- Ethereum accumulating deal with holdings have surged by 60% since August 2024

- Volatility took cost of Ethereum’s value motion during the last 48 -72 hours

Since hitting a latest excessive of $4,109, Ethereum’s [ETH] value chart has seen a powerful market correction. In reality, previous to its press time restoration that noticed it achieve by over 7% in 24 hours, the altcoin dropped to as little as $3,095.

This market correction left many key stakeholders speaking. In line with CryptoQuant’s analyst Mac D, this correction might have been pushed by macroeconomic elements.

And but, at press time, some restoration was so as, with the altcoin’s buyers nonetheless accumulating the altcoin.

ETH accumulation deal with holdings surge

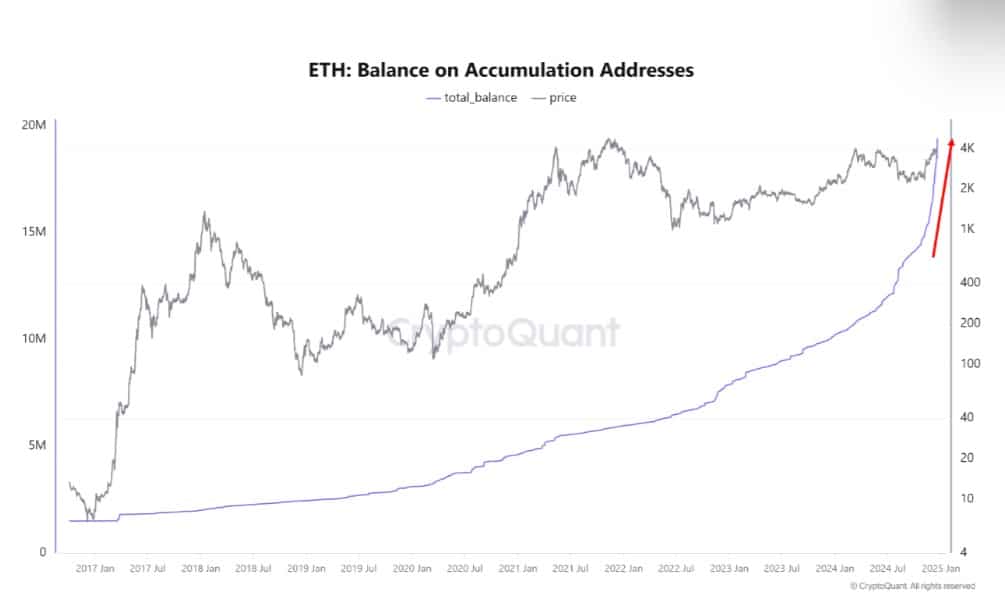

In line with CryptoQuant, Ethereum accumulating addresses have surged considerably these days, outpacing earlier cycles whereas doing so.

Primarily based on this evaluation, accumulating addresses registered a powerful hike in August, spiking by 16% or 19.4 million ETH tokens of the full Ethereum provide of 120 million ETH. When it comes to progress charge, this uptick represented a 60% improve from 10% in August to 16% in December 2024. Such a large upsurge was unprecedented in earlier ETH cycles.

This uptick in addresses holding ETH underlined the widespread market expectations over Trump’s pro-crypto insurance policies. Equally, it urged that regardless of the altcoin’s unstable value, sensible cash will proceed accumulating ETH.

Whereas market correction may be very doubtless within the quick time period as a result of macroeconomic elements, the long-term upside potential continues to be excessive. This, as a result of buyers proceed to purchase ETH and accumulating addresses are continuously rising.

Influence on altcoin’s value

As anticipated, a hike in accumulation has had a large affect on ETH’s value chart. For example, all through this accumulating interval, ETH surged from a low of $2,116 to a excessive of $4,109.

In reality, on the time of writing, Ethereum was buying and selling at $3,504, following a hike of over 5% within the final 24 hours.

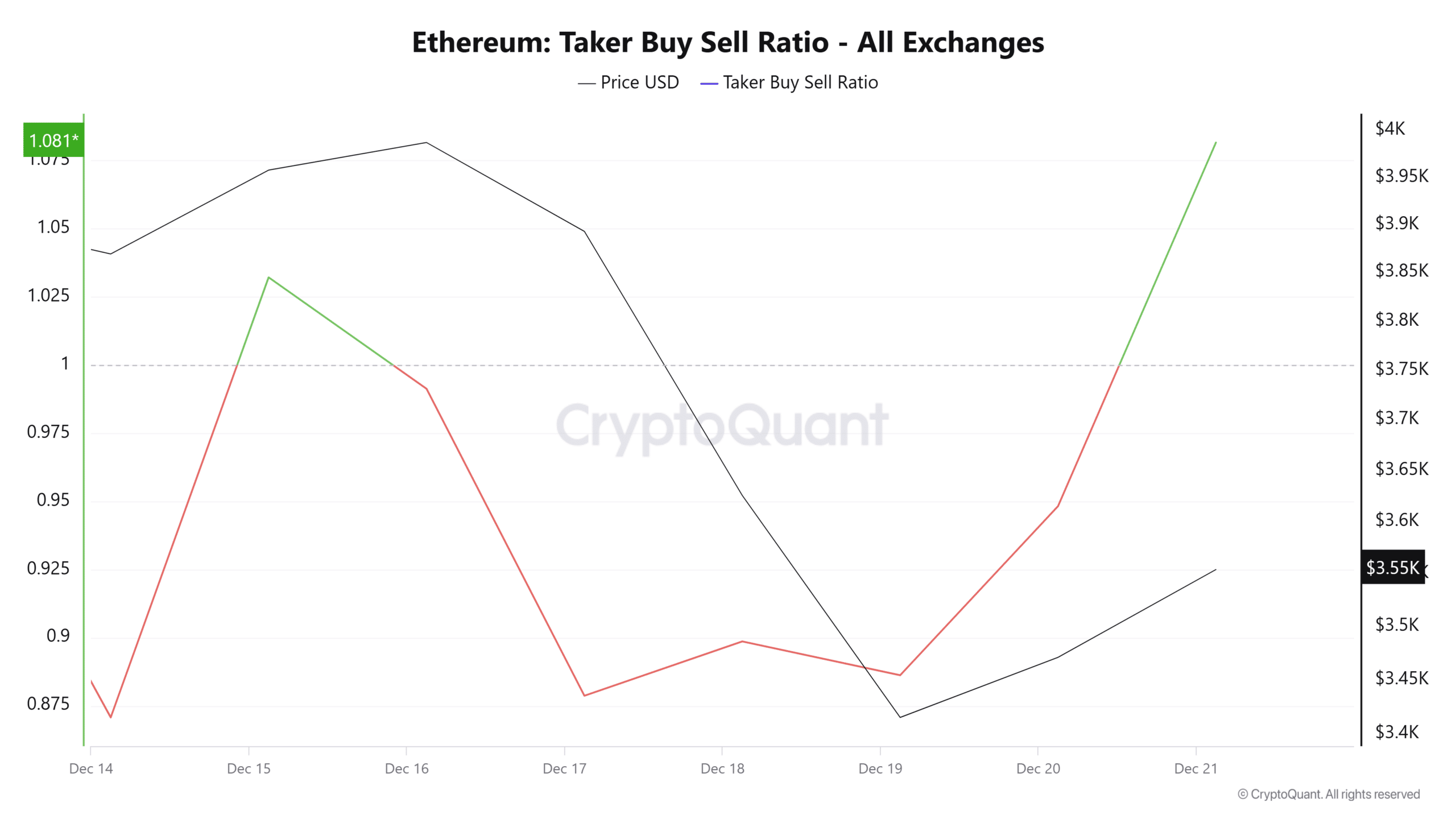

This upside momentum witnessed right here was largely pushed by an uptick in shopping for strain. We are able to see this phenomenon with the spike in Taker Purchase promote ratio too, with the identical surging to 1.08 at press time.

Such a hike implies that patrons are extra aggressive than sellers. Therefore, demand could also be outweighing provide proper now.

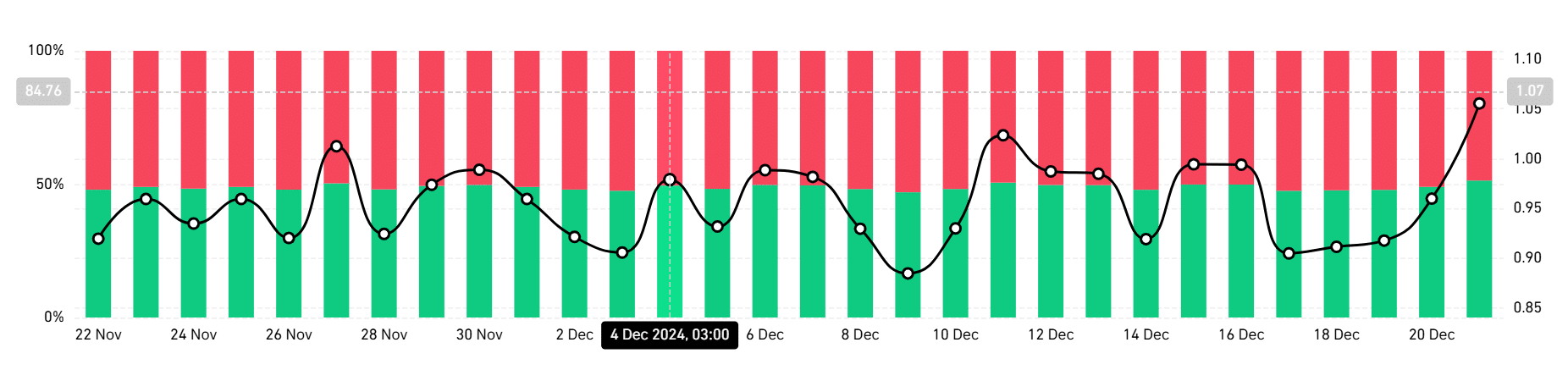

Equally, this shopping for strain may be interpreted to be an indication of the prevailing bullish sentiment. This bullishness was evidenced by buyers taking lengthy positions too. On the time of writing, these taking lengthy positions had been dominating the market with 51% – An indication that the majority merchants anticipate extra good points.

In conclusion, with buyers turning to accumulating Ethereum, the altcoin could also be nicely positioned for additional progress. When extra buyers elevate their holdings, it fuels increased shopping for strain, doubtlessly leading to a provide squeeze. Such circumstances put quite a lot of constructive strain on the altcoin’s value.

Subsequently, if the accumulating addresses proceed to surge, ETH may reclaim $3,713. Consequently, a drop just like the one seen a couple of days in the past would see Ethereum drop to $3,300.