Spot bitcoin exchange-traded funds (ETFs), launched in January 2024, have develop into a game-changer for cryptocurrency investing.

These new monetary devices attracted a large influx of over $12 billion in simply three months, at present holding a big 4.20% share of all bitcoins.

Latest traits elevate questions on their short-term impression and spotlight the complicated dynamics at play within the crypto market.

The preliminary surge in ETF funding was attributed to their ease of entry for mainstream buyers. Not like conventional strategies like crypto exchanges, ETFs supply a well-known buying and selling platform and doubtlessly decrease charges.

This accessibility fueled optimism, with some analysts predicting a repeat of the parabolic worth progress witnessed after the 2020 halving, the place bitcoin’s worth skyrocketed by 654%.

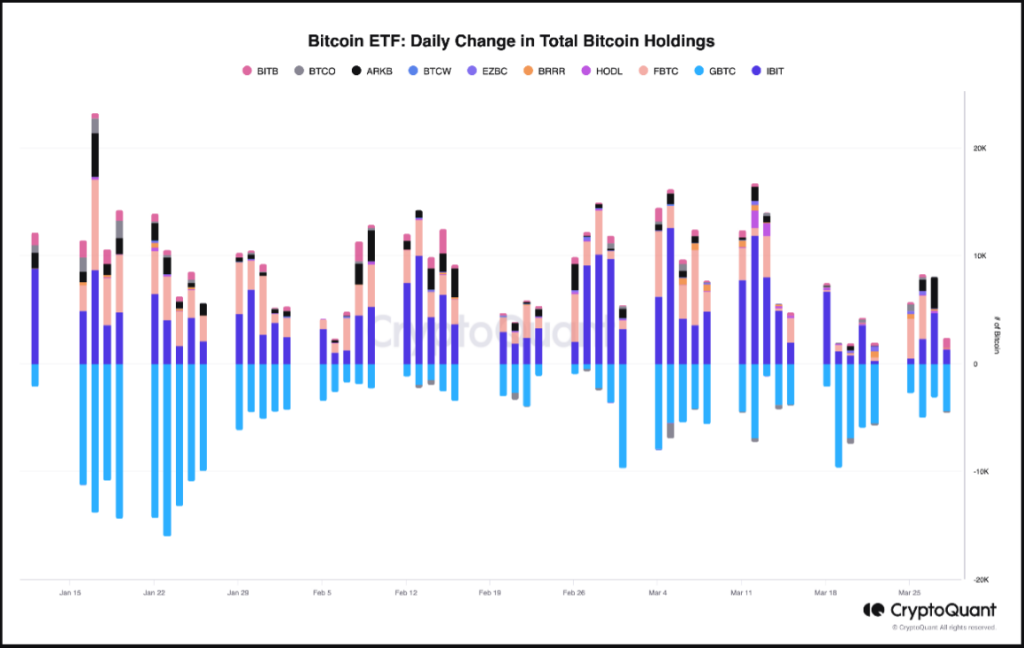

Nevertheless, current information paints a barely regarding image. Whereas the preliminary euphoria was sturdy, interest in spot bitcoin ETFs seems to be waning. Crucially, these funds are not projected to soak up new bitcoins getting into the market. In a current report, the analyst working underneath the alias Oinonen_t of CryptoQuant noticed this.

Supply: CryptoQuant

This “adverse provide absorption” might clarify the stagnation in bitcoin’s worth regardless of the approaching halving occasion, scheduled for later this month. The halving, by lowering the variety of new bitcoins mined every day, is meant to extend shortage and theoretically drive up the value.

This slowdown in ETF funding could possibly be attributed to a number of elements. One risk is a shift in retail investor focus. With the rise of different cryptocurrencies like Solana-based tokens and meme cash, some buyers is likely to be exploring these doubtlessly high-growth, high-risk choices.

Moreover, issues stay in regards to the volatility inherent to the cryptocurrency market as a complete, which might deter some from long-term bitcoin funding by means of ETFs.

BTCUSD buying and selling at $69,480 on the weekly chart: TradingView.com

Bitcoin’s Lengthy-Time period Outlook Upbeat

Regardless of these short-term issues, the long-term outlook for bitcoin appears to stay optimistic for a lot of analysts. The upcoming halving nonetheless presents a possible catalyst for worth appreciation.

Moreover, the general market capitalization of bitcoin, at present a fraction of gold’s, might see important progress if it reaches parity with the dear metallic, as some predict. This could translate to a staggering 1000% improve in bitcoin’s worth.

Nevertheless, reaching such a feat depends closely on elements outdoors the instant scope of spot bitcoin ETFs. Regulatory environments, institutional adoption, and broader financial traits will all play a vital function in shaping the way forward for bitcoin.

Spot bitcoin ETFs have undoubtedly opened up new avenues for mainstream buyers to take part within the cryptocurrency market.

Their preliminary success suggests a robust urge for food for regulated, easy-to-access bitcoin publicity. Nevertheless, the current slowdown in funding and the shortage of short-term worth motion elevate questions on their instant impression.

Featured picture from Luis Quintero/Pexels, chart from TradingView