- Spot market demand leads Bitcoin’s upward momentum.

- BTC has declined by 2.46% over the previous 24 hours.

Over the previous month, Bitcoin [BTC] has skilled a sustained uptrend, hitting a brand new ATH of $108268.

This uptrend has left key stakeholders deliberating over elements behind it. Inasmuch, CryptoQuant analysts have cited rising spot market demand as the foremost issue pushing BTC’s costs up.

Bitcoin’s spot market demand soars

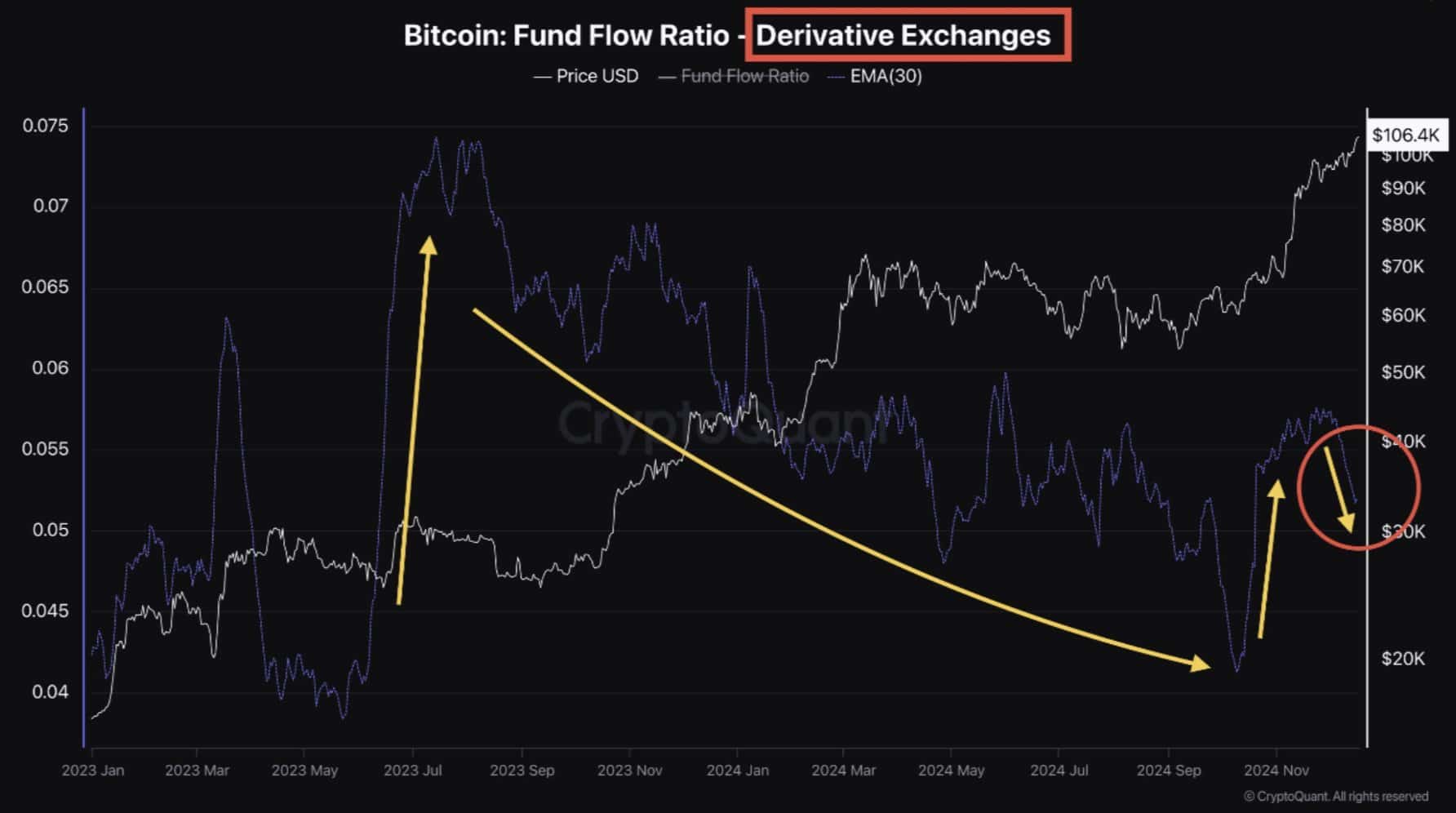

In his evaluation, Avocado on-chain posited that Bitcoin’s bull cycle is both pushed by the Futures market or the spot market.

As such, the 2023 bull run was pushed by the Futures market adopted by a spike in spot market exercise, thus driving costs up.

Nonetheless, the spot and Futures market noticed a chronic decline from March 2024 to September. In October 2024, Bitcoin noticed an increase in buying and selling volumes for each markets, which has since pushed costs as much as new ATH.

Whereas Futures market demand has declined over the previous month, spot market demand continues to extend.

This surge in spot market demand means that speculative extra within the Futures market is cooling, whereas shopping for stress within the spot market is gaining momentum.

Subsequently, Futures markets will proceed to expertise a cycle of liquidations and overheating, thus leading to BTC’s worth development. As such, this worth motion will encourage additional capital inflows into the spot market.

Typically, a surge in spot market demand pushes an asset’s worth up by way of the next shopping for stress.

Affect on BTC

Normally, an increase in shopping for stress results in larger costs. Nonetheless, Bitcoin has skilled a market correction over the previous day.

In actual fact, as of this writing, Bitcoin was buying and selling at $103825, a 2.46% decline in every day charts. Regardless of the dip, the market is frequently experiencing larger demand, particularly within the spot market.

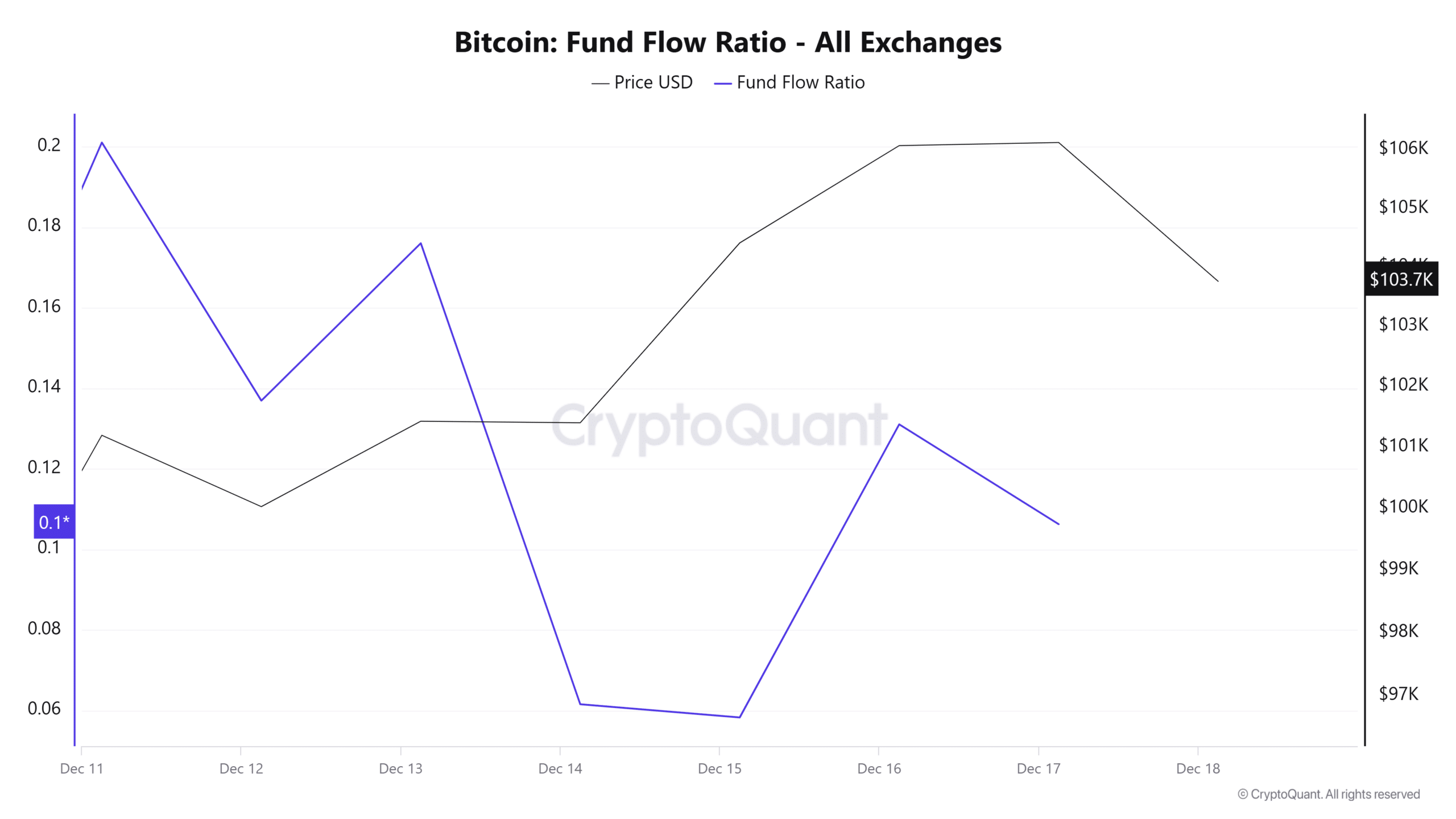

This surge in spot market demand is clear by way of the decline in fund circulate ratio. Notably, customers are withdrawing funds from exchanges and holding them in personal wallets.

It is a bullish sign displaying diminished change exercise, which correlates with long-term market confidence.

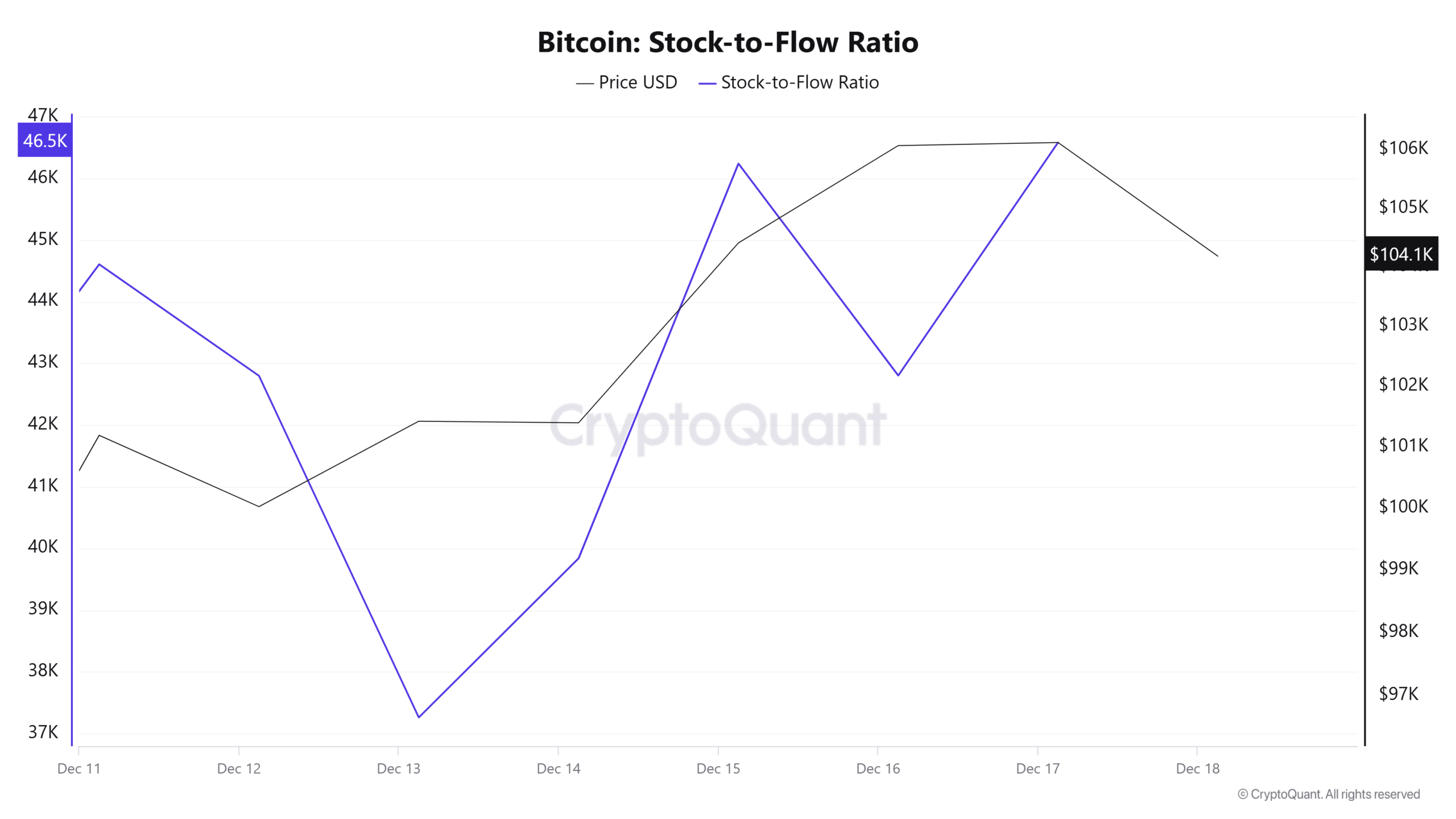

Moreover, Bitcoin’s stock-to-flow ratio has spiked to 46.5k after declining to 37k. A surge in SFR suggests a spike in BTC shortage.

This exhibits that the provision of the property is lowering whereas the demand will increase. When demand rises amidst rising shortage, it causes a provide squeeze, thus driving costs up.

Learn Bitcoin Price Prediction 2024–2025

Merely put, a surge in Bitcoin’s spot market demand positions the crypto for extra positive aspects on its worth charts by way of the next shopping for stress. Subsequently, if this demand continues, costs will proceed rising.

If that’s the case, we might see BTC reclaim $106,000 and push in direction of a brand new excessive. Subsequently, if the correction witnessed over the previous day persists, the king coin will decline to $102630 earlier than one other uptrend.