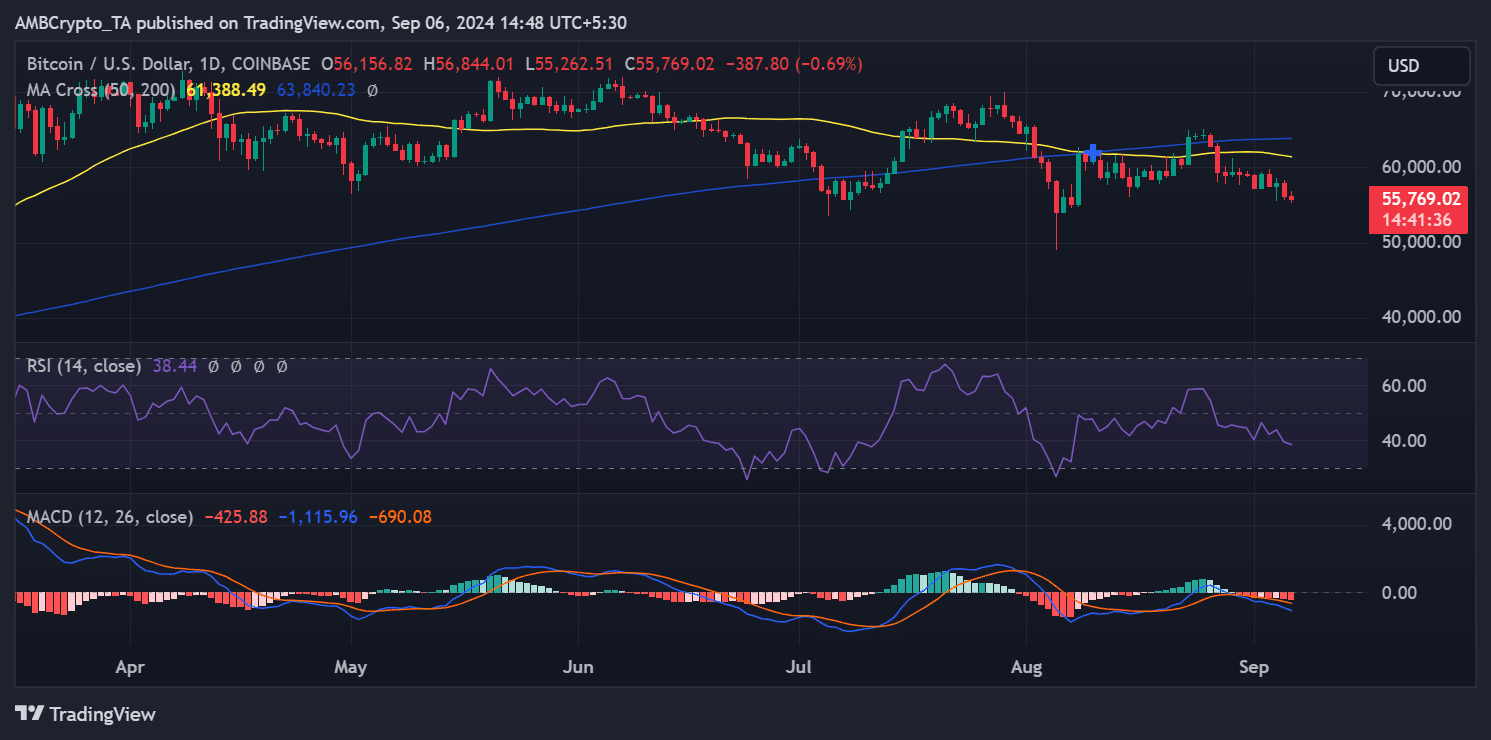

BTC falls additional down the charts

Bitcoin’s value wrestle has persevered, with AMBCrypto’s evaluation of its every day chart displaying a decline of over 3% within the final buying and selling session. The decline introduced its value all the way down to round $56,000. On the time of writing, the decline appeared to proceed with an extra 0.7% drop, pushing the worth to roughly $55,700.

The Relative Power Index (RSI) for Bitcoin had dropped barely beneath 40, indicating that it entered the oversold zone. Merely put, promoting strain could have peaked, which might sign a possible value rebound shortly.

– Learn Bitcoin (BTC) Price Prediction 2024-25

Nevertheless, regardless of the continued value decline, the optimistic development in Bitcoin’s Lengthy-Time period Holder (LTH) provide might encourage additional accumulation at this value stage.

As long-term holders proceed to construct their positions, it might present assist for the worth. This could doubtlessly result in stabilization and even restoration, because the market digests the downtrend.