Particular due to Andrew Miller for arising with this assault, and to Zack Hess, Vlad Zamfir and Paul Sztorc for dialogue and responses

One of many extra fascinating surprises in cryptoeconomics in latest weeks got here from an assault on SchellingCoin conceived by Andrew Miller earlier this month. Though it has all the time been understood that SchellingCoin, and comparable techniques (together with the extra superior Truthcoin consensus), depend on what’s thus far a brand new and untested cryptoeconomic safety assumption – that one can safely depend on individuals appearing truthfully in a simultaneous consensus sport simply because they imagine that everybody else will – the issues which were raised thus far need to do with comparatively marginal points like an attacker’s skill to exert small however growing quantities of affect on the output over time by making use of continued strain. This assault, however, reveals a way more basic drawback.

The situation is described as follows. Suppose that there exists a easy Schelling sport the place customers vote on whether or not or not some specific truth is true (1) or false (0); say in our instance that it is really false. Every person can both vote 1 or 0. If a person votes the identical as the bulk, they get a reward of P; in any other case they get 0. Thus, the payoff matrix appears to be like as follows:

| You vote 0 | You vote 1 | |

| Others vote 0 | P | 0 |

| Others vote 1 | 0 | P |

The idea is that if everybody expects everybody else to vote in truth, then their incentive is to additionally vote in truth in an effort to adjust to the bulk, and that is the rationale why one can anticipate others to vote in truth within the first place; a self-reinforcing Nash equilibrium.

Now, the assault. Suppose that the attacker credibly commits (eg. through an Ethereum contract, by merely placing one’s status at stake, or by leveraging the status of a trusted escrow supplier) to pay out X to voters who voted 1 after the sport is over, the place X = P + ε if the bulk votes 0, and X = 0 if the bulk votes 1. Now, the payoff matrix appears to be like like this:

| You vote 0 | You vote 1 | |

| Others vote 0 | P | P + ε |

| Others vote 1 | 0 | P |

Thus, it is a dominant technique for anybody to vote 1 it doesn’t matter what you assume the bulk will do. Therefore, assuming the system will not be dominated by altruists, the bulk will vote 1, and so the attacker won’t have to pay something in any respect. The assault has efficiently managed to take over the mechanism at zero price. Notice that this differs from Nicholas Houy’s argument about zero-cost 51% attacks on proof of stake (an argument technically extensible to ASIC-based proof of labor) in that right here no epistemic takeover is required; even when everybody stays useless set in a conviction that the attacker goes to fail, their incentive continues to be to vote to help the attacker, as a result of the attacker takes on the failure threat themselves.

Salvaging Schelling Schemes

There are just a few avenues that one can take to attempt to salvage the Schelling mechanism. One strategy is that as an alternative of spherical N of the Schelling consensus itself deciding who will get rewarded based mostly on the “majority is true” precept, we use spherical N + 1 to find out who needs to be rewarded throughout spherical N, with the default equilibrium being that solely individuals who voted accurately throughout spherical N (each on the precise truth in query and on who needs to be rewarded in spherical N – 1) needs to be rewarded. Theoretically, this requires an attacker wishing to carry out a cost-free assault to deprave not only one spherical, but in addition all future rounds, making the required capital deposit that the attacker should make unbounded.

Nevertheless, this strategy has two flaws. First, the mechanism is fragile: if the attacker manages to deprave some spherical within the far future by really paying up P + ε to everybody, no matter who wins, then the expectation of that corrupted spherical causes an incentive to cooperate with the attacker to back-propagate to all earlier rounds. Therefore, corrupting one spherical is dear, however corrupting 1000’s of rounds will not be rather more pricey.

Second, due to discounting, the required deposit to beat the scheme doesn’t should be infinite; it simply must be very very massive (ie. inversely proportional to the prevailing rate of interest). But when all we would like is to make the minimal required bribe bigger, then there exists a a lot less complicated and higher technique for doing so, pioneered by Paul Storcz: require individuals to place down a big deposit, and construct in a mechanism by which the extra rivalry there’s, the extra funds are at stake. On the restrict, the place barely over 50% of votes are in favor of 1 consequence and 50% in favor of the opposite, your complete deposit it taken away from minority voters. This ensures that the assault nonetheless works, however the bribe should now be larger than the deposit (roughly equal to the payout divided by the discounting charge, giving us equal efficiency to the infinite-round sport) moderately than simply the payout for every spherical. Therefore, in an effort to overcome such a mechanism, one would wish to have the ability to show that one is able to pulling off a 51% assault, and maybe we might merely be snug with assuming that attackers of that dimension don’t exist.

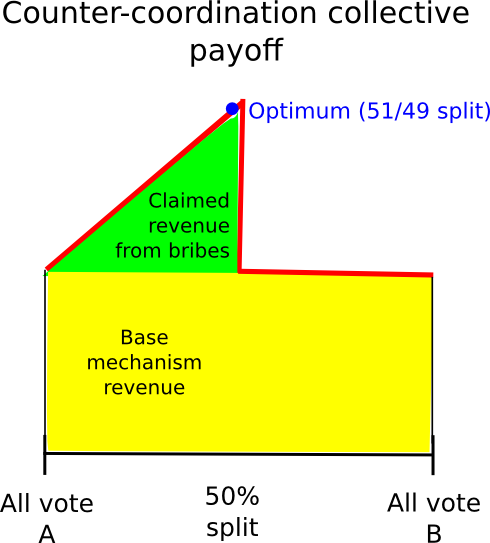

One other strategy is to depend on counter-coordination; basically, someway coordinate, maybe through credible commitments, on voting A (if A is the reality) with likelihood 0.6 and B with likelihood 0.4, the speculation being that this may enable customers to (probabilistically) declare the mechanism’s reward and a portion of the attacker’s bribe on the identical time. This (appears to) work significantly properly in video games the place as an alternative of paying out a relentless reward to every majority-compliant voter, the sport is structured to have a relentless whole payoff, adjusting particular person payoffs to perform this aim is required. In such conditions, from a collective-rationality standpoint it’s certainly the case that the group earns a highest revenue by having 49% of its members vote B to say the attacker’s reward and 51% vote A to ensure the attacker’s reward is paid out.

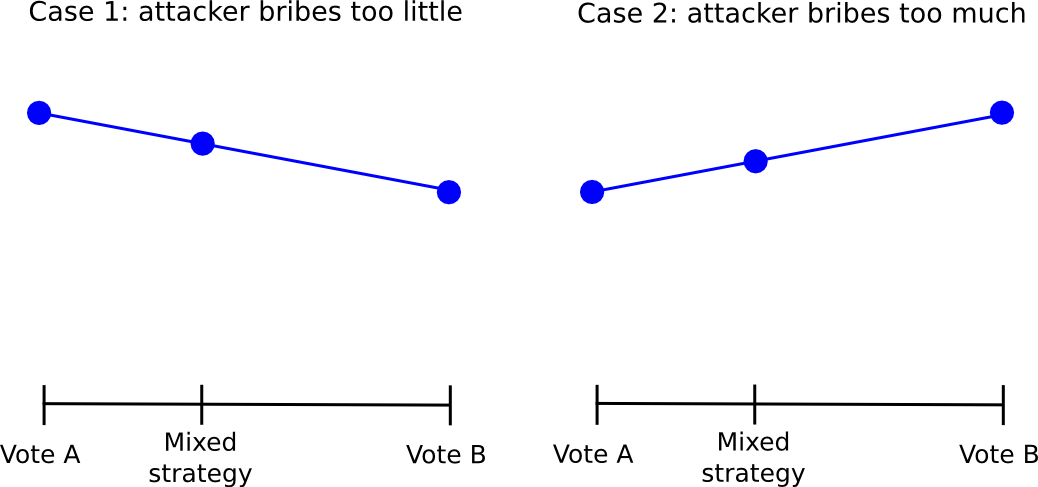

Nevertheless, this strategy itself suffers from the flaw that, if the attacker’s bribe is excessive sufficient, even from there one can defect. The elemental drawback is that given a probabilistic blended technique between A and B, for every the return all the time adjustments (nearly) linearly with the likelihood parameter. Therefore, if, for the person, it makes extra sense to vote for B than for A, it is going to additionally make extra sense to vote with likelihood 0.51 for B than with likelihood 0.49 for B, and voting with likelihood 1 for B will work even higher.

Therefore, everybody will defect from the “49% for 1” technique by merely all the time voting for 1, and so 1 will win and the attacker can have succeeded within the costless takeover. The truth that such sophisticated schemes exist, and are available so near “seeming to work” means that maybe within the close to future some advanced counter-coordination scheme will emerge that really does work; nevertheless, we should be ready for the eventuality that no such scheme will probably be developed.

Additional Penalties

Given the sheer variety of cryptoeconomic mechanisms that SchellingCoin makes attainable, and the significance of such schemes in almost all purely “trust-free” makes an attempt to forge any type of hyperlink between the cryptographic world and the true world, this assault poses a possible critical menace – though, as we’ll later see, Schelling schemes as a class are in the end partially salvageable. Nevertheless, what’s extra fascinating is the a lot bigger class of mechanisms that do not look fairly like SchellingCoin at first look, however the truth is have very comparable units of strengths and weaknesses.

Notably, allow us to level to 1 very particular instance: proof of labor. Proof of labor is the truth is a multi-equilibrium sport in a lot the identical approach that Schelling schemes are: if there exist two forks, A and B, then should you mine on the fork that finally ends up successful you get 25 BTC and should you mine on the fork that finally ends up dropping you get nothing.

| You mine on A | You mine on B | |

| Others mine on A | 25 | 0 |

| Others mine on B | 0 | 25 |

Now, suppose that an attacker launches a double-spend assault towards many events concurrently (this requirement ensures that there isn’t a single social gathering with very sturdy incentive to oppose the attacker, opposition as an alternative changing into a public good; alternatively the double spend may very well be purely an try to crash the worth with the attacker shorting at 10x leverage), and name the “essential” chain A and the attacker’s new double-spend fork B. By default, everybody expects A to win. Nevertheless, the attacker credibly commits to paying out 25.01 BTC to everybody who mines on B if B finally ends up dropping. Therefore, the payoff matrix turns into:

| You mine on A | You mine on B | |

| Others mine on A | 25 | 25.01 |

| Others mine on B | 0 | 25 |

Thus, mining on B is a dominant technique no matter one’s epistemic beliefs, and so everybody mines on B, and so the attacker wins and pays out nothing in any respect. Notably, word that in proof of labor we shouldn’t have deposits, so the extent of bribe required is proportional solely to the mining reward multiplied by the fork size, not the capital price of 51% of all mining tools. Therefore, from a cryptoeconomic safety standpoint, one can in some sense say that proof of labor has just about no cryptoeconomic safety margin in any respect (if you’re bored with opponents of proof of stake pointing you to this article by Andrew Poelstra, be at liberty to hyperlink them right here in response). If one is genuinely uncomfortable with the weak subjectivity situation of pure proof of stake, then it follows that the proper answer might maybe be to reinforce proof of labor with hybrid proof of stake by including safety deposits and double-voting-penalties to mining.

In fact, in follow, proof of labor has survived regardless of this flaw, and certainly it might proceed to outlive for a very long time nonetheless; it might simply be the case that there is a excessive sufficient diploma of altruism that attackers usually are not really 100% satisfied that they may succeed – however then, if we’re allowed to depend on altruism, naive proof of stake works tremendous too. Therefore, Schelling schemes too might properly merely find yourself working in follow, even when they aren’t completely sound in concept.

The following a part of this publish will focus on the idea of “subjective” mechanisms in additional element, and the way they can be utilized to theoretically get round a few of these issues.