At this time’s Bitcoin value motion is a confluence of things together with large liquidations, macroeconomic pressures, and the affect of destructive Coinbase Premium alongside Bitcoin ETF dynamics. These parts mixed have led to a noticeable dip in Bitcoin’s value.

#1 Lengthy Liquidations

At this time’s Bitcoin market noticed a major value drop, initiated by a sweeping liquidation occasion on the futures market. Over the past 24 hours, crypto dealer liquidations exceeded $682.54 million throughout greater than 191,000 merchants, based on Coinglass data.

This surge in liquidations resulted in Bitcoin’s value plummeting by 8% in mere hours, falling from $72,000 to $66,500. Though there was a minor restoration, with Bitcoin’s value rebounding to the $68,000 degree, it presently stands almost 10% under its March 14 all-time excessive of $73,737.

A notable 80% of those liquidations have been lengthy positions, contributing to $544.99 million of the full. Brief place liquidations made up the remaining $136.94 million, with Bitcoin longs alone accounting for $242.37 million in liquidations.

#2 Macro Situations Weighing On Bitcoin Value

The macroeconomic panorama has positioned further strain on Bitcoin’s worth. Ted, a macro analyst often called @tedtalksmacro, highlighted on X the affect of macro circumstances on the cryptocurrency market.

He stated, “If BTC is digital gold, count on it to commerce in lockstep with gold, nevertheless, with greater beta.” With the Federal Reserve’s assembly looming subsequent week, macroeconomic components are anticipated to take heart stage briefly.

Yesterday’s US Producer Value Index (PPI) knowledge, displaying a 0.6% enhance in February and surpassing forecasts of 0.3 month-over-month, has precipitated a ripple impact with CPI just lately additionally hotter than anticipated, resulting in an increase in US bond yields. The benchmark 10-year charge noticed a rise of 10 foundation factors to 4.29%, whereas two-year charges rose to 4.69% from 4.63%. These developments have led merchants to regulate their expectations for the Federal Reserve’s rate of interest insurance policies in 2024.

Mohamed A. El-Erian, from Queens’ School, Cambridge College, Allianz, and Gramercy, remarked on the state of affairs: “US authorities bond yields jumped as we speak in response to one more (barely) hotter-than-expected inflation print (this time PPI).” This means a rising consciousness of the challenges that persistent inflation poses to reaching the Fed’s 2% inflation goal.

#3 Adverse Coinbase Premium / Quiet Bitcoin ETF Day

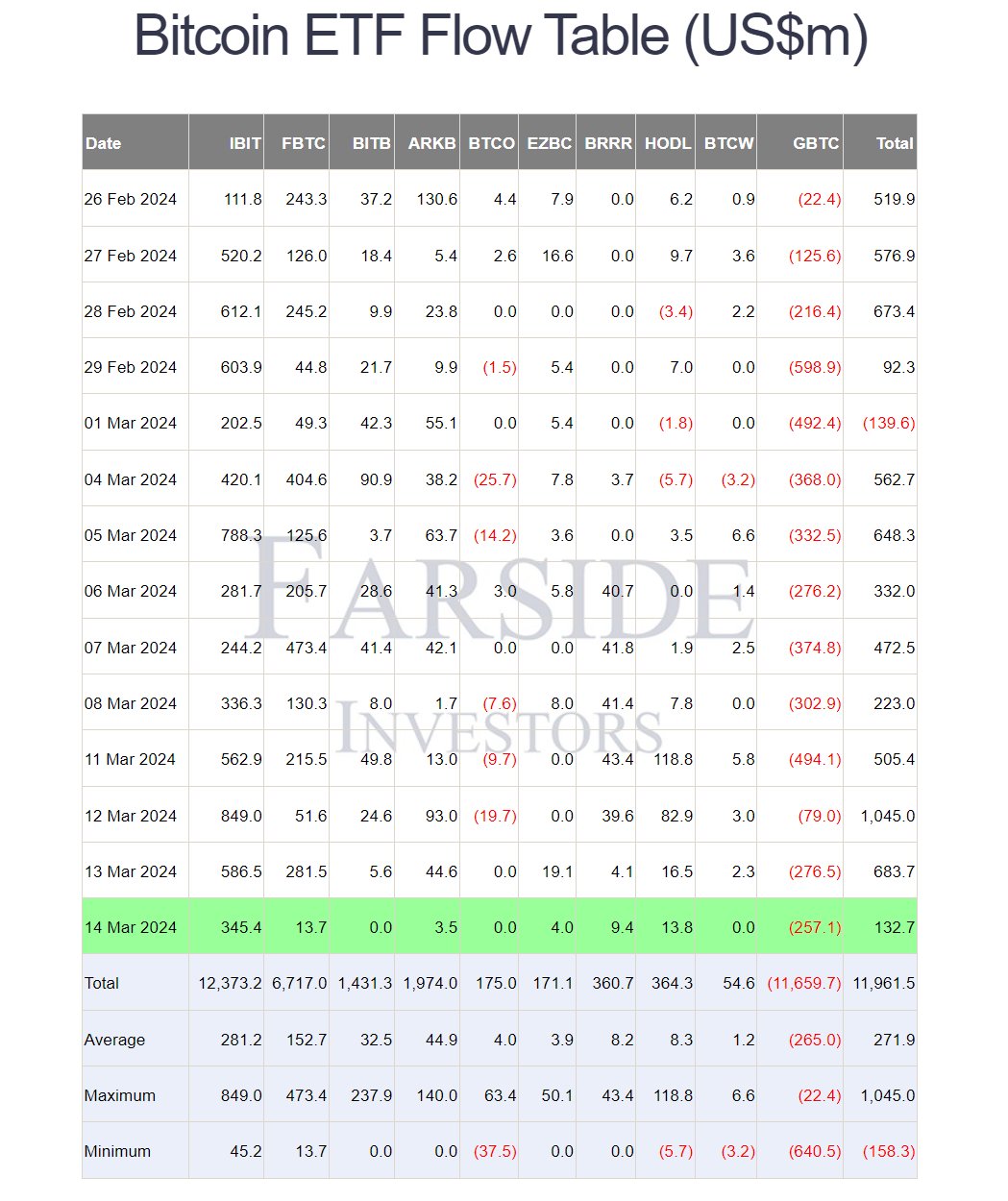

The decline of Bitcoin under the $70,000 threshold can also be attributed to the “Coinbase Premium” – the change which custodies nearly all of all spot Bitcoin ETFs – dipping into destructive territory for the primary time since February 26, indicating a bearish sentiment from US markets. This phenomenon is probably going a consequence of serious gross sales of Grayscale GBTC, whereas the spot ETF skilled comparatively calm exercise.

Following a report $1 billion internet influx day for the spot ETF on March 12, inflows dropped to only $132.7 million just lately, with Blackrock contributing the lion’s share at $345.4 million. In the meantime, Constancy and ARK noticed minimal inflows of $13.7 million and $3.5 million respectively, after a beforehand robust week. GBTC outflows have been reported at $257.1 million, aligning with common ranges.

Crypto analyst WhalePanda commented on the state of affairs, noting that regardless of the lowered influx, “$132.7 million continues to be 2 full days of mining rewards.” He suggests a possible rebound available in the market, stating, “We’re simply ranging now and overleveraged individuals getting margin known as. I suppose the following transfer up is for subsequent week.”

At press time, BTC traded at $67,916.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal danger.