Unlock the Editor’s Digest totally free

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

OK, let’s hear them out:

We provoke MSTR at a Purchase/Excessive Threat. Our $485 goal worth relies on (i) Citi’s ahead 12-month rolling base-case Bitcoin forecast of $181k (63% upside from present ranges) and (ii) our view that MSTR’s NAV premium can vary 25%-35%, in step with inventory’s historic 2.5x-3.5x Bitcoin Yield a number of assuming continued optimistic momentum for Bitcoin. Technique is a Digital Asset Treasury (DAT) firm making its inventory a leveraged and extra risky play on Bitcoin. The inventory gives amplified returns on the upside however may lead to sharp underperformance on the draw back. Assuming Citi’s forecasted Bear case situation for Bitcoin (down ~25% from present ranges) and our assumption MSTR’s NAV premium goes from 35%-40% to -10%, we estimate the inventory may decline 61% ceteris paribus.

Isn’t that logic a bit, . . .

We acknowledge the diploma of round reference: The next MSTR relative to BTC leads to a better NAV premium, which then leads to greater BTC yield thus reinforcing a better MSTR relative to BTC. Success does beget success on this mannequin. Though risky, MSTR’s NAV premium has averaged ~3.0x the QoQ change in BTC yield (annualized) and is our proxy for NAV premium in our SOTPs. The reverse is probably going true in a downward BTC situation, although MSTRs NAV premium turning into a reduction may all the time happen. We see MSTR as a bellwether of BTC’s potential upside and draw back momentum. A fabric decline in BTC momentum would doubtless trigger us to revise our NAV premium assumption decrease. Of notice, our SOTP’s assigns <2% of complete worth to Technique’s underlying software program enterprise.

Grasp on, Technique’s software program enterprise is value $1bn? Two occasions gross sales? Why?

The software program enterprise is now exhibiting little progress and decrease profitability and generates inadequate money move to significant contribute to Technique’s Bitcoin acquisition technique.

Um, then perhaps we will deal with the bitcoin acquisition technique. Certainly there’s no solution to do a forecast desk for a dilution-as-a-service car?

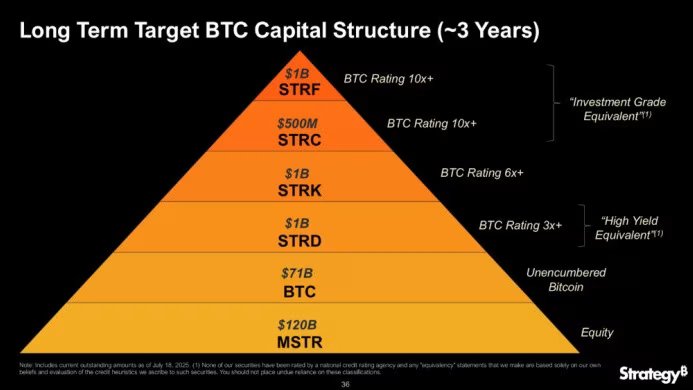

[Zoom]

Effectively, there you go. Something to remember about these numbers?

Critics level to the immense danger from financing risky Bitcoin purchases with borrowed cash. A pointy drop in Bitcoin’s worth may set off a cascade of points, together with debt compensation difficulties.

Critics do point that out, it’s true.

To fund its continued Bitcoin purchases, Technique has repeatedly issued new debt and fairness (inventory and most popular shares). This ongoing capital-raising technique dilutes the possession stake of present shareholders, eroding the worth of their holdings. This creates a state of affairs the place shareholders are caught between two dangers: if the corporate stops shopping for Bitcoin, investor confidence may collapse; but when it continues, dilution will additional devalue their shares.

Hold going.

MSTR inventory usually trades at a major premium to its Internet Asset Worth (NAV), which is calculated primarily based on its Bitcoin holdings and software program enterprise. This implies buyers are paying extra for the underlying property than in the event that they merely bought Bitcoin immediately.

And that’s . . . . dangerous?

With the rise of extra environment friendly and accessible funding autos like spot Bitcoin exchange-traded funds (ETFs), the argument for investing in MSTR as a major solution to acquire Bitcoin publicity has weakened considerably. A direct ETF funding is a less complicated solution to monitor Bitcoin’s worth with decrease volatility and no underlying enterprise or dilution dangers.

Uh huh. The rest?

With MSTR controlling over 3% of the overall bitcoin provide, critics argue that this centralization creates a single level of failure and threatens the community’s foundational ethos. MSTR has financed a considerable portion of its huge bitcoin purchases by debt and fairness raises. If the value of Bitcoin had been to drop sharply, MSTR could possibly be pressured to liquidate a few of its holdings to cowl its debt. This pressured promoting of a considerable amount of Bitcoin directly may set off a large market cascade, placing vital downward strain on the value and probably amplifying a crypto market crash.

Are we finished with the danger components but?

Whereas MSTR is the pioneer of the technique, the rise of different [Digital Asset Treasury Companies] probably reduces MSTR’s shortage worth. Ought to the DATCO area turn into extreme sooner or later (Galaxy’s 2Q’25 State of Crypto Leverage Report [8/14] signifies there was ~$14 billion debt supporting Bitcoin treasury corporations), MSTR may probably be impacted by systematic contagion involving pressured gross sales of crypto property.

What about now?

Company Different Minimal Tax guidelines may change . . .

What about now?

Highly effective quantum computer systems, as soon as absolutely developed, may disrupt Bitcoin by ..

Possibly simply minimize to the conclusion.

And is there something to declare?

Nice stuff. Thanks, Citi.

Additional studying:

— Bitcoin will go up if more people buy bitcoin and won’t if they don’t: Citi (FTAV)