- Trump’s tariff announcement wiped $490M from crypto as Bitcoin and Ethereum costs plunged sharply.

- Concern overtook sentiment whereas correlated inventory sell-offs deepened crypto’s downward momentum.

The cryptocurrency market noticed intense volatility up to now 24 hours, sparked by U.S. President Donald Trump’s sweeping new tariffs.

These included a minimal 10% obligation on all imports, with larger charges for key companions like China (34%), Japan (24%), and the European Union (20%).

Because the information broke, each conventional and digital markets reacted shortly. Bitcoin [BTC] dropped from $88,500 to $83,500, whereas Ethereum [ETH] fell from $1,934 to below $1,800 on the time of writing.

Furthermore, the whole crypto market cap slipped by 2%, settling close to $2.68 trillion. This drop occurred through the mid-Japanese buying and selling session on the third of April.

Such a pointy response underlines how delicate crypto stays to world macroeconomic shocks. Subsequently, these tariffs didn’t simply disrupt world commerce—they brought about a direct hit to digital property.

Liquidations wipe out over 160,000 merchants

Following the latest worth plunge, over $490 million in leveraged positions have been liquidated, affecting greater than 160,000 merchants. The biggest single liquidation occurred on Binance, the place an ETH/USDT place price $12 million was closed. Most losses have been incurred by lengthy merchants who had guess on rising costs.

Bitcoin futures accounted for $170 million in liquidations, whereas Ethereum contracts misplaced $120 million. Smaller altcoins contributed an extra $50 million to the whole.

Apparently, volatility impacted each market instructions—$257 million got here from liquidated lengthy positions, whereas $232 million got here from shorts. This downturn finally punished each bullish and bearish merchants.

Market sentiment shifts sharply into concern

At first, the market skilled a short wave of optimism. Nonetheless, as merchants absolutely assessed the influence of the tariffs, that confidence shortly dissipated.

Markets analyst Rachael Lucas reported a 46% surge in buying and selling quantity, pushed by giant gamers adjusting their positions. Retail merchants, then again, remained principally cautious.

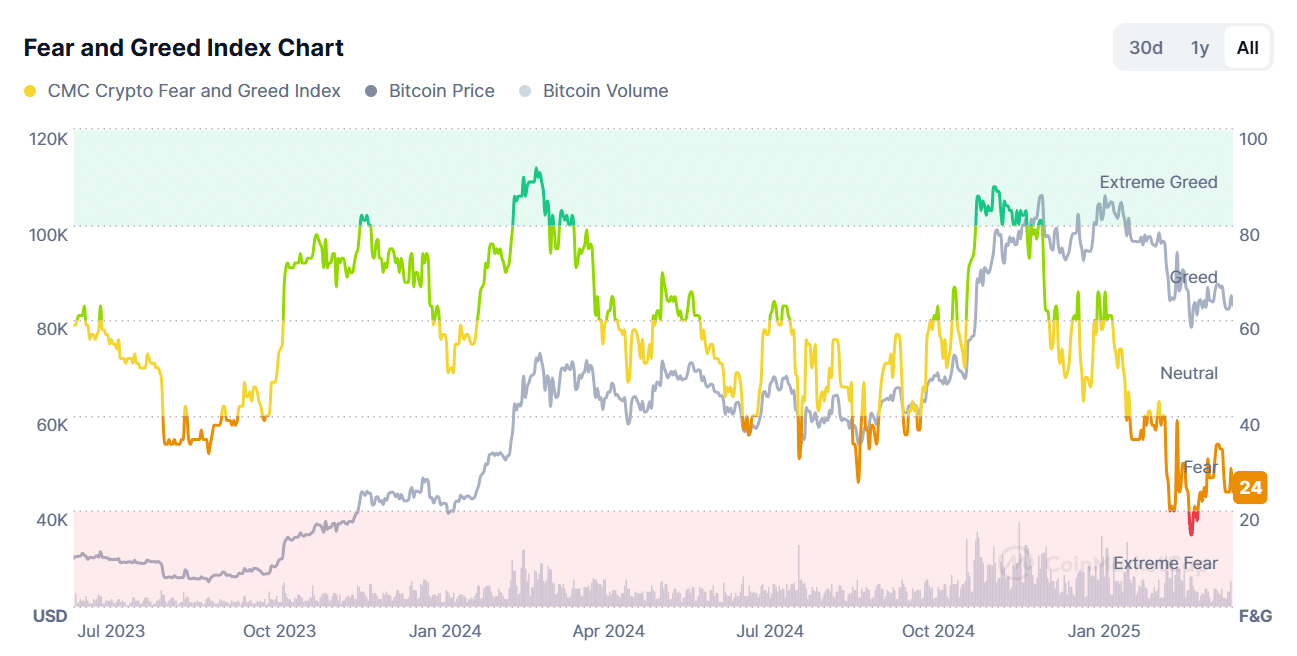

The Crypto Concern & Greed Index dropped to 24, indicating heightened concern throughout the market. Only a week in the past, sentiment was nearer to impartial. This sharp shift in investor outlook highlights how delicate the market is to vital coverage adjustments.

Heavy inventory market sell-off fuels crypto losses

The S&P 500 futures shed $2 trillion in market capitalization inside simply quarter-hour of the announcement. Main tech shares, together with Apple (-5.59%), Amazon (-4.50%), and Nvidia (-3.43%), skilled vital losses.

This broad sell-off additionally spilled over into cryptocurrency markets.

As crypto markets have grown extra correlated with equities, each sectors declined in unison. Consequently, the panic in conventional finance magnified the crypto crash. The shock was each instant and carefully tied to widespread financial fears.

Conclusively, the crypto market crash immediately was brought about straight by U.S. commerce tariff bulletins.

These sparked concern, triggered mass liquidations, and aligned with a world fairness sell-off. Subsequently, clear geopolitical coverage—not rumors—was the foundation explanation for the crash.