- Bitcoin lately registered a significant interval of worth stabilization after an prolonged interval of consolidation

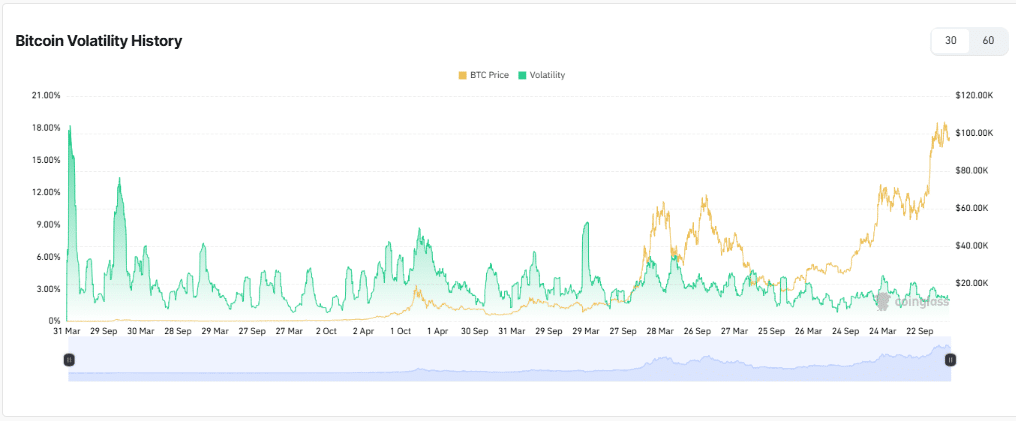

- Its volatility has fallen in latest weeks, alongside its worth motion on the charts

Bitcoin [BTC] lately underwent a interval of worth stabilization, sometimes called sideways motion – A section that has traditionally preceded a surge in retail investor curiosity. After an prolonged interval of consolidation although, Bitcoin could also be getting ready to a constructive shift now, with rising retail demand poised to drive its worth larger.

A shift in direction of progress and market optimism

During the last 30 days, retail investor exercise for Bitcoin has declined by roughly 2% – A notable lower in comparison with the 20% drop in January.

Such a moderation in retail demand signifies that the market has reached a degree of stabilization, setting the stage for potential progress. Additionally, at press time, evaluation highlighted the 30-day change in retail demand, revealing how earlier durations of progress in demand have been linked with worth hikes.

The smaller decline in retail exercise over the previous month may point out that the consolidation section is nearing its finish. As retail demand begins to develop once more, it might create a constructive shift in market sentiment, favoring Bitcoin’s worth within the brief time period.

Bitcoin’s sturdy foundations for future progress

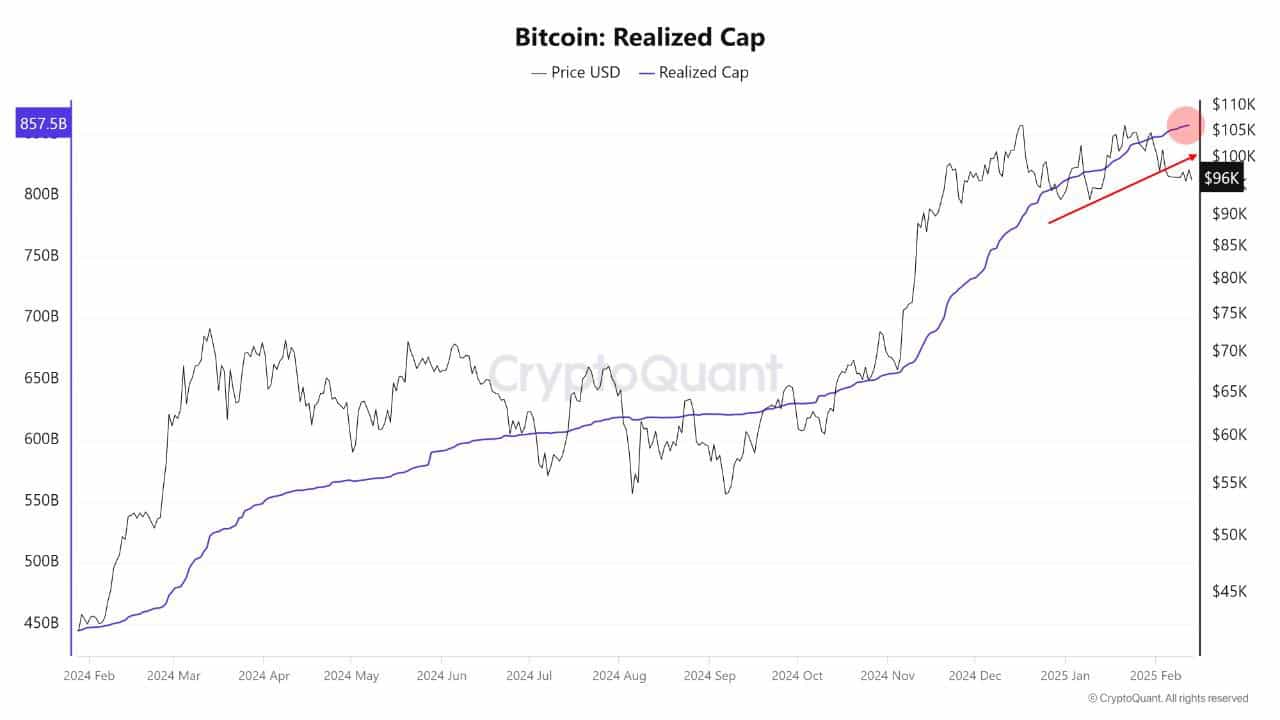

Bitcoin’s realized market cap lately hit an all-time excessive of $857 billion. This achievement merely reinforces the continued power of Bitcoin’s bull cycle – An indication of sturdy market well being regardless of occasional worth corrections.

Actually, long-term holders are capitalizing on larger costs, signaling confidence within the asset’s long-term worth. Concurrently, new buyers are coming into the market and absorbing promote stress, whereas sustaining upward momentum.

This interaction between long-term holders and new buyers signifies that bullish sentiment for Bitcoin has remained sturdy. This additionally helps the probability of sustained worth progress within the close to time period.

Affect of worthwhile positions on worth

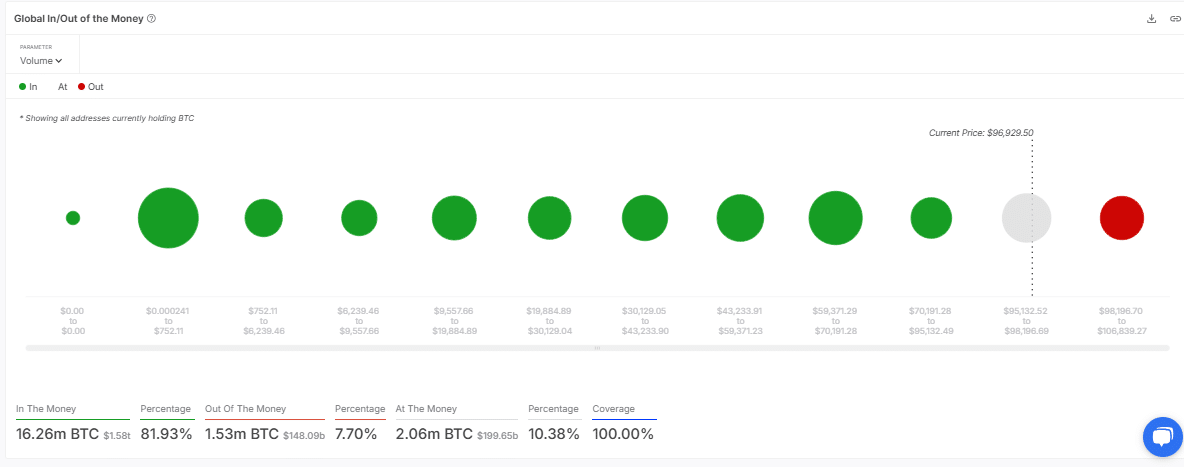

In accordance with an evaluation of Bitcoin’s International In/Out of the Cash metric, the crypto’s worth of roughly $96,929.50 has positioned a good portion of addresses ‘Within the Cash.’ Such a discovering additionally hinted that many buyers are in worthwhile positions proper now.

This typically triggers a worry of lacking out (FOMO) sentiment, with potential patrons in search of to enter the market earlier than additional positive aspects happen.

Fewer ‘Out of the Cash’ addresses scale back promoting stress, doubtlessly permitting for a extra secure and constant worth hike. The prevailing state of affairs appeared to indicate {that a} favorable ratio of worthwhile positions may additional contribute to momentum in Bitcoin’s worth.

A precursor to potential to extra upside?

Lastly, Bitcoin’s volatility has fallen in latest weeks, alongside its worth motion. Since durations of decrease volatility typically precede vital worth actions, it may be assumed that the market could also be consolidating earlier than a breakout.

This mix of low volatility, excessive market cap, and constructive retail demand is essential for BTC’s price action. A fall in volatility, mixed with different bullish indicators, could be a precursor to a bullish pattern, with Bitcoin doubtlessly breaking out of its consolidation section.