One of many essential indicators of how a lot load the Ethereum blockchain can safely deal with is how the uncle charge responds to the fuel utilization of a transaction. In all blockchains of the Satoshian proof-of-work selection, any block that’s printed has the danger of howbecoming a “stale”, ie. not being a part of the primary chain, as a result of one other miner printed a competing block earlier than the lately printed block reached them, resulting in a scenario the place there’s a “race” between two blocks and so one of many two will essentially be left behind.

One essential reality is that the extra transactions a block accommodates (or the extra fuel a block makes use of), the longer it’s going to take to propagate via the community. Within the Bitcoin community, one seminal research on this was Decker and Wattenhofer (2013), which discovered that the common propagation time of a block was about 2 seconds plus one other 0.08 seconds per kilobyte within the block (ie. a 1 MB block would take ~82 seconds). A more recent Bitcoin Unlimited study confirmed that this has since lowered to ~0.008 seconds per kilobyte resulting from transaction propagation know-how enhancements. We will additionally see that if a block takes longer to propagate, the prospect that it’s going to turn out to be a stale is greater; at a block time of 600 seconds, a propagation time enhance of 1 second ought to correspond to an elevated 1/600 probability of being left behind.

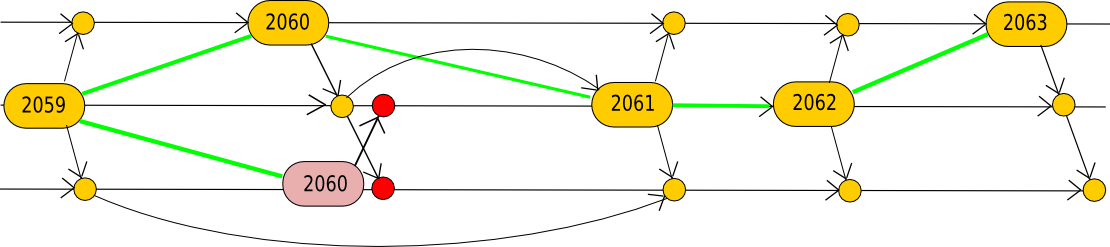

In Ethereum, we are able to make an analogous evaluation, besides that because of Ethereum’s “uncle” mechanic we’ve got very stable knowledge to research from. Stale blocks in Ethereum will be re-included into the chain as “uncles”, the place they obtain as much as 75% of their authentic block reward. This mechanic was initially launched to scale back centralization pressures, by decreasing the benefit that well-connected miners have over poorly linked miners, but it surely additionally has a number of aspect advantages, one in every of which is that stale blocks are tracked all the time in a really simply searchable database – the blockchain itself. We will take an information dump of blocks 1 to 2283415 (earlier than the Sep 2016 assaults) as a supply of knowledge for evaluation.

Here’s a script to generate some supply knowledge: http://github.com/ethereum/research/tree/master/uncle_regressions/block_datadump_generator.py

Right here is the supply knowledge: http://github.com/ethereum/research/tree/master/uncle_regressions/block_datadump.csv

The columns, so as, signify block quantity, variety of uncles within the block, the entire uncle reward, the entire fuel consumed by uncles, the variety of transactions within the block, the fuel consumed by the block, the size of the block in bytes, and the size of the block in bytes excluding zero bytes.

We will then use this script to research it: http://github.com/ethereum/research/tree/master/uncle_regressions/base_regression.py

The outcomes are as follows. Normally, the uncle charge is persistently round 0.06 to 0.08, and the common fuel consumed per block is round 100000 to 300000. As a result of we’ve got the fuel consumed of each blocks and uncles, we run a linear regression to estimate of how a lot 1 unit of fuel provides to the likelihood {that a} given block might be an uncle. The coefficients develop into as follows:

Block 0 to 200k: 3.81984698029e-08

Block 200k to 400k: 5.35265798406e-08

Block 400k to 600k: 2.33638832951e-08

Block 600k to 800k: 2.12445242166e-08

Block 800k to 1000k: 2.7023102773e-08

Block 1000k to 1200k: 2.86409050022e-08

Block 1200k to 1400k: 3.2448993833e-08

Block 1400k to 1600k: 3.12258208662e-08

Block 1600k to 1800k: 3.18276549008e-08

Block 1800k to 2000k: 2.41107348445e-08

Block 2000k to 2200k: 1.99205804032e-08

Block 2200k to 2285k: 1.86635688756e-08

Therefore, every 1 million fuel price of transactions that will get included in a block now provides ~1.86% to the likelihood that that block will turn out to be an uncle, although throughout Frontier this was nearer to 3-5%. The “base” (ie. uncle charge of a 0-gas block) is persistently ~6.7%. For now, we are going to depart this outcome as it’s and never make additional conclusions; there’s one additional complication that I’ll talk about later no less than with regard to the impact that this discovering has on fuel restrict coverage.

Gasoline pricing

One other concern that touches uncle charges and transaction propagation is fuel pricing. In Bitcoin improvement discussions, a typical argument is that block measurement limits are pointless as a result of miners have already got a pure incentive to restrict their block sizes, which is that each kilobyte they add will increase the stale charge and therefore threatens their block reward. Given the 8 sec per megabyte impedance discovered by the Bitcoin Limitless research, and the truth that every second of impedance corresponds to a 1/600 probability of dropping a 12.5 BTC block reward, this implies an equilibrium transaction payment of 0.000167 BTC per kilobyte assuming no block measurement limits.

In Bitcoin’s surroundings, there are causes to be long-term skeptical concerning the economics of such a no-limit incentive mannequin, as there’ll ultimately be no block reward, and when the one factor that miners need to lose from together with too many transactions is charges from their different transactions, then there’s an financial argument that the equilibrium stale charge might be as high as 50%. Nonetheless, there are modifications that may be made to the protocol to restrict this coefficient.

In Ethereum’s present surroundings, block rewards are 5 ETH and can keep that approach till the algorithm is modified. Accepting 1 million fuel means a 1.86% probability of the block turning into an uncle. Thankfully, Ethereum’s uncle mechanism has a cheerful aspect impact right here: the common uncle reward is lately round 3.2 ETH, so 1 million fuel solely means a 1.86% probability of placing 1.8 ETH in danger, ie. an anticipated lack of 0.033 ETH and never 0.093 as could be the case with out an uncle mechanism. Therefore, the present fuel costs of ~21 shannon are literally fairly near the “economically rational” fuel value of 33 shannon (that is earlier than the DoS assaults and the optimizations arising therefrom; now it’s doubtless even decrease).

The only option to push the equilibrium gasprice down additional is to enhance uncle inclusion mechanics and attempt to get uncles included in blocks as shortly as attainable (maybe by individually propagating each block as a “potential uncle header”); on the restrict, if each uncle is included as shortly as attainable, the equilibrium fuel value would go right down to about 11 shannon.

Is Information Underpriced?

A second linear regression evaluation will be carried out with supply code right here: http://github.com/ethereum/research/tree/master/uncle_regressions/tx_and_bytes_regression.py

The aim right here is to see if, after accounting for the above computed coefficients for fuel, there’s a correlation with the variety of transactions or with the scale of a block in bytes left over. Sadly, we don’t have block measurement or transaction depend figures for uncles, so we’ve got to resort to a extra oblique trick that appears at blocks and uncles in teams of fifty. The fuel coefficients that this evaluation finds are greater than the earlier evaluation: round 0.04 uncle charge per million fuel. One attainable clarification is that if a single block has a excessive propagation time, and it results in an uncle, there’s a 50% probability that that uncle is the high-propagation-time block, however there’s additionally a 50% probability that the uncle would be the different block that it competes in opposition to. This idea matches properly with the 0.04 per million “social uncle charge” and the ~0.02 per million “non-public uncle charge” discovering; therefore we are going to take it because the most certainly clarification.

The regression finds that, after accounting for this social uncle charge, one byte accounts for an extra ~0.000002 uncle charge. Bytes in a transaction take up 68 fuel, of which 61 gas accounts for its contribution to bandwidth (the remaining 7 is for bloating the historical past database). If we would like the bandwidth coefficient and the computation coefficient within the fuel desk to each mirror propagation time, then this means that if we needed to actually optimize fuel prices, we would want to extend the fuel price per byte by 50 (ie. to 138). This may additionally entail elevating the bottom fuel price of a transaction by 5500 (word: such a rebalance wouldn’t imply that every little thing will get costlier; the fuel restrict could be raised by ~10% in order that the average-case transaction throughput would stay unchanged). Then again, the danger of worst-case denial-of-service assaults is worse for execution than for knowledge, and so execution requires bigger security components. Therefore, there’s arguably not sufficiently sturdy proof to do any re-pricings right here no less than in the intervening time.

One attainable long-term protocol change could be to introduce separate fuel pricing mechanisms for in-EVM execution and transaction knowledge; the argument right here is that the 2 are a lot simpler to separate as transaction knowledge will be computed individually from every little thing else, and so the optimum technique could also be to one way or the other enable the market to stability them; nevertheless, exact mechanisms for doing such a factor nonetheless should be developed.

Gasoline Restrict Coverage

For a person miner figuring out their fuel value, the “non-public uncle charge” of 0.02 per million fuel is the related statistic. From the perspective of the entire system, the “social uncle charge” of 0.04 per million fuel is what issues. If we didn’t care about security components and had been comfortable with an uncle charge of 0.5 uncles per block (which means, a “51% assault” would solely want 40% hashpower to succeed, truly not as dangerous because it sounds) then no less than this evaluation means that the fuel restrict might theoretically be raised to ~11 million (20 tx/sec given a median 39k fuel per tx as is the case below present utilization, or 37 tx/sec price of easy sends). With the newest optimizations, this might be pushed even greater. Nonetheless, since we do care about security components and like to have a decrease uncle charge to alleviate centralization dangers, 5.5 million is probably going an optimum degree for the fuel restrict, although within the medium time period a “dynamic fuel restrict” system that targets a selected block processing time could be a greater method, as it could be capable to shortly and routinely alter in response to assaults and dangers.

Observe that the priority concerning the centralization dangers and the necessity for security components don’t stack on high of one another. The reason being that in an energetic denial-of-service assault, the blockchain must survive, not be long-term economically centralization-resistant; the argument is that if the attacker’s purpose was to economically encourage centralization, then the attacker might simply donate cash to the most important pool to be able to bribe different miners to affix it.

Sooner or later, we are able to count on digital machine enhancements to lower uncle charges additional, although enhancements to networking are ultimately going to be required as properly. There’s a restrict to how a lot scalability is feasible on a single chain, with the first bottleneck being disk reads and writes, so after some level (doubtless 10-40 million fuel) sharding would be the solely option to course of extra transactions. If we simply wish to lower equilibrium fuel costs, then Casper will assist considerably, by making the “slope” of uncle charge to fuel consumption near-zero no less than as much as a sure level.