- BTC might hit a brand new ATH within the subsequent three months, per a macro analyst.

- The True MVRV worth was at 1.7, suggesting slight room for progress earlier than BTC hits a neighborhood peak.

Bitcoin [BTC] has consolidated round $105K for 4 days, signaling a buildup for an additional rally or a possible pullback.

However analysts have made worth requires $135K-$200K within the subsequent 3–6 months, citing enhancing macro entrance.

On the twelfth of Might, BTC dumped 4% from $105K to $100.7K, a typical sell-the-news after the US-China commerce deal.

Nevertheless, the asset reversed the losses on the thirteenth of Might after a modest 0.2% month-on-month April CPI inflation print, towards the anticipated 0.3%.

The annual price got here in at 2.3%, falling under the forecasted 2.4%, a constructive outlook on Fed price reduce expectations from Q3.

Low inflation, constructive macro to gas BTC?

In an e-mail assertion, 21Shares crypto funding specialist David Hernandez advised AMBCrypto,

“If this trajectory (easing inflation, nation-state adoption) continues, worth targets of $200,000 by year-end now appear more and more life like.”

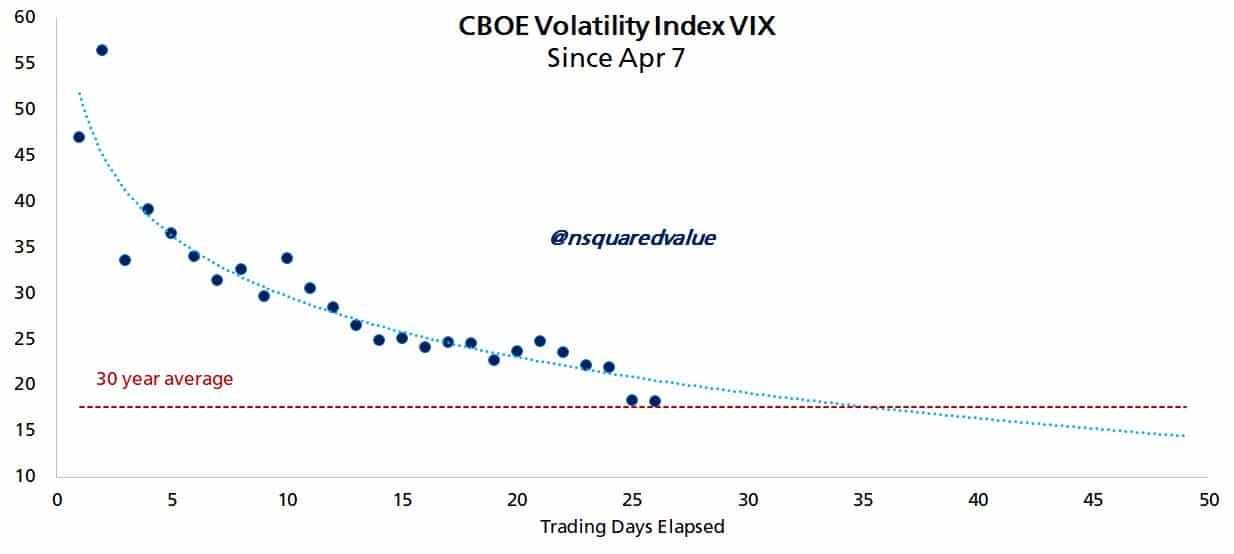

Likewise, Timothy Peterson, a BTC community analyst, noted that the US-China commerce deal triggered the VIX (volatility index) to drop to a ‘regular’ 30-year common.

The VIX decline and decrease inflation had been an ideal set-up for a ‘risk-on’ rally, added Peterson.

“Inflation simply got here in decrease than anticipated. This shall be a ‘danger on’ setting for the foreseeable future.”

For these unfamiliar, VIX tracks future worth swings and, by extension, the market worry gauge.

Merely put, with the US-China tariff struggle out of the way in which, market worry (larger VIX) has been changed by risk-on (decrease VIX) sentiment.

In an X post on the first of Might, Peterson highlighted {that a} potential VIX dip to 18 might push BTC to $107K in 3 weeks and +$135K in 100 days.

“A continuation of this path, and VIX <= 18, implies Bitcoin at $107k in 2-3 weeks and $135,000+ in 100 days.”

What’s subsequent within the brief time period?

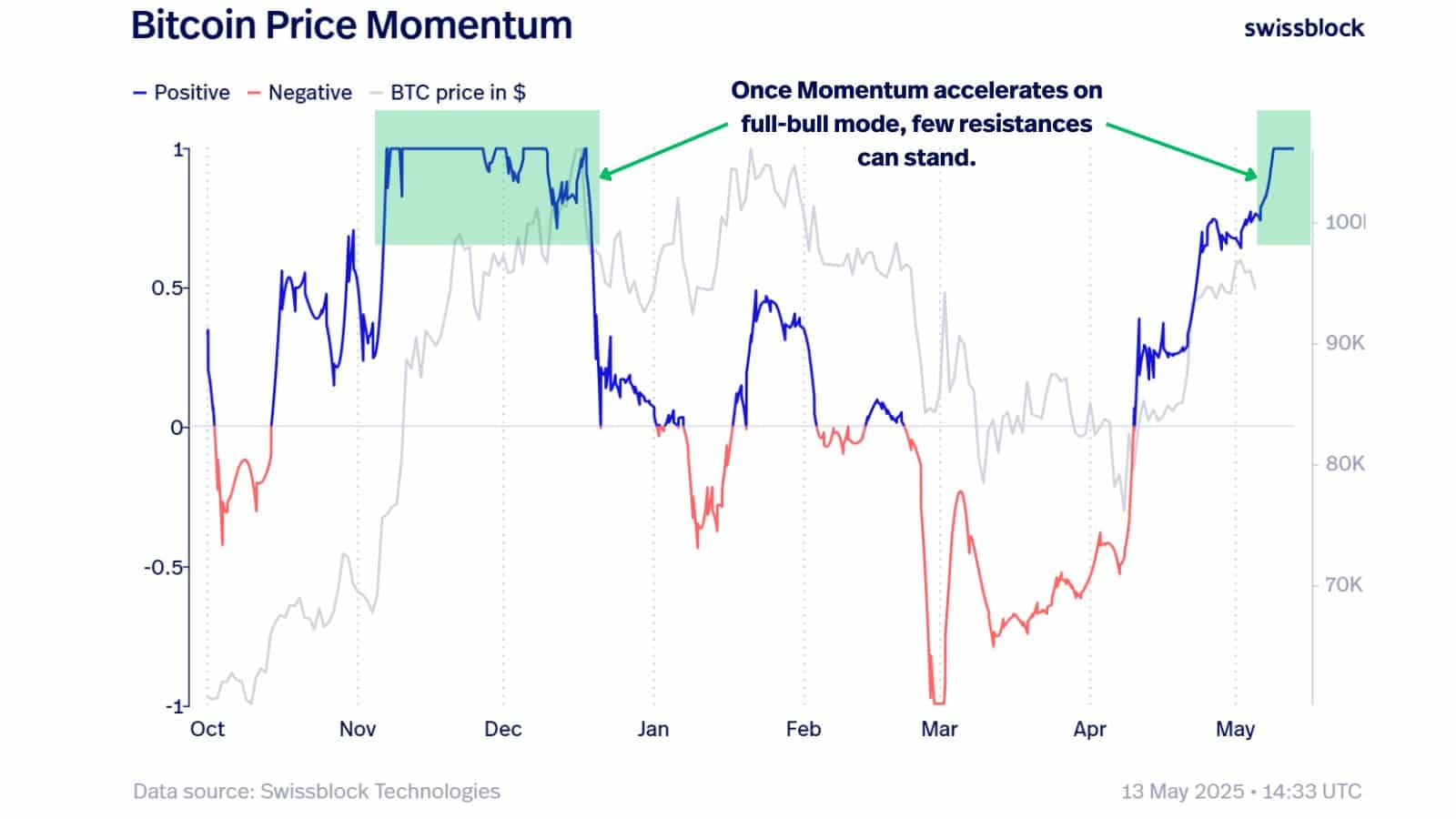

Nevertheless, the soar to a brand new ATH will not be a clean experience, in response to a report by crypto analysis agency Swissblock.

The agency cited previous BTC worth momentum and said a possible correction at $104K-$106K earlier than a rebound to a report stage was probably.

“Can $BTC push to uncharted territory? A reset might gas the subsequent leg.”

The connected chart confirmed that BTC was in full bullish momentum, however present ranges additionally marked a retracement within the final November-December rally.

However True MVRV, a valuation metric that flagged early and late 2024 native peaks and bottoms, disagreed with the Swissblock outlook.

Supply: CryptoQuant

The metric’s studying was at 1.7, barely removed from the potential native peak stage of two. In different phrases, BTC nonetheless had room for progress earlier than a possible large pullback.

On the Choices market, merchants positioned themselves for both state of affairs.

Up to now 24 hours, $95K put choices (bearish bets) had been the most important by buying and selling quantity, whereas requires $105K and $115K (bullish bets) ranked second and third.

Put in a different way, merchants anticipated BTC to hit $115K in Might however had been ready for a possible dip to $95K.

Supply: Deribit

Total, the constructive macro setting might gas additional risk-on sentiment and push BTC to a brand new ATH. Nevertheless, there have been nonetheless probabilities of BTC dipping under $100K.