- Over 300,000 ETH had been withdrawn from exchanges previously week alone.

- The ETH value has continued its slight uptrend.

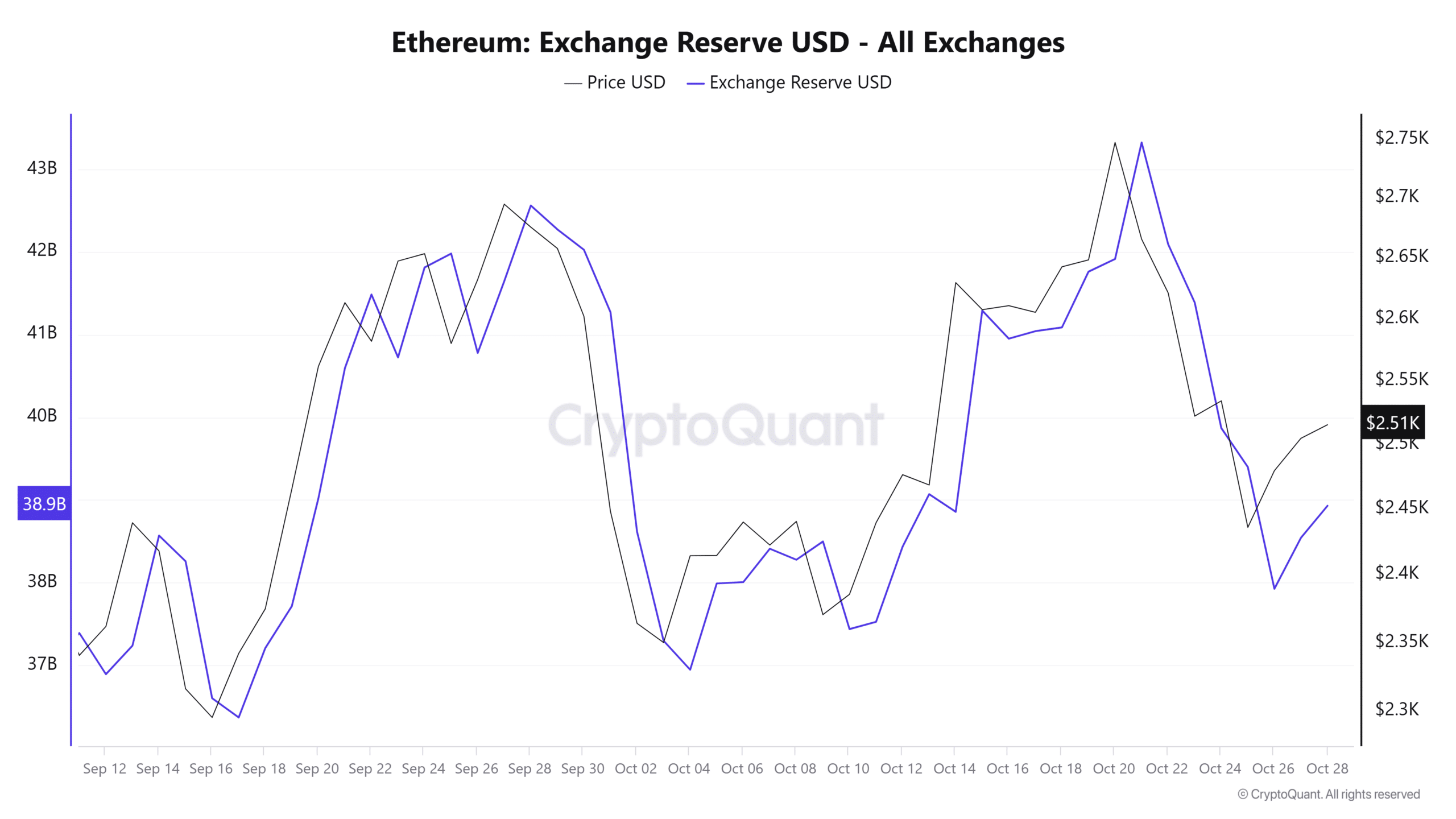

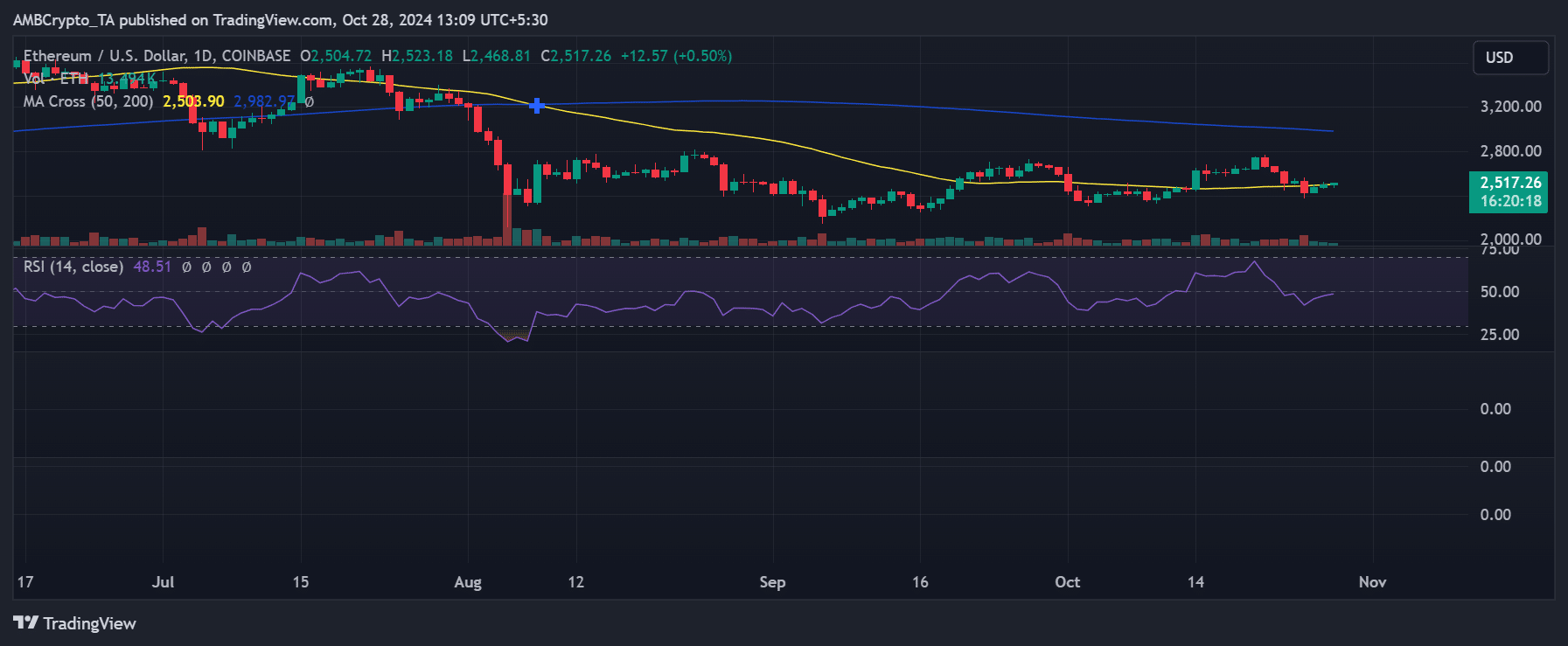

Ethereum’s [ETH] current value motion across the $2,500 mark comes as trade reserves considerably drop. The drop highlights potential adjustments in investor sentiment.

A decline in reserves usually indicators that buyers are transferring their holdings off exchanges. The transfer usually signifies a long-term holding technique moderately than an intent to promote. This shift could possibly be important in stabilizing ETH’s value and shaping its future efficiency.

Over $4 billion in Ethereum withdrawn from exchanges

In accordance with CryptoQuant knowledge, Ethereum’s trade reserves have fallen sharply. Knowledge confirmed a drop from over $42 billion to roughly $38.9 billion inside just a few weeks. This represents greater than $4 billion value of ETH being moved off exchanges.

The transfer hints at many buyers shifting their technique towards holding moderately than buying and selling within the close to time period. This pattern emerges at a time when Ethereum’s value fluctuates between $2,400 and $2,700.

Ethereum withdrawal coincides with value consolidation

This pattern of withdrawals aligns with Ethereum’s current battle to surpass resistance ranges at round $2,600. By transferring holdings off exchanges, buyers could possibly be signaling confidence in its long-term worth.

This conduct might cut back promoting strain, significantly if trade reserves proceed to say no within the coming days, permitting its value to consolidate and stabilize. The value may stabilize with fewer tokens accessible for quick commerce, particularly if demand holds regular.

How declining Ethereum reserves may influence value stability

Diminished trade reserves usually lead to decrease accessible liquidity. This could contribute to cost stability or upward motion if demand stays constant. When fewer tokens are available on exchanges, any surge in shopping for curiosity can drive extra vital value results.

As Ethereum goals to regain traction after current dips, these trade outflows counsel a shift in sentiment. It exhibits that holders are extra inclined to carry, lowering the chance of large-scale sell-offs.

Nonetheless, a steady demand degree might be essential. If demand weakens, ETH might proceed to battle with resistance ranges, doubtlessly resulting in a extra extended consolidation interval.

Quick-term outlook for Ethereum

The present decline in trade reserves suggests a interval of value consolidation, with the potential of upward momentum. Holding the $2,500 assist degree and a gradual decline in reserves may assist set a basis for sustainable restoration.

Learn Ethereum (ETH) Price Prediction 2024-25

Ought to market circumstances favor elevated demand, Ethereum may see strengthened shopping for curiosity, making additional value good points attainable.

Nonetheless, if market circumstances shift and demand decreases, ETH should face strain at resistance ranges. The most recent knowledge signifies cautious optimism, with long-term holders exhibiting resilience via the continued market fluctuations.