- USDT’s sharp provide drop mirrored regulatory scrutiny and macroeconomic uncertainties.

- Bitcoin confronted lowered shopping for stress, with USDT’s contraction constraining liquidity.

The market is navigating unsure waters as Tether [USDT], the business’s main stablecoin, has seen its circulating provide drop by over $1.3 billion in simply ten days.

Because the lifeblood of crypto liquidity, USDT’s sudden contraction raises alarms about potential shifts in market dynamics.

Whether or not pushed by regulatory scrutiny, waning investor confidence, or broader market changes, the decline comes at a essential juncture with Bitcoin teetering close to key assist ranges.

The query now’s whether or not this alerts a brief slowdown in buying and selling exercise or a extra profound market recalibration.

USDT provide contraction

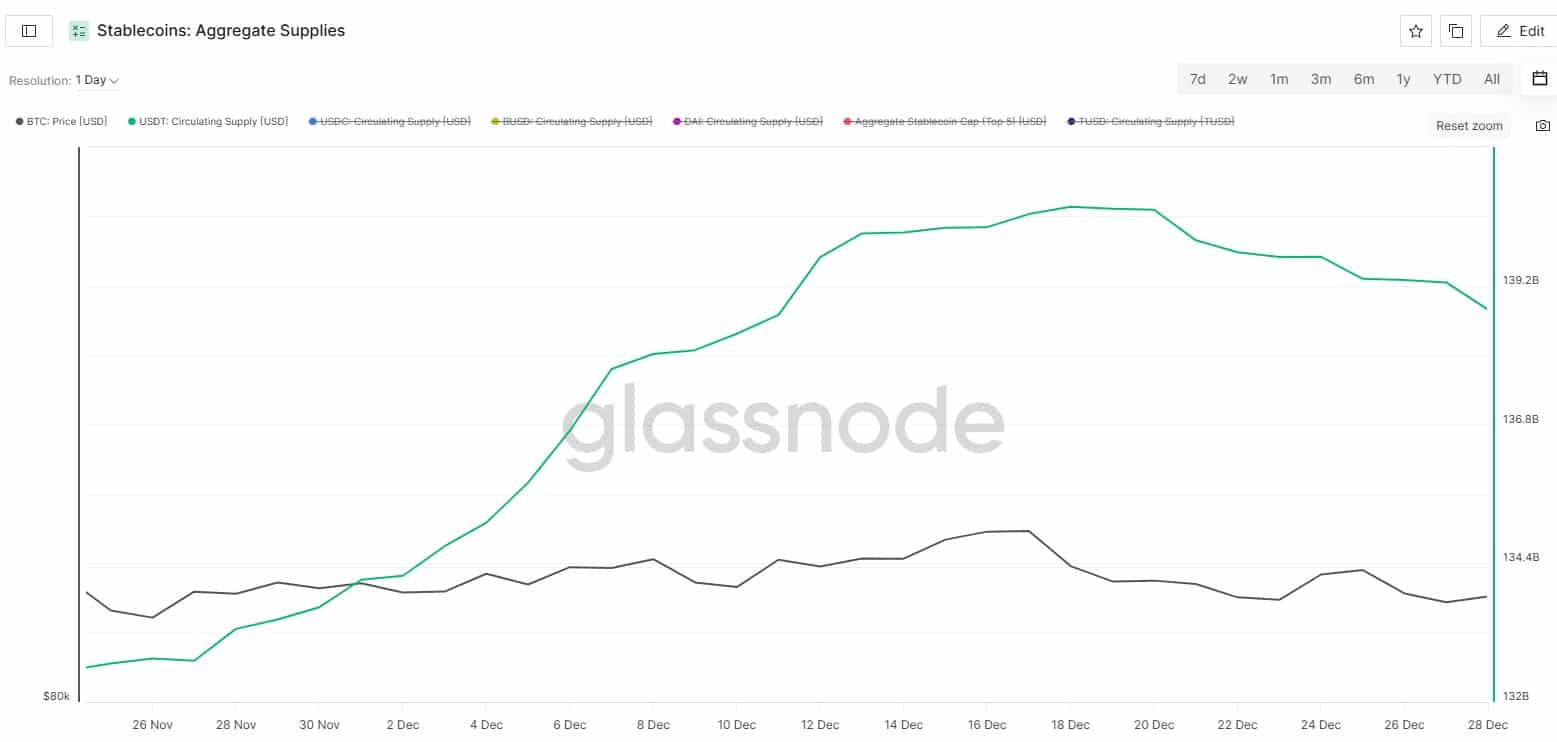

Latest knowledge revealed a pointy decline in USDT’s circulating provide, dropping from a peak of roughly $140.5 billion to $139.2 billion over ten days. This contraction seemingly displays a mixture of things.

First, heightened regulatory scrutiny, significantly within the U.S. post-FTX collapse, might have prompted redemptions as buyers search safer fiat options.

Second, diminished buying and selling volumes throughout main exchanges point out lowered demand for stablecoin liquidity, correlating with Bitcoin’s latest value stagnation close to key assist ranges.

Lastly, macroeconomic uncertainties, together with rising treasury yields and a stronger greenback, are pushing capital out of risk-on crypto markets.

The sharp drop in USDT provide underscored shifting sentiment, suggesting the market could also be recalibrating amid these headwinds relatively than experiencing a brief slowdown.

Bitcoin value motion amid USDT provide decline

The chart highlighted Bitcoin’s [BTC] wrestle to keep up stability as USDT’s provide contracts. Bitcoin’s value has hovered round $94,900, with declining quantity signaling lowered shopping for stress.

The RSI at 45.44 recommended a bearish sentiment, falling beneath the impartial 50 line. In the meantime, the OBV confirmed a dip to -90K, indicating web capital outflows as market individuals scale back threat publicity.

This alignment of metrics implies that the contraction in USDT’s provide correlates with diminished liquidity, constraining Bitcoin’s upward momentum.

Moreover, market warning could also be fueled by macroeconomic headwinds and regulatory uncertainties, exacerbating promoting stress.

Bitcoin’s incapability to reclaim prior assist ranges displays a broader recalibration part, with shrinking stablecoin liquidity serving as a key limiting issue.

Implications for crypto market liquidity

The shrinking USDT provide alerts potential liquidity constraints heading into 2025. Stablecoins like USDT act as intermediaries, enabling seamless capital flows between property.

A $1.3 billion contraction in USDT limits market depth, growing slippage dangers and volatility. This might deter institutional merchants reliant on excessive liquidity, probably shrinking buying and selling volumes throughout exchanges.

Furthermore, tighter liquidity impacts altcoins disproportionately, amplifying volatility in smaller-cap property.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

As market individuals search stability, Bitcoin and Ethereum [ETH] might retain dominance, however speculative progress in DeFi and NFT markets might stagnate.

Except stablecoin provide replenishes, pushed by renewed investor confidence or regulatory readability, the market dangers getting into a interval of subdued exercise, with fewer arbitrage alternatives and delayed value recoveries throughout downturns.