Key Notes

- Sharplink funded the huge ETH buy by way of $537 million in fairness choices throughout August’s rally interval.

- The corporate launched ETH Focus metric to assist buyers monitor publicity per diluted share excellent.

- Current Ethereum ETF outflows of $255.9 million counteracted institutional shopping for strain on ETH value motion.

Sharplink Gaming, the second-largest Ethereum

BTC

$112 805

24h volatility:

2.2%

Market cap:

$2.24 T

Vol. 24h:

$46.60 B

treasury investor behind Bitmine, has expanded its holdings with a recent $667.2 million buy.

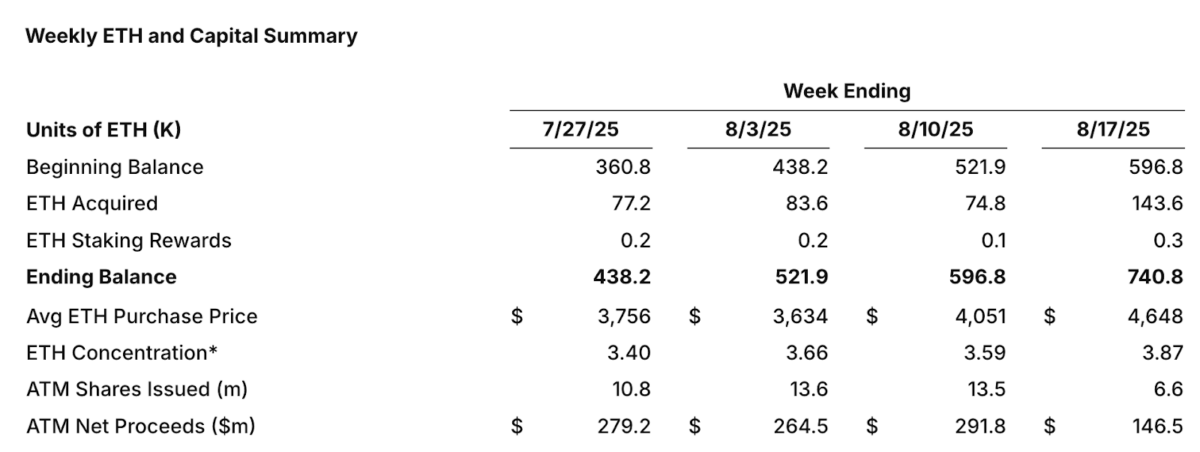

In line with the agency’s newest disclosure on Tuesday, Aug. 19, the corporate acquired 143,593 ETH at a mean value of $4,648, elevating its complete treasury to 740,760 ETH price $3.1 billion at press time.

NEW: SharpLink acquired 143,593 ETH at ~$4,648, bringing complete holdings to 740,760 ETH

Key highlights for the week ending Aug 17, 2025:

→ Raised $537M by way of ATM and direct choices

→ Added 143,593 ETH at ~$4,648 avg. value

→ Staking rewards: 1,388 ETH since June 2 launch… pic.twitter.com/GSe6XzSAwW— SharpLink (SBET) (@SharpLinkGaming) August 19, 2025

The funding was funded by way of $537 million raised through at-the-market (ATM) and direct choices, making Sharplink some of the aggressive patrons throughout Ethereum’s August rally.

Since launching its Ethereum accumulation technique on June 2, the corporate has additionally earned 1,388 ETH in staking rewards.

Sharplink Gaming Ethereum Holdings Abstract as of Aug. 19, 2025 | Supply: buyers.sharplink.com

The corporate additionally launched a brand new transparency metric referred to as “ETH Focus.” This determine divides Sharplink’s ETH holdings by each 1,000 assumed diluted shares excellent, which incorporates issued widespread inventory together with shares that will be generated if all warrants, choices, and restricted models had been exercised.

In line with the agency, this metric will enable buyers to raised assess ETH-per-share publicity alongside NAV progress.

On the identical time, Sharplink confirmed greater than $84 million in money reserves stay undeployed, hinting at additional ETH purchases within the close to time period. This strategic buildup indicators the corporate’s long-term dedication to Ethereum as each a treasury asset and a staking income generator, whilst market volatility intensifies.

Ethereum ETF Promote-Offs Weigh Down Worth Motion

Regardless of Sharplink’s aggressive accumulation, Ethereum’s value efficiency has been muted. ETH value declined 3% intraday on Tuesday, sliding to $4,182 and lengthening its losses to 13% since final week’s peak of $4,831.

Whereas new buyers like Sharplink Gaming proceed to make purchases, very important market information reveals the bullish impression is now being nullified by outflows from different US-based company entities.

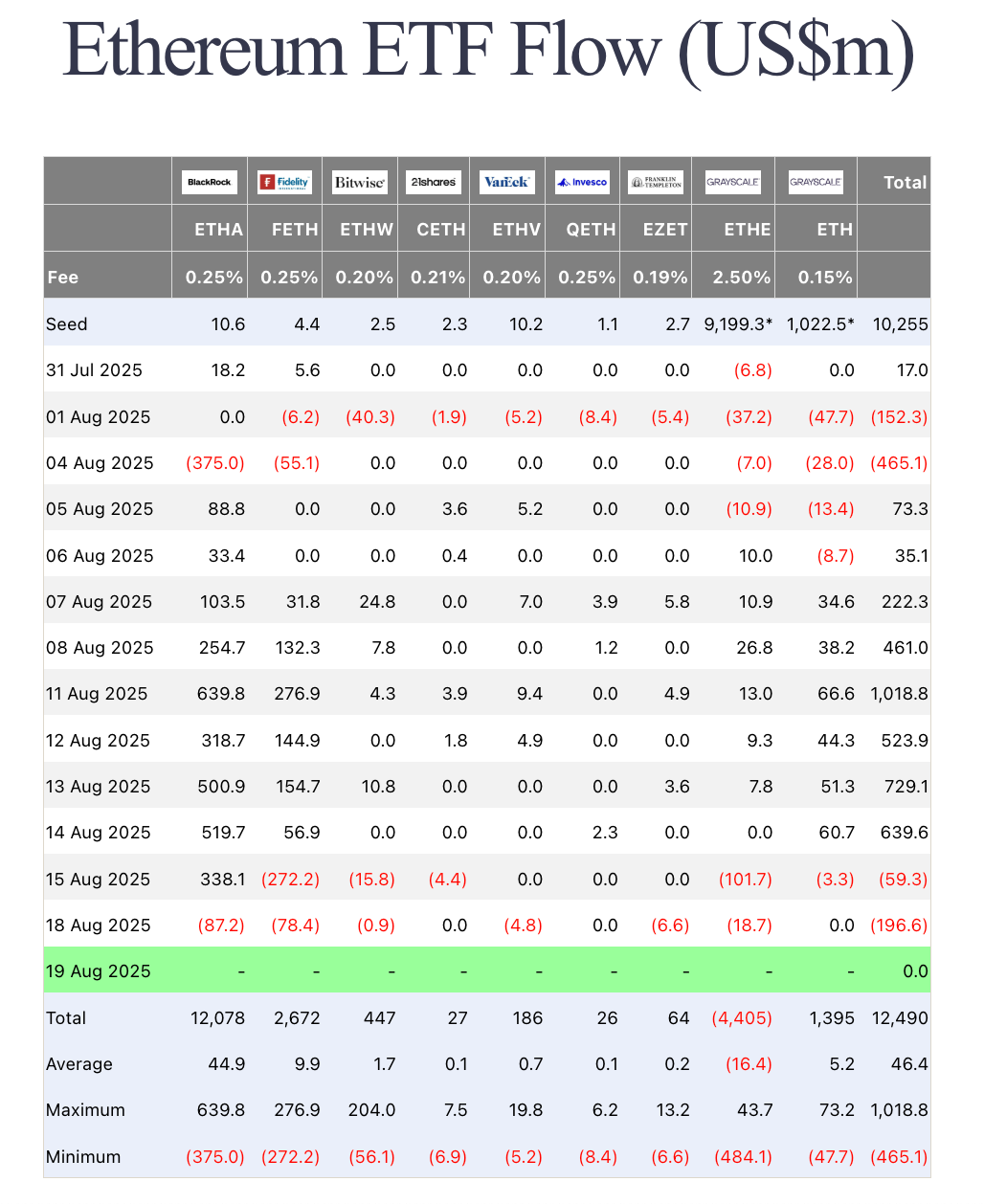

Ethereum ETF Flows, August 2025 | Farside Buyers

In line with the newest data from Farside Investors, Ethereum exchange-traded funds (ETFs) have recorded back-to-back redemptions of $59 million on Friday and $169 million on Monday.

The current $255.9 million ETH ETF withdrawals ended a streak of eight consecutive classes of inflows that had beforehand netted $3.7 billion and helped gasoline Ethereum’s 42% rally earlier this month.

This divergence has blunted the impression of Sharplink’s newest treasury purchases on ETH value motion, leaving ETH susceptible to short-term declines. It stays to be seen if institutional demand persists to soak up sell-side strain and stop bears from driving Ethereum beneath the $4,000 mark because the week unfolds.

Ethereum Momentum Fuels Curiosity in Token6900

Ethereum’s market turbulence has additionally sparked consideration for brand new tasks rising round its ecosystem, together with Token6900, a community-driven memecoin venture.

The venture’s tokenomics reveals a complete provide of 930,993,091 tokens and a tough cap of $5 million, with builders locking 6,900 tokens for 5 years to display long-term dedication.

Token6900 Presale

As Ethereum continues to draw institutional treasuries to cushion value corrections this week, the Token6900 presale has raised $2.3 million as strategic buyers may change focus to newly launched tasks like Token6900 to mitigate draw back dangers.

Go to the Token6900 official presale website to get in early earlier than the subsequent value replace.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.