Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

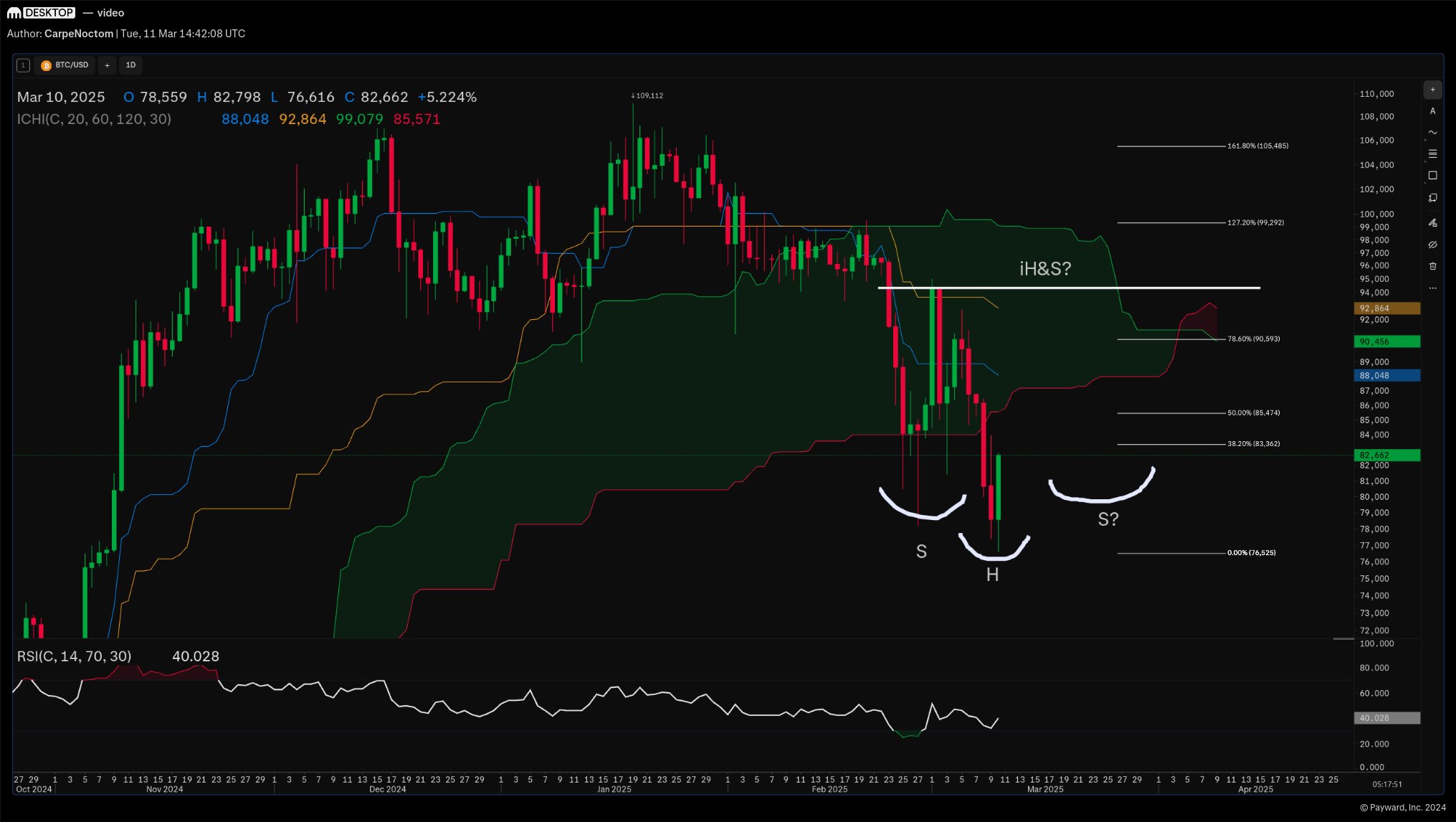

Bitcoin (BTC) stays at a vital juncture, holding above its yearly pivot stage. In his newest market evaluation, seasoned crypto dealer Josh Olszewicz outlined key technical elements that would decide Bitcoin’s subsequent transfer in his newest video evaluation, emphasizing the significance of RSI divergences, quantity tendencies, and candlestick formations.

With BTC experiencing heavy downward stress over the previous few weeks, Olszewicz examined whether or not the market has reached an exhaustion level for sellers or if additional draw back stays doubtless.

Is The Bitcoin Backside In?

An important statement in Olszewicz’s evaluation is the presence of bullish divergence on each RSI and quantity, a sample that traditionally indicators a possible development reversal. He famous: “BTC for the second is holding on the yearly pivot, it’s holding on the OG Pitchfork right here, and we did put in a bullish divergence on each RSI and quantity. We acquired a decrease low in value, larger low in RSI on decrease quantity.”

Associated Studying

This setup mirrors related situations noticed in August and September, the place Bitcoin noticed comparatively equal lows in value, however RSI shaped considerably larger lows. Whereas this doesn’t assure an imminent reversal, Olszewicz identified that it will increase the chance of a possible upside transfer, particularly if additional confirmations come up.

From a candlestick perspective, Bitcoin’s value motion is exhibiting early indicators of potential stabilization. Olszewicz highlighted the importance of Dragonfly Doji formations, significantly together with bullish engulfing candles, which regularly sign vendor exhaustion and development reversals.

“What I’d like to see on many of those charts is what we’re already seeing on the every day—a inexperienced Dragonfly candlestick. It’s a small physique with an extended wick, exhibiting clear rejection of decrease costs. If confirmed, this might be an early bottoming sign.”

Nevertheless, he cautioned that whereas these patterns may be indicative of a shift in market sentiment, they don’t seem to be foolproof and require further affirmation from value construction and momentum indicators. Furthermore, Olszewicz added through X: “BTC iHS brewing? Manner too early to name this definitively however we’ve acquired the early trappings of a multi-week backside right here. Would align with a possible kumo breakout in Q2 and measures to an ATH retest. One thing to observe all through March, a brand new LL would doubtless negate this chance.”

Olszewicz suggested merchants to stay disciplined and keep away from over-leveraging positions in risky situations. He careworn the significance of sustaining a constant commerce sizing technique and avoiding emotional decision-making. “You don’t need to make all of it again in a single commerce. You don’t need to revenge commerce. Confidence drops in occasions of chaos, and that’s when most individuals make errors.”

Associated Studying

He additionally warned towards blindly dollar-cost averaging into belongings just because they seem closely discounted: “Simply because one thing is down 80% doesn’t imply it’s an automated purchase. The technicals would possibly look nice right now, however that doesn’t imply it received’t hold going decrease. That’s why danger administration is essential.”

Whereas the broader macroeconomic landscape stays unsure—with ongoing tariff concerns and blended indicators from conventional markets—Bitcoin’s technical positioning suggests {that a} potential reduction rally may emerge within the coming months.

Olszewicz recommended that March and April might be pivotal intervals for Bitcoin, the place a clearer development may develop. Nevertheless, he reiterated that for now, merchants ought to concentrate on high-probability setups reasonably than speculative performs. “If BTC can stabilize right here and reclaim key ranges, the case for a stronger restoration into Q2 strengthens. Nevertheless it’s too early to make that decision. Proper now, one of the best technique might merely be to attend for high-confidence setups.”

At press time, BTC traded at $81,599.

Featured picture created with DALL.E, chart from TradingView.com