- Ethereum ETFs see $760M in outflows as investor sentiment shifts in the direction of Bitcoin amid favorable situations.

- Bitcoin ETFs entice $785M in inflows, signaling renewed investor confidence, whereas Ethereum faces investor retreat.

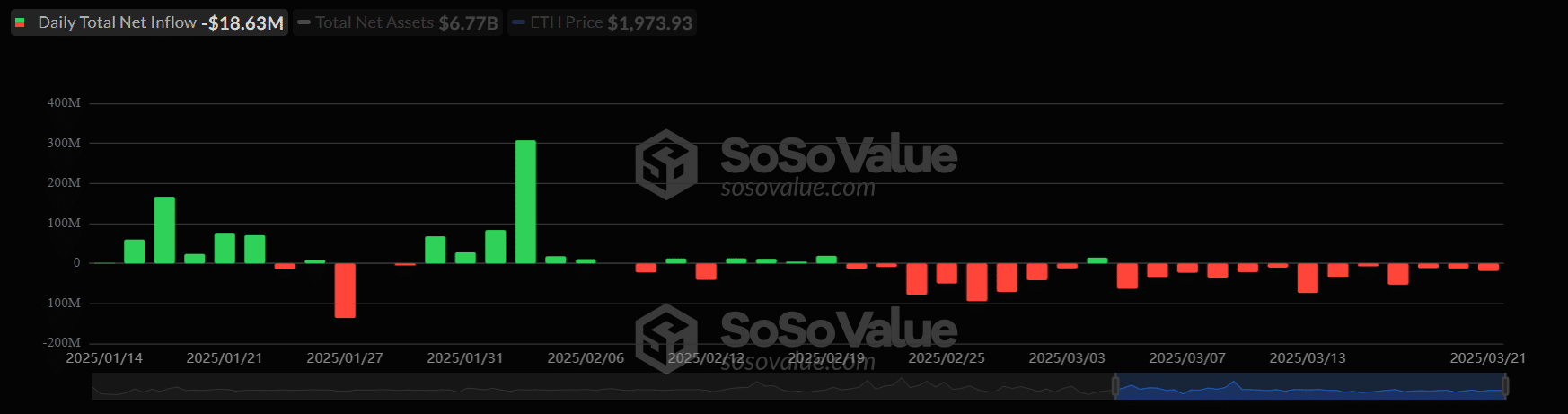

Ethereum [ETH] is falling out of favor — at the very least for now. Over the previous month, U.S.-listed Ethereum ETFs have recorded greater than $760 million in outflows, a pointy distinction to the surging curiosity in Bitcoin [BTC].

In simply the final six days, Bitcoin ETFs have pulled in $785 million in contemporary capital, signaling a decisive shift in investor sentiment and elevating contemporary questions on Ethereum’s position within the evolving digital asset panorama.

Ethereum ETFs see regular outflows as market sentiment turns cautious

Ethereum ETFs have entered a chronic interval of investor retreat, shedding over $760 million in web outflows over the previous month.

Inflows peaked briefly on the finish of January — most notably with a single-day surge above $300 million — however shortly reversed into constant outflows via February and March.

Since mid-February, pink bars dominate the chart, illustrating a virtually unbroken stretch of each day web outflows that mirror rising warning towards Ethereum.

Whole web belongings for Ethereum ETFs now sit at $6.77 billion, with ETH itself buying and selling just below $2,000.

Institutional buyers are dropping confidence in Ethereum’s near-term efficiency, particularly amid a broader narrative more and more centered round Bitcoin.

With outflows accelerating, Ethereum dangers dropping its standing because the second most favored crypto asset amongst ETF buyers.