Dogecoin has seen a bounce of over 12% throughout the previous day, however this development brewing in an on-chain indicator may spell a bearish finish to the run.

Dogecoin Traders Have Been Displaying Indicators Of FOMO Just lately

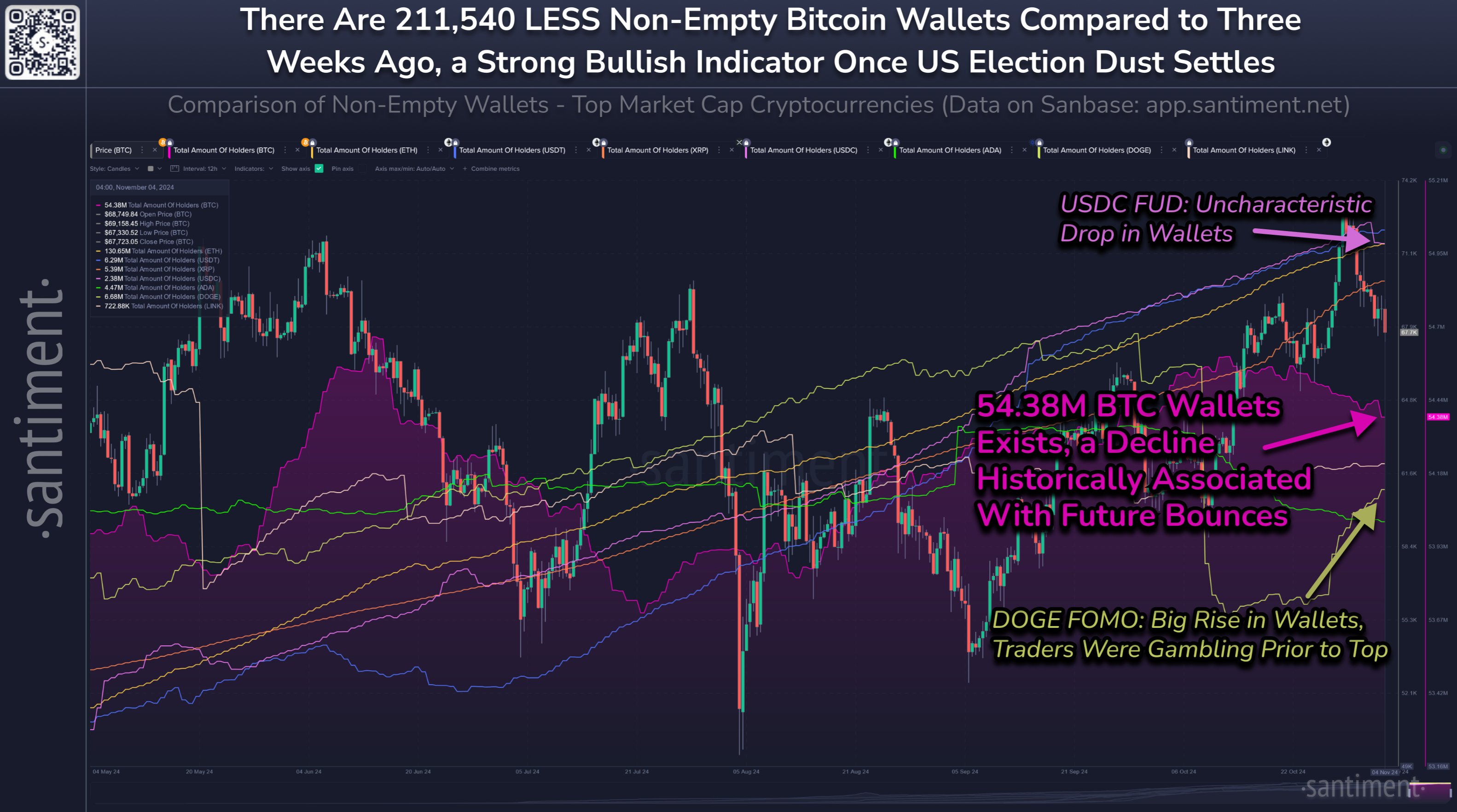

In a brand new post on X, the on-chain analytics agency Santiment has mentioned about how the development within the Whole Quantity of Holders has been like for the assorted prime cash within the cryptocurrency sector.

Associated Studying

The “Total Amount of Holders” right here refers to an indicator that, as its title suggests, retains observe of the overall variety of addresses on a given community which can be carrying a non-zero steadiness.

When the worth of this metric rises, it means new traders are becoming a member of the blockchain or previous ones who had bought earlier are shopping for again into the coin. The indicator additionally registers a rise at any time when present customers divide their holdings into a number of wallets for functions like privateness.

Normally, all three of those elements are concurrently at play at any time when this development develops, so some web adoption of the asset could possibly be assumed to be happening.

However, the indicator happening suggests a few of the holders have determined to filter their wallets, probably as a result of they wish to get away from the cryptocurrency.

Now, here’s a chart that exhibits the development within the Whole Quantity of Holders for Bitcoin, Dogecoin, and different prime property:

As displayed within the above graph, a lot of the property have registered a rise in Whole Quantity of Holders not too long ago, however Bitcoin has gone towards the grain as its non-zero wallets have declined as an alternative.

Extra notably, the primary cryptocurrency at the moment hosts 211,500 much less addresses in comparison with three weeks in the past, which has introduced the metric’s worth to 54.38 million.

Because of this some traders of the asset don’t consider the present rally would proceed additional, as they’ve determined to liquidate their holdings on the latest costs.

Traditionally, property within the sector have tended to be delicate to investor sentiment, however the relationship has been an inverse one: costs are inclined to go up when traders are displaying FUD, whereas they go down in occasions of FOMO.

Thus, the latest drop within the Whole Quantity of Holders may very well show to be a bullish signal for Bitcoin. From the chart, it’s seen that the metric has proven the alternative trajectory for Dogecoin, as 46,400 addresses with a steadiness have confirmed up on the community previously week alone.

Associated Studying

“It is a signal of merchants speculating and playing on meme cash, even after final week’s native prime,” notes the analytics agency. Going by what historical past tells us, this FOMO will not be one of the best signal for Dogecoin.

DOGE Value

Dogecoin has continued its newest bullish push over the past 24 hours as its worth has damaged past the $0.168 mark. Given the FOMO that has been growing, nevertheless, this run will not be sustainable.

Featured picture from Dall-E, Santiment.web, chart from TradingView.com