In what has been an “uncommon” September, Bitcoin (BTC) has now recorded one other constructive weekly efficiency. In accordance with data from CoinMarketCap, the maiden cryptocurrency surged by 5.07% within the final seven days, shifting its cumulative achieve on this month to 11.30%. Curiously, with Bitcoin halving since gone, analysts stay extremely expectant of the standard market bull run by the most important digital asset.

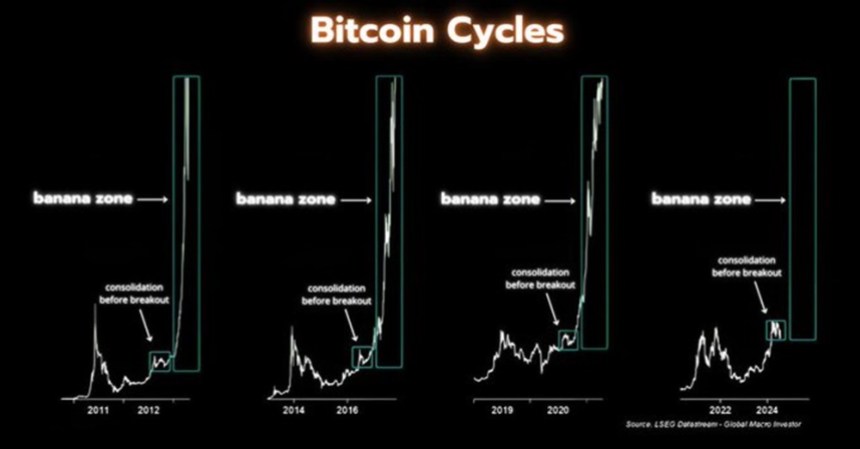

BTC In Consolidation As It Gathers Momentum For Breakout

In an X post on Friday, well-liked analyst Crypto Rover predicted BTC will hit a $290,000 value mark within the upcoming bull run.

Curiously, this value projection tallies with earlier statements from analysts who put a six-figure price target for BTC following the introduction of the Bitcoin spot ETFs which represents an elevated institutional demand for the crypto market chief.

Notably, BTC has been shifting between $55,000 – $70,000 over the past seven months which represents a state of consolidation. In accordance with Crypto Rover, following a breakout from this present sideways motion, Bitcoin is prone to enter the “banana zone” i.e. the part of outrageous value development, as seen in earlier bull cycles.

The crypto analyst predicts that in this era which historically lasts for 12-18 months, BTC might commerce as excessive as $290,000 representing a 339.39% achieve on the asset’s present value.

For a lot of crypto fans, it’s seemingly that the much-anticipated breakout will happen within the fast-approaching weeks as Bitcoin has now shaped an inverse head and shoulders sample as highlighted by Crypto Rover in another post. To elucidate, the inverse head and shoulders sample is a standard bullish indicator of potential reversals of a downtrend. If the worth breaks above the neckline with important quantity, it signifies a shift to bullish management.

These sentiments on a value breakout are additional strengthened by the upcoming This autumn which has proven to be essentially the most bullish interval for Bitcoin with a mean achieve of 88% over the past 11 years.

Bitcoin Alternate Stablecoins Ratio Exhibits Bullish Sign

In additional constructive information for the Bitcoin neighborhood, the Bitcoin Alternate Stablecoin Ratio is at present indicating a purchase sign. In accordance with CryptoQuant analyst with username EgyHash, this metric which measures BTC reserves (in USD) to the mixed stablecoin reserves on alternate is at present on the low ranges seen firstly of 2024.

EgyHash explains {that a} low ratio signifies merchants have an elevated shopping for energy because of excessive stablecoin holdings which might translate into investments in Bitcoin, thus leading to a value achieve. Subsequently, the present low Bitcoin Alternate Ratio provides to the checklist of bullish indicators for Bitcoin traders.

On the time of writing, the premier cryptocurrency continues to commerce at $66,064 with a 1.14% achieve within the final day. In the meantime, Bitcoin’s day by day buying and selling quantity is down by 12.92% and valued at $32.01 billion.

Featured picture from Cwallet, chart from Tradingview