Crypto analyst Grasp Ananda has asserted that the underside is in for the Bitcoin worth following its massive crash below $80,000 final week. In step with this, the analyst revealed what to anticipate subsequent from the flagship crypto.

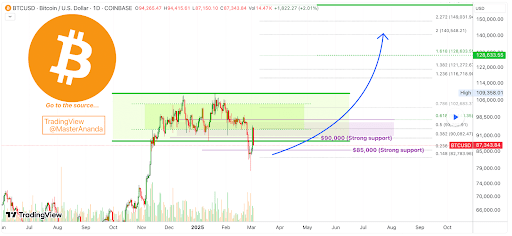

In a TradingView post, Grasp Ananda claimed that the underside is in based mostly on the present Bitcoin worth motion. He acknowledged that final week’s drop, touch-and-go, is the proper backside sign. The analyst additional remarked that $78,300 will be taken as the underside, which represents a 28% decline from BTC’s all-time high (ATH) of $109,000.

Associated Studying

Grasp Ananda additionally famous that this was a traditional retrace, as there all the time is one after a robust bullish breakout. He defined that this traditional retrace is nice for the Bitcoin worth as a result of the flagship crypto will take its time to construct up energy. The analyst added that taking time to develop is nice, and is the one means it could possibly work if BTC is to maneuver larger in the long run.

In the meantime, as to what’s subsequent for the Bitcoin worth, the crypto analyst acknowledged that on common, every day worth will increase of $500 or $800 can reveal how lengthy it can take to achieve larger costs and better ranges within the coming months. Grasp Ananda then urged that the flagship crypto could reach $200,000 subsequent month.

Grasp Ananada then suggested market members to purchase and maintain seeing because the low is in for the Bitcoin worth. He added that the market is giving a second alternative, as market members have the prospect to purchase at comparatively low costs. The crypto analyst additionally talked about that BTC is in an accumulation part and asserted that it’ll go up and proceed to develop within the long-term.

BTC Regaining Momentum

Crypto analyst Titan of Crypto additionally affirmed that the Bitcoin worth is regaining momentum. He famous that BTC has reacted strongly to the Kijun appearing as assist on the weekly chart. The analyst added {that a} weekly shut above the Tenkan at round $94,000 would verify a shift in momentum and reinforce the bullish case for the flagship crypto.

Associated Studying

In the meantime, in one other X submit, the analyst asserted that the Bitcoin bull market remains to be on. He claimed that there was no bear market in sight in keeping with the Supertrend indicator. As such, the analyst believes that it isn’t but time to be bearish. His accompanying chart urged that the Bitcoin worth may nonetheless rally to above $200,000 earlier than the bear market kicks in.

On the time of writing, the Bitcoin worth is buying and selling at round $92,000, up over 5% within the final 24 hours, in keeping with data from CoinMarketCap.

Featured picture from LinkedIn, chart from Tradingview.com