One of many questions that has maybe been central to my very own analysis in blockchain know-how is: finally, what’s it even helpful for? Why do we’d like blockchains for something, what sorts of providers ought to be run on blockchain-like architectures, and why particularly ought to providers be run on blockchains as an alternative of simply dwelling on plain previous servers? Precisely how a lot worth do blockchains present: are they completely important, or are they simply good to have? And, maybe most significantly of all, what’s the “killer app” going to be?

Over the previous couple of months, I’ve spent a whole lot of time fascinated about this subject, discussing it with cryptocurrency builders, enterprise capital companies, and notably folks from outdoors the blockchain house, whether or not civil liberties activists, folks within the finance and funds trade or wherever else. Within the means of this, I’ve come to a lot of necessary, and significant, conclusions.

First, there will probably be no “killer app” for blockchain know-how. The explanation for that is easy: the doctrine of low-hanging fruit. If there existed some explicit software for which blockchain know-how is massively superior to the rest for a good portion of the infrastructure of recent society, then folks could be loudly speaking about it already. This will likely seem to be the old economics joke about an economist discovering a twenty greenback invoice on the bottom and concluding it should be faux as a result of in any other case it could have already got been taken, however on this case the state of affairs is subtly completely different: in contrast to the greenback invoice, the place search prices are low and so choosing up the invoice is sensible even when there may be solely a 0.01% likelihood it’s actual, right here search prices are very excessive, and loads of folks with billions of {dollars} of incentive have already been looking. And up to now, there was no single software that anybody has provide you with that has severely stood out to dominate all the pieces else on the horizon.

In reality, one can fairly fairly argue that the closest issues that we are going to ever need to “killer apps” are exactly these apps which have already been completed and recited and sensationalized advert nauseam: censorship resistance for Wikileaks and Silk Street. Silk Street, the web nameless drug market that was shut down by regulation enforcement in late 2013, processed over $1 billion in sales throughout its 2.5 years of operations, and whereas the payment-system-orchestrated blockade in opposition to Wikileaks was in progress, Bitcoin and Litecoin donations had been responsible for the bulk of its revenue. In each instances the necessity was clear and the potential financial surplus was very excessive – earlier than Bitcoin, you’d haven’t any selection however to purchase the medicine in individual and donate to Wikileaks by cash-in-the-mail, and so Bitcoin offered an enormous comfort achieve and thus the chance was snatched up virtually immediately. Now, nevertheless, that’s a lot much less the case, and marginal alternatives in blockchain know-how aren’t practically such straightforward grabs.

Whole and Common Utility

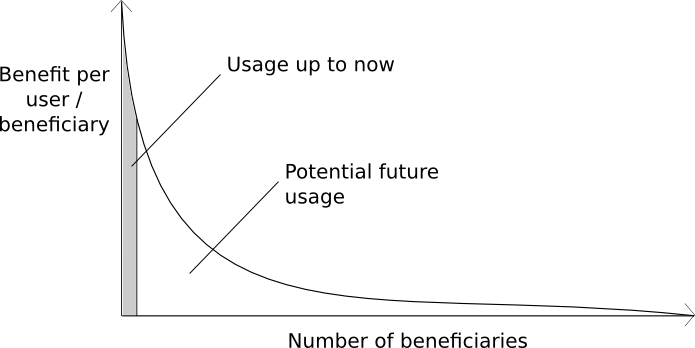

Does this imply, nevertheless, that blockchains have hit their peak utility? Most actually not. They’ve hit peak necessity, within the sense of peak utility per consumer, however that isn’t the identical factor as peak utility. Though Silk Street was indispensable for most of the those that used it, even among the many drug-using neighborhood it is not indispensable normally; as a lot because it befuddles this explicit writer how bizarre people are speculated to get such connections, most individuals have by some means discovered “a man” that they know that they will buy their weed from. Curiosity in smoking weed in any respect appears to strongly correllate with having easy accessibility to it. Therefore, within the grand scheme of issues, Silk Street has solely had an opportunity to develop into related to a really area of interest group of individuals. Wikileaks is analogous; the set of people that care about company and governmental transparency strongly sufficient to donate cash to a controversial group in assist of it’s not very massive in comparison with the complete inhabitants of the world. So what’s left? In brief, the lengthy tail.

So what’s the lengthy tail? That is the place it will get onerous to clarify. I may present a listing of functions which are included on this “lengthy tail” of functions; nevertheless, blockchains aren’t indispensable, and don’t even supply extraordinarily robust elementary benefits for every one. For every particular person case, an advocate of both the “blockchain functions are overrated, it is the Bitcoin forex that issues” or the “blockchain tech as a complete is ineffective” place can fairly fairly provide you with a option to implement the scheme simply as simply on a centralized server, exchange blockchain governance with a authorized contract, and apply no matter different replacements to show the product into one thing way more much like a standard system. And on that time, they might be utterly appropriate: for that exact use case, blockchains aren’t indispensable. And that is the entire level: these functions aren’t on the prime of the distribution, up there with Wikileaks and Silk Street; in the event that they had been, they might have been applied already. Within the lengthy tail, blockchains aren’t vital; they’re handy. They’re merely marginally higher than the subsequent accessible software for the job. And but, as a result of these functions are way more mainstream, and might profit a whole bunch of tens of millions of customers, the overall achieve to society (which could be seen from the world on the above chart) is far bigger.

Maybe the very best analogy to this line of reasoning is to ask the next rhetorical query: what’s the killer app of “open supply”? Open supply has clearly been an excellent factor for society, and it’s getting used for tens of millions of software program packages world wide, however nonetheless it’s nonetheless onerous to reply the query. And the reason being the identical: there isn’t a killer app, and the checklist of functions has a really very lengthy tail – principally, nearly each form of software program conceivable, with explicit emphasis on lower-level libraries that find yourself reused by tens of millions of initiatives many occasions over and important cryptographic safety libraries.

Blockchains, Redefined… Once more

Now, what are the particular advantages of blockchains that make the lengthy tail worthwhile? To begin off, let me present the present description that I take advantage of of what a blockchain is:

A blockchain is a magic pc that anybody can add applications to and go away the applications to self-execute, the place the present and all earlier states of each program are at all times publicly seen, and which carries a really robust cryptoeconomically secured assure that applications working on the chain will proceed to execute in precisely the way in which that the blockchain protocol specifies.

Discover that this definition does NOT:

- Use financially-charged phrases like “ledger”, “cash” or “transactions”, or certainly any phrases geared towards a specific use case

- Point out any explicit consensus algorithm, or certainly point out something concerning the technical properties of how a blockchain works (apart from the truth that it is “cryptoeconomic”, a technical time period roughly which means “it is decentralized, it makes use of public key cryptography for authentication, and it makes use of financial incentives to make sure that it retains going and does not return in time or incur some other glitch”)

- Make a restriction to any explicit kind of state transition operate

The one factor that the definition does effectively is clarify what a blockchain does, and it explains it in such a means that any software program developer will have the ability to pretty clearly have at the least an intuitive grasp of its worth proposition. Now, in follow, generally the programming language that the applications run in could be very restrictive; Bitcoin’s language could be seen as requiring a sequence of DESTROY COIN:

The one factor that the definition emphasizes extraordinarily effectively is that blockchains aren’t about bringing to the world anyone explicit ruleset, whether or not it is a forex with a fixed-supply financial coverage, a reputation registry with a 200-day re-registration time, a specific decentralized change design or no matter else; slightly, they’re about creating the liberty to create a brand new mechanism with a brand new ruleset extraordinarily shortly and pushing it out. They’re Lego Mindstorms for constructing financial and social establishments.

That is the core of the extra reasonable model of the “it is the blockchain that is thrilling, not the forex” place that’s so prevalent in mainstream trade: it’s certainly true that forex is important to make cryptoeconomic blockchains work (though NOT blockchain-like knowledge buildings following the Stellar subjective consensus model), however the forex is there merely as financial plumbing to incentivize consensus participation, maintain deposits and pay transaction charges, not because the center-stage level of speculative mania, shopper curiosity and pleasure.

Now, why are blockchains helpful? To summarize:

- You’ll be able to retailer knowledge on them and that knowledge is assured to have a really excessive diploma of availability

- You’ll be able to run functions on them and be assured an especially excessive uptime

- You’ll be able to run functions on them, and be assured an especially excessive uptime going very far into the long run

- You’ll be able to run functions on them, and persuade your customers that the applying’s logic is sincere and is doing what you might be promoting that it does

- You’ll be able to run functions on them, and persuade your customers that your software will stay working even when you lose curiosity in sustaining it, you might be bribed or threatened to control the applying state in a roundabout way, otherwise you purchase a revenue motive to control the applying state in a roundabout way

- You’ll be able to run functions on them, and provides your self the backdoor key whether it is completely vital, BUT put “constitutional” limiations in your use of the important thing – for instance, requiring a software program replace to go by way of a public one-month ready interval earlier than it may be launched, or on the very least instantly notifying customers of software updates

- You’ll be able to run functions on them, and provides a backdoor key to a specific governance algorithm (eg. voting, futarchy, some difficult multicameral parliament structure), and persuade your customers that the actual governance algorithm in query is definitely accountable for the applying

- You’ll be able to run functions on them, and people functions can discuss to one another with 100% reliability – even when the underlying platform has solely 99.999% reliability

- A number of customers or corporations can run functions on them, and people functions can work together with one another at extraordinarily excessive pace with out requiring any community messages, whereas on the identical time making certain that every firm has complete management over its personal software

- You’ll be able to construct functions that very simply and effectively benefit from the info produced by different functions (eg. combining funds and repute programs is maybe the biggest achieve right here)

All of these issues are beneficial not directly to billions of individuals world wide, probably notably in areas of the world the place extremely developed financial, monetary and social infrastructure at the moment merely doesn’t work in any respect (although know-how will typically have to be mixed with political reforms to resolve most of the issues), and blockchains are good at offering these properties. They’re notably clearly beneficial in finance, as finance is maybe probably the most concurrently computationally and trust-intensive trade on the earth, however they’re additionally beneficial in lots of different spots in web infrastructure. There do exist different architectures that may additionally present these properties, however they’re barely to reasonably much less good than blockchains are. Gavin Wooden has began describing this preferrred computing platform as “the world pc” – a pc the state of which is shared amongst everybody and which a really massive group of individuals, which anybody is free to hitch, are concerned in sustaining.

Base Layer Infrastructure

Like open supply, by far the biggest alternative for features out of blockchain know-how are out of what could be referred to as “base-layer infrastructure” providers. Base-layer infrastructure providers, as a normal class, are characterised by the next properties:

- Dependency – there exist many different providers that intimately rely on the base-layer service for performance

- Excessive community results – there are substantial advantages from very massive teams of individuals (and even everybody) utilizing the identical service

- Excessive switching prices – it’s tough for a person to modify from one service to the opposite

Word that one concern that isn’t in there may be any notion of uncooked “necessity” or “significance”; there could be pretty unimportant base layers (eg. RSS feeds) and necessary non-base-layers (eg. meals). Base-layer providers have existed ever since even earlier than the daybreak of civilization; within the so-called “caveman days” the one most necessary base-layer service of all was language. In considerably newer occasions, the first examples turned roads, the authorized system and postal and transportation programs, within the twentieth century we added phone networks and monetary programs, and on the finish of the millennium emerged the web. Now, nevertheless, the brand new base-layer providers of the web are virtually completely informational: web cost programs, identification, area identify programs, certificates authorities, repute programs, cloud computing, varied sorts of knowledge feeds, and maybe within the close to future prediction markets.

In ten years time, the extremely networked and interdependent nature of those providers might make it such that it’s tougher for people to modify from one system to a different than it’s for them to even change which authorities they’re dwelling beneath – and that signifies that ensuring that these providers are constructed accurately and that their governance course of doesn’t put a number of non-public entities in positions of utmost energy is of utmost significance. Proper now, many of those programs are in-built a extremely centralized trend, and that is partly merely attributable to the truth that the unique design of the World Huge Internet failed to comprehend the significance of those providers and embody defaults – and so, even at present, most web sites ask you to “register with Google” or “register with Fb”, and certificates authorities run into problems like this:

“A solo Iranian hacker on Saturday claimed accountability for stealing a number of SSL certificates belonging to among the Internet’s greatest websites, together with Google, Microsoft, Skype and Yahoo.

Early response from safety consultants was combined, with some believing the hacker’s declare, whereas others had been doubtful.

Final week, conjecture had centered on a state-sponsored assault, maybe funded or performed by the Iranian authorities, that hacked a certificates reseller affiliated with U.S.-based Comodo.

On March 23, Comodo acknowledged the assault, saying that eight days earlier, hackers had obtained 9 bogus certificates for the log-on websites of Microsoft’s Hotmail, Google’s Gmail, the Web telephone and chat service Skype and Yahoo Mail. A certificates for Mozilla’s Firefox add-on website was additionally acquired.”

Why should not certificates authorities be decentralized at the least to the purpose of an M-of-N system once more? (Word that the case for way more widespread use of M-of-N is logically separable from the case for blockchains, however blockchains occur to be platform to run M-of-N on).

Id

Allow us to take a specific use case, “identification on the blockchain”, and run with it. Basically, what do you want as a way to have an identification? The only reply is one we already know: that you must have a private and non-private key. You publish the general public key, which turns into your ID, and also you digitally signal each message you ship together with your non-public key, permitting anybody to confirm that these messages had been produced by you (the place, from their perspective, “you” means “the entity that holds that exact public key”). Nonetheless, there are a number of challenges:

- What occurs in case your key will get stolen, and that you must change to a brand new one?

- What occurs when you lose your key?

- What if you wish to consult with different customers by their names, and never only a random 20-byte string of cryptographic knowledge?

- What if you wish to use a extra superior strategy for safety resembling multisig, and never only a single key?

Allow us to strive fixing these challenges one-by-one. We will begin off with the fourth. A easy answer is that this: as an alternative of requiring one explicit cryptographic signature kind, your public key turns into a program, and a legitimate signature turns into a string that, when fed into this system along with the message, returns 1. Theoretically, any single-key, multi-key or no matter different form of ruleset could be encoded into such a paradigm.

Nonetheless, this has an issue: the general public keys will get too lengthy. We will clear up this by placing the precise “public key” into some knowledge retailer (eg. a distributed hash table if we wish decentralization) and utilizing the hash of the “public key” because the consumer’s ID. This doesn’t but require blockchains – though, within the newest designs, within the restrict scalable blockchains are actually not that completely different in design from DHTs and so it’s completely attainable that, in ten years time, each form of decentralized system used for something will by accident or deliberately converge into some form of scalable blockchain.

Now, think about the primary downside. We will consider this because the certificate revocation downside: if you wish to “revoke” a specific key, how do you make sure that it will get round to everybody who must see it? This by itself can as soon as once more be solved by a distributed hash desk. Nonetheless, this results in the subsequent downside: if you wish to revoke a key, what do you exchange it with? In case your secret is stolen, you and the attacker each have it, and so neither of you could be convincingly extra authoritative. One answer is to have three keys, after which if one will get revoked then require a signature from two or all of them to approve the subsequent key. However this results in a “nothing at stake” downside: if the attacker finally manages to steal all three of your keys from some level in historical past, then they will simulate a historical past of assigning a brand new key, assigning additional new keys from there, and your personal historical past is now not extra authoritative. This is a timestamping downside, and so right here blockchains can really assist.

For the second downside, holding a number of keys and reassigning additionally works fairly effectively – and right here, blockchains aren’t wanted. In reality, you do not want to re-assign; with intelligent use of secret sharing you may really get well from key losses just by retaining your key in “shards”, such that when you lose any single shard you may at all times use secret sharing math to easily get well it from the others. For the third downside, blockchain-based identify registries are the only answer.

Nonetheless, in follow most individuals aren’t well-equipped to securely retailer a number of keys, and there are at all times going to be mishaps, and sometimes centralized providers play an necessary function: serving to folks get their accounts again within the occasion of a mistake. On this case, the blockchain-based answer is easy: social M-of-N backup.

You decide eight entities; they could be your mates, your employer, some company, nonprofit and even sooner or later a authorities, and if something goes unsuitable a mixture of 5 of them can get well your key. This idea of social multi-signature backup is maybe one of the highly effective mechanisms to make use of in any form of decentralized system design, and gives a really excessive quantity of safety very cheaply and with out counting on centralized belief. Word that blockchain-based identification, notably with Ethereum’s contract mannequin, makes all of this very straightforward to program: within the identify registry, register your identify and level it at a contract, and have that contract preserve the present major key and backup keys related to the identification in addition to the logic for updating them over time. An identification system, secure and easy-to-use sufficient for grandma, completed with none particular person entity (apart from you!) in management.

Id isn’t the one downside that blockchains can alleviate. One other element, intimately tied up with identification, is repute. At present, what passes for “repute programs” within the trendy world are invariably both insecure, attributable to their incapability to make sure that an entity score one other entity actually interacted with them, or centralized, tying repute knowledge to a specific platform and having the repute knowledge exist beneath that platform’s management. Once you change from Uber to Lyft, your Uber score doesn’t carry over.

A decentralized repute system would ideally include two separate layers: knowledge and analysis. Knowledge would consist of people making impartial scores about others, scores tied to transactions (eg. with blockchain-based funds one can create an open system such that you would be able to solely give retailers a score when you really pay them), and a group of different sources, and anybody can run their very own algorithm to judge their knowledge; “light-client pleasant” algorithms that may consider a proof of repute from a specific dataset shortly might develop into an necessary analysis space (many naive repute algorithms contain matrix math, which has practically cubic computational complexity within the underlying knowledge and so is difficult to decentralize). “Zero-knowledge” repute programs that permit a consumer to offer some form of cryptographic certificates proving that they’ve at the least x repute factors in keeping with a specific metric with out revealing the rest are additionally promising.

The case of repute is attention-grabbing as a result of it combines collectively a number of advantages of the blockchain as a platform:

- Its use as an information retailer for identification

- Its use as an information retailer for reputational information

- Inter-application interoperability (scores tied to proof of cost, capability for any algorithm to work over the identical underlying set of knowledge, and so on)

- A assure that the underlying knowledge will probably be transportable going into the long run (corporations might voluntarily present a repute certificates in an exportable format, however they haven’t any option to pre-commit to persevering with to have that performance going into the long run)

- Using a decentralized platform extra typically to ensure that the repute wasn’t manipulated on the level of calculation

Now, for all of those advantages, there are substitutes: we will belief Visa and Mastercard to offer cryptographically signed receipts {that a} explicit transaction came about, we will retailer reputational information on archive.org, we will have servers discuss to one another, we will have non-public corporations specify of their phrases of service that they comply with be good, and so forth. All of those choices are fairly efficient, however they’re not practically as good as merely placing all the pieces out into the open, working it on “the world pc” and letting cryptographic verification and proofs do the work. And an analogous argument could be made for each different use case.

Slicing Prices

If the biggest worth from blockchain know-how comes on the lengthy tail, as this thesis suggests, then that results in an necessary conclusion: the per-transaction achieve from utilizing a blockchain could be very small. Therefore, the issue of chopping prices of consensus and rising blockchain scalability turns into paramount. With centralized options, customers and companies are used to paying primarily $0 per “transaction”; though people trying to donate to Wikileaks could also be keen to pay even a price of $5 to get their transaction by way of, somebody attempting to add a repute report might effectively solely be keen to pay a price of $0.0005.

Therefore, the issue of constructing consensus cheaper, each within the absolute sense (ie. proof of stake) and within the per-transaction sense (ie. through scalable blockchain algorithms the place at most a few hundred nodes course of each transaction), is completely paramount. Moreover, blockchain builders ought to needless to say the final forty years of software program improvement has been a historical past of transferring to progressively much less and fewer environment friendly programming languages and paradigms solely as a result of they permit builders to be much less skilled and lazier, and equally work to design blockchain algorithms that work across the precept that builders are actually not going to be all that good and even handed about what they placed on the blockchain and what they maintain off – although a well-designed system of transaction charges will possible result in builders naturally studying a lot of the necessary factors by way of private expertise.

Therefore, there may be substantial hope for a future that may be, to a considerable diploma, extra decentralized; nevertheless, the times of straightforward features are over. Now could be the time for a a lot tougher, and longer, slog of wanting into the true world, and seeing how the applied sciences that we’ve constructed can really profit the world. Throughout this stage, we are going to possible uncover that sooner or later we are going to hit an inflection level, the place most situations of “blockchain for X” will probably be made not by blockchain fans searching for one thing helpful to do, coming upon X, and attempting to do it, however slightly by X fans who take a look at blockchains and understand that they’re a reasonably useful gizmo for performing some a part of X. Whether or not X is web of issues, monetary infrastructure for the creating world, bottom-up social, cultural and financial establishments, higher knowledge aggregation and safety for healthcare, or just controversial charities and uncensorable marketplaces. Within the latter two instances, the inflection level has possible already hit; most of the unique crowd of blockchain fans turned blockchain fans due to the politics. As soon as it hits within the different instances, nevertheless, then we are going to really know that it has gone mainstream, and that the biggest humanitarian features are quickly to return.

Moreover, we are going to possible uncover that the idea of “the blockchain neighborhood” will stop to be significant as any form of quasi-political motion in its personal proper; if any label applies in any respect, “crypto 2.0” is prone to be probably the most defensible one. The reason being much like why we would not have an idea of “the distributed hash desk neighborhood”, and “the database neighborhood”, whereas existent, is basically merely a set of pc scientists who occur to focus on databases: blockchains are only one know-how, and so finally the best progress can solely be achieved by engaged on mixture with a complete set of different set of decentralized (and decentralization-friendly) applied sciences: reputation systems, distributed hash tables, “peer-to-peer hypermedia platforms“, distributed messaging protocols, prediction markets, zero-knowledge proofs and sure many extra that haven’t but been found.