The Bitcoin worth started Friday, August 16 from beneath the $57,000 stage, following a sudden 7% fall on Thursday. Whereas the premier cryptocurrency is exhibiting good indicators of restoration, a outstanding crypto analyst has defined how the newest price decline might have pushed the BTC worth right into a bearish part.

Bitcoin MVRV Drops Under 1-Yr SMA – Influence On Value?

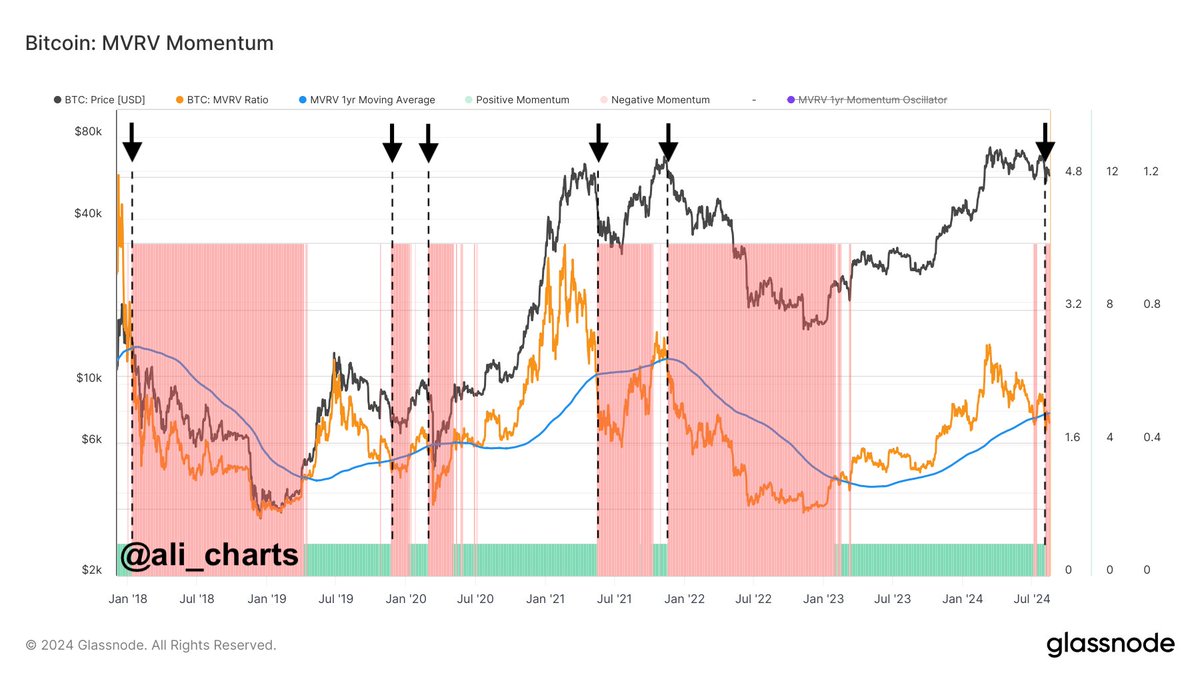

In a publish on the X platform, fashionable crypto analyst Ali Martinez shared that the Bitcoin worth has skilled a shift in its cycle following the newest worth dip. This on-chain revelation is predicated on the Glassnode MVRV (Market Worth to Realized Worth) Momentum indicator, which serves as a software for figuring out macro market tendencies.

The MVRV Momentum indicator primarily consists of the MVRV ratio and the 1-year easy transferring common (SMA). When the MVRV ratio breaks above this SMA, it signifies a transition into the bull market. In the meantime, a break beneath the 1-year easy transferring common alerts a shift to the bearish part.

Usually, sturdy breaches above the MVRV 1-year SMA recommend that giant volumes of Bitcoin had been acquired beneath the present worth, exhibiting that the holders at the moment are in revenue. On the flip aspect, when there’s a sturdy break beneath the transferring common, it signifies that giant volumes of BTC had been bought above the present worth, with the holders within the purple.

A chart exhibiting the Bitcoin worth and the MVRV momentum indicator | Supply: Ali_charts/X

In line with Martinez, the BTC cycle transitioned to a bearish part after the Bitcoin worth slumped beneath $61,500. This newest important break of the MVRV ratio beneath the SMA reveals {that a} important quantity of BTC was acquired above $61,500. Nevertheless, the cash at the moment are in loss, which can probably result in heavy distribution by buyers who need to reduce their losses.

When numerous investors are in the red, there’s an elevated stress to promote, which might put additional downward stress on the Bitcoin worth. In the end, this might result in a scenario the place falling costs lead to extra asset offloading, thereby strengthening the momentum of the bearish part.

Bitcoin Value At A Look

As of this writing, the price of Bitcoin continues to hover round $59,000, reflecting a 2.5% improve previously 24 hours. However, the premier cryptocurrency is down by almost 3% on the weekly timeframe, in accordance with information from CoinGecko.

The value of Bitcoin hovers across the $59,000 stage on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView