- BTC has reclaimed the $63K vary, fueled by a brief squeeze, sparking market anticipation.

- But, a considerable breakout stays unlikely.

The market is buzzing with anticipation as Bitcoin [BTC] reclaims the important $63K mark. BTC was buying and selling at $63,413 at press time, signaling the potential for a robust This fall breakout.

This restoration follows a quick bout of volatility attributable to external components. Now, stakeholders seem to have regained management of the market, positioning Bitcoin for its subsequent huge transfer.

But, considerations loom as BTC stays inclined to pressures from the by-product market, which might expose it to sudden swings, thwarting any makes an attempt at a bullish reversal.

BTC grapples with growing speculative management

Fortunately for BTC, the speculative dominance stays low at 2.5%, maintaining its long-term outlook comparatively secure.

Nonetheless, there’s a rising development of merchants seeking to quick Bitcoin over shorter timeframes.

If this development continues to construct, it may trigger BTC to be excessively influenced by by-product devices, undermining hopes of pushing the value above $100K by subsequent 12 months.

Apparently, when BTC hit its ATH of $73K in March, open curiosity (OI) surged previous the 30-billion mark for the primary time, reaching a staggering $36.44 billion.

Simply three months later, on July 28, OI climbed to an ATH of $37.22 billion, which overheated the market and despatched BTC again right down to $54K inside only a week.

The accompanying lengthy pink candles on the day by day chart vividly depicted the size of losses incurred throughout that cycle. At present, OI is growing at an analogous tempo, resting at $34.33 billion at press time.

In keeping with AMBCrypto, this development may sign a reversal of the cycle by pushing buyers right into a state of maximum greed and indicating the danger of market overheating.

Shorts resurgence poses a critical risk

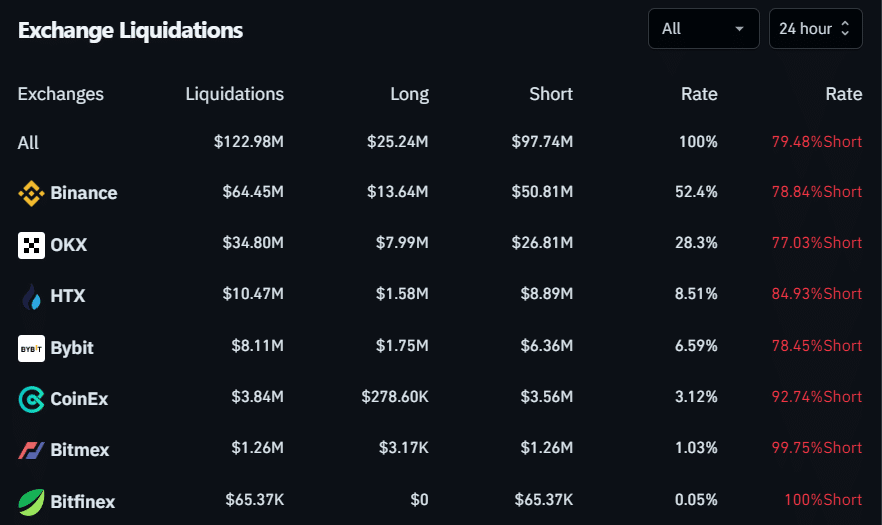

The final 24 hours have seen a big wave of quick liquidations, hitting a 100% fee on the Bitfinex alternate whereas Bitcoin examined the $63K stage.

This means that the current rise in worth could have come from quick positions closing, forcing merchants to purchase again BTC. Usually, this sudden spike in demand usually results in a near-term worth correction.

Whereas this example alerts a bullish development with lengthy positions dominating the by-product market, the probability of changing the near-term correction ($63K) right into a long-term reversal ($75K) stays elusive.

This concern is heightened by the expected resurgence of quick positions, which appears imminent given the overextended OI ranges.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

In essence, Bitcoin finds itself in a susceptible state. If it succumbs to by-product stress – which appears possible – it could encounter rejection close to $64K, harking back to the August rally.

The rising variety of merchants shorting BTC over quick timeframes threatens the potential for $64K to flip to assist. This necessitates cautious monitoring of the by-product area.