- South Korea might observe Japan’s lead on Bitcoin ETFs.

- Asia’s BTC ETF race is predicted to warmth up as Japan’s eyes laws within the second half of 2025.

South Korea might soar on the Bitcoin[BTC] ETF bandwagon following a softer stance by Japan on the cryptocurrency.

In line with a report by the South Korean-based writer Maeil Enterprise Newspaper, Seoul may approve BTC ETFs if Tokyo greenlights them.

The media outlet reported that South Korea’s regulator, the Monetary Supervisory Service (FSS), monitored Japan’s digital asset developments and famous its openness to crypto ETFs.

Moreover, the report said that Japan’s ongoing dialogue on digital belongings will probably be carried out within the first half of 2025, and laws will probably be crafted within the second half. By 2026, Japan’s nationwide meeting will probably be able to vote for the framework.

Bitcoin ETF: Will South Korea observe Japan?

Japan’s intention is essential as a result of South Korean authorities have hesitated concerning the merchandise, citing Japan and the UK’s lackluster. In February, Kim So Younger, Vice Chairman of South Korea’s FSS, said,

“I’ll fastidiously assessment (Bitcoin spot ETFs), and it’s nonetheless comparable in a giant context…There are some international locations that haven’t but launched them, there may be the UK or Japan.”

How Seoul will reply to Japan’s transfer stays to be seen. Nevertheless, a number of jurisdictions have turn out to be open to BTC ETFs for the reason that U.S. authorised the merchandise final 12 months.

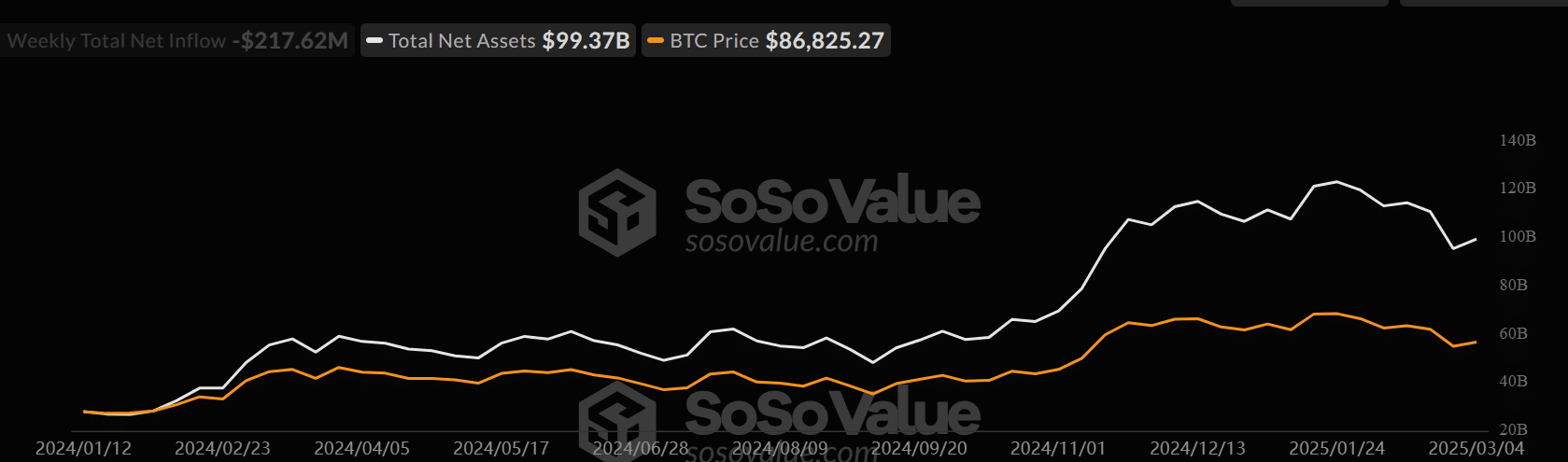

This made it simpler to purchase or promote BTC by way of conventional inventory markets. In truth, the U.S. spot BTC ETFs now have $100 billion in belongings underneath administration (AUM).

Hong Kong, adopted the U.S., greenlighted the merchandise final April, and now has $354M in AUM.

BTC surged from $40K to $70K with inventory market integration, then surpassed $100K as a result of ‘Trump commerce.’

State Avenue predicts crypto ETF AUM may exceed treasured metals ETF AUM by late 2025, reflecting rising market confidence.

Within the 2025 ETF outlook report, BlackRock’s digital asset analysis head, Robert Mitchnick, said that U.S. fiscal debt and nation-state adoption of BTC instead reserve asset may drive the cryptocurrency’s worth.

“An growing give attention to U.S. debt and deficit challenges has the potential to function a catalyst for Bitcoin adoption, whereas the potential of higher-for-longer rates of interest symbolize a possible worth headwind.”