Key Notes

- Commonplace Chartered forecasts ETH treasury holdings may attain 10% of whole provide, value $45.5 billion at present market cap.

- ETH-focused treasury corporations gathered 1% of circulating provide in two months, equal to just about $9 billion in holdings.

- Technical evaluation exhibits ETH testing $4,000 resistance with potential breakout to $4,500 if institutional shopping for momentum continues.

Ethereum‘s

ETH

$3 767

24h volatility:

0.5%

Market cap:

$454.60 B

Vol. 24h:

$33.31 B

value has dipped 4% within the final 24 hours, mirroring the broader crypto market downtrend on Tuesday amid widespread profit-taking. Nonetheless, regardless of the continuing ETH value dip, institutional enchantment continues to accentuate.

According to a recent Decrypt report, Commonplace Chartered Financial institution’s head of digital property analysis, Geoff Kendrick, believes ETH could possibly be on the verge of main institutional inflows.

“If the flows can proceed, ETH could possibly break above the important thing $4,000 degree (our present end-2025 forecast),” Kendrick wrote.

His bullish projection is predicated on the remark that Ethereum treasury accumulation is happening twice as quick as Bitcoin

BTC

$117 776

24h volatility:

0.1%

Market cap:

$2.34 T

Vol. 24h:

$41.20 B

treasury progress. If this tempo sustains, Kendrick expects ETH treasury holdings to develop tenfold, reaching 10% of whole provide. With Ethereum’s market cap at the moment trending at $450 billion, a ten% accumulation would see the treasury companies sit on ETH holdings value $45.5 billion.

Notably, within the final two months, ETH-focused treasury corporations have gathered round 1% of the whole circulating provide, in line with the Strategic ETH Reserve. At present costs, that’s equal to just about $9 billion in holdings, quickly approaching the two% mark.

The important thing gamers main this institutional ETH cost embrace Peter Thiel-backed BitMine, which now holds over $2 billion in ETH, whereas gaming agency, SharpLink, also scooped up another $1.3 billion. This aggressive accumulation is pushed by Ethereum’s staking yields, and potential income enhance from DeFi companies, making upside potential larger than the less-programmable Bitcoin community.

ETH Value Forecast Right now: Pullback or Breakout Above $4,000?

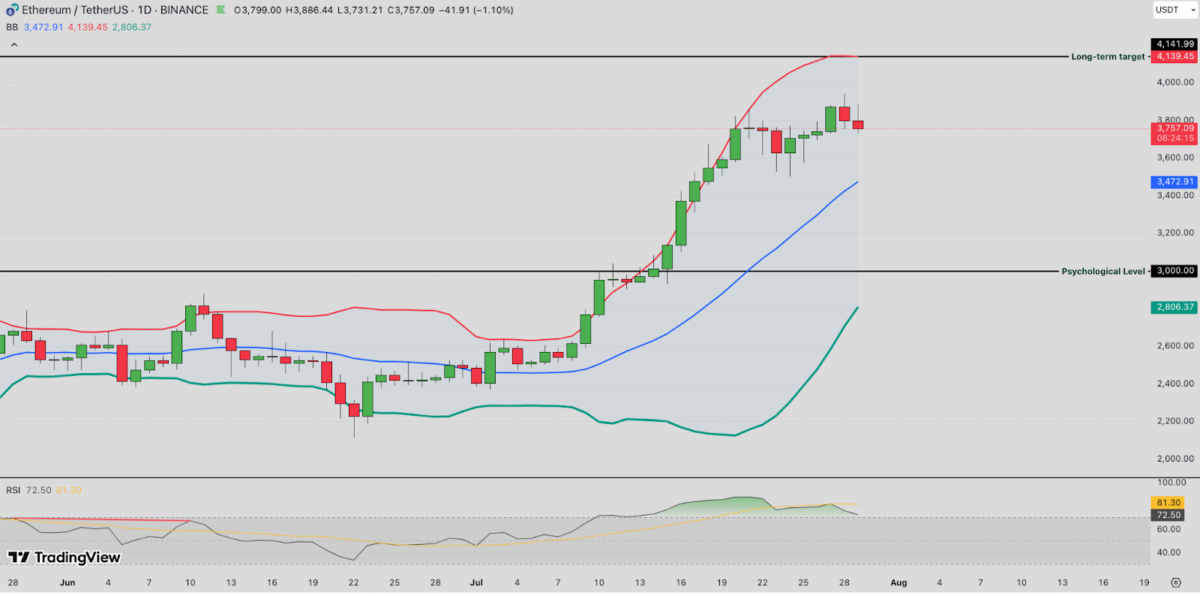

Ethereum is at the moment buying and selling at $3,762, exhibiting a modest 0.96% day by day decline following a rally that examined resistance close to the $4,140 degree, additionally marked because the long-term goal.

Within the upside situation, if ETH rebounds from the present assist round $3,700, we may see one other take a look at of the $4,000 resistance. A clear breakout above $4,140 would open the trail to $4,500 within the coming weeks, particularly if treasury shopping for continues.

Ethereum value forecast | ETHUSDT 24H Chart | July 29, 2025

Nonetheless, if the bearish momentum will increase, Ethereum may retest assist ranges at $3,473 (mid-Bollinger Band) and even fall to the psychological $3,000 mark. RSI at the moment sits at 72.90, sloping downwards, suggesting weak shopping for momentum because the market enters overbought situations. Nonetheless, with ETH value nonetheless holding above the 20-day EMA at $3,472, bulls have a good likelihood of sparking an early rebound, particularly if momentum builds up round Commonplace Chartered’s influx predictions.

Finest Pockets Presale Good points Momentum Amid ETH Treasury Growth

As Ethereum attracts main capital inflows from establishments, crypto customers are more and more on the lookout for safe methods to retailer and stake their ETH. One of many options in excessive demand is Finest Pockets, a non-custodial, multi-chain pockets that’s gaining critical traction.

Finest Pockets Presale

Presently priced at $0.025, the $BEST token powers the Finest Pockets ecosystem, providing early entry to presales, neighborhood voting rights, staking rewards, and decreased transaction charges. The presale has already attracted over $14.3 million, a powerful sign of market demand. Go to the official Best Wallet to affix the presale earlier than the following value enhance.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.