- IBCI stabilized mid-cycle whereas the valuation ratios signaled that BTC could also be undervalued

- Miners diminished their promote stress as Bitcoin’s value held on to its ascending assist

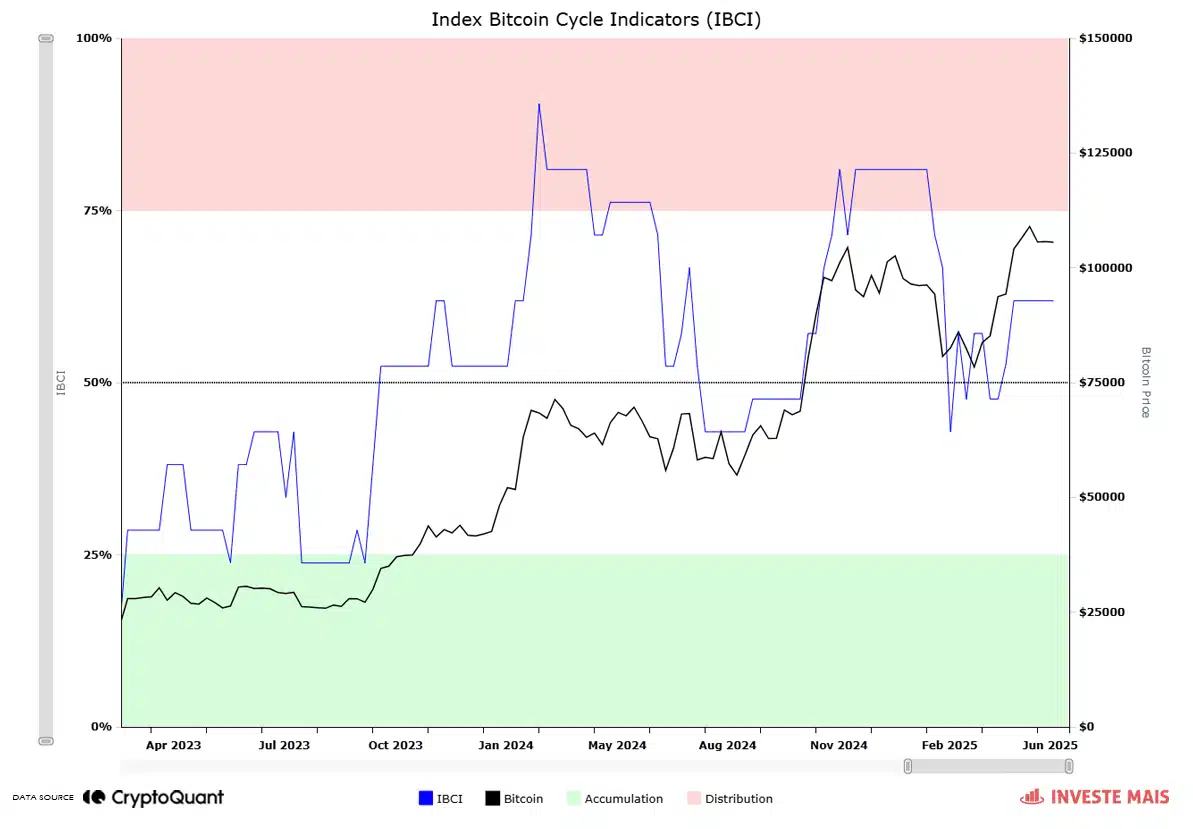

Bitcoin’s [BTC] market construction, on the time of writing, seemed to be intact because the IBCI consolidated close to the 50% zone – A area traditionally seen between exhaustion and new impulses.

In reality, after peaking above 75% in early 2024 and briefly pulling again, the Index Bitcoin Cycle Indicators (IBCI) is now at a impartial midpoint.

Such a zone usually alludes to a pause relatively than a peak, particularly when supported by recovering costs.

At press time, Bitcoin was buying and selling round $105,571, whereas sustaining a wholesome distance from overbought ranges. This would possibly additional reinforce the thesis that the market may very well be transitioning – Not topping.

BTC rides ascending channel as bulls guard essential construction

Regardless of the most recent pullback, Bitcoin has continued to respect the ascending channel fashioned since April. The worth motion stays above the important thing midline assist, whereas resistance close to $112,000 may be looming simply forward.

The Relative Energy Index (RSI) gave the impression to be hovering between 49.89 and 53.14, suggesting an absence of directional bias. Furthermore, the trendline was unbroken, indicating purchaser confidence.

Due to this fact, so long as the construction holds, the potential for larger highs might be legitimate. Notably if bullish catalysts return.

On-chain valuation metrics crash – Bullish divergence or crimson flag?

The Community Worth to Transaction (NVT) ratio dropped by 52.62% to 33.87 and the Community Worth to Metcalfe Ratio (NVM) fell 43.35% to 2.49. These steep declines normally indicate that the market capitalization could also be undervaluing the precise transaction exercise and consumer base enlargement.

Traditionally, sharp drops in these ratios have preceded important rallies as they mirror a market underpricing on-chain utility.

Due to this fact, this hidden divergence could also be fueling optimism amongst long-term traders looking for to enter earlier than valuations normalize once more.

Are declining stablecoin reserves actually a bearish sign?

On the time of writing, the Trade Stablecoin Ratio stood at 5.60 after a 2.38% drop – Hinting at a slight discount in stablecoin liquidity on exchanges.

Nonetheless, this isn’t essentially bearish. Whereas it might allude to a fall in instant shopping for energy, the broader reserve ranges stay wholesome sufficient to assist massive entries.

In reality, consolidations usually happen earlier than inflows resume. Due to this fact, except the ratio sharply breaks decrease, the market will nonetheless possess sufficient capital to gas a continuation of Bitcoin’s uptrend.

Miners retreat from promoting as accumulation takes entrance seat

Miners’ Place Index (MPI) surged by 49.8%, settling at -0.88. This detrimental worth signaled that miner outflows remained nicely under the 1-year common.

Traditionally, such habits has aligned with holding sentiment and declining promote stress. As miners are key liquidity suppliers, a fall in promoting from this group is usually bullish.

Due to this fact, the surge in MPI, regardless of the detrimental worth, confirmed a good situation for value resilience. Particularly when supported by different bullish metrics.

With the IBCI stabilizing mid-cycle, technical construction intact, and key metrics flashing undervaluation, Bitcoin could also be poised for additional upside.

The absence of miner promoting, strong liquidity, and low valuation ratios collectively prompt that the continued pause may evolve into one other rally leg. If the construction holds and macro traits stay steady.