- Jerome Powell spoke about fee cuts as short-term Fed liquidity weakened

- Bitcoin and the broader crypto market have been displaying indicators of bullish sentiment

Jerome Powell’s current statement has set the stage for vital shifts within the cryptocurrency market. Powell’s indication that “The time has come for coverage to regulate” means that U.S fee cuts are on the horizon.

This transfer, mixed with sturdy international liquidity, is anticipated to weaken the U.S Greenback (USD) considerably. Because the USD weakens, Bitcoin (BTC) and different cryptocurrencies could also be poised for vital positive factors.

Within the quick time period, the Federal Reserve’s liquidity outlook stays weak although, a continuation of the medium-term downtrend that started again in April.

This pattern means that Fed liquidity might hit a brand new “decrease low” by the top of September, probably reaching its lowest degree since March 2023.

As liquidity fades and fee cuts loom, Bitcoin’s pairing with USD turns into more and more advantageous. Significantly as Bitcoin prepares to shut its seventh consecutive month-to-month candle above its 2021 all-time excessive.

The longer Bitcoin’s worth consolidates above this degree, the stronger the help, setting the stage for a possible breakout in September when the Fed begins its fee cuts.

Bitcoin’s worthwhile days

Bitcoin has traditionally been a powerful performer, with over 96% of its historical past displaying profitability for holders.

This historic pattern, coupled with the approaching weakening of the USD, makes a compelling case for a hike in Bitcoin’s price.

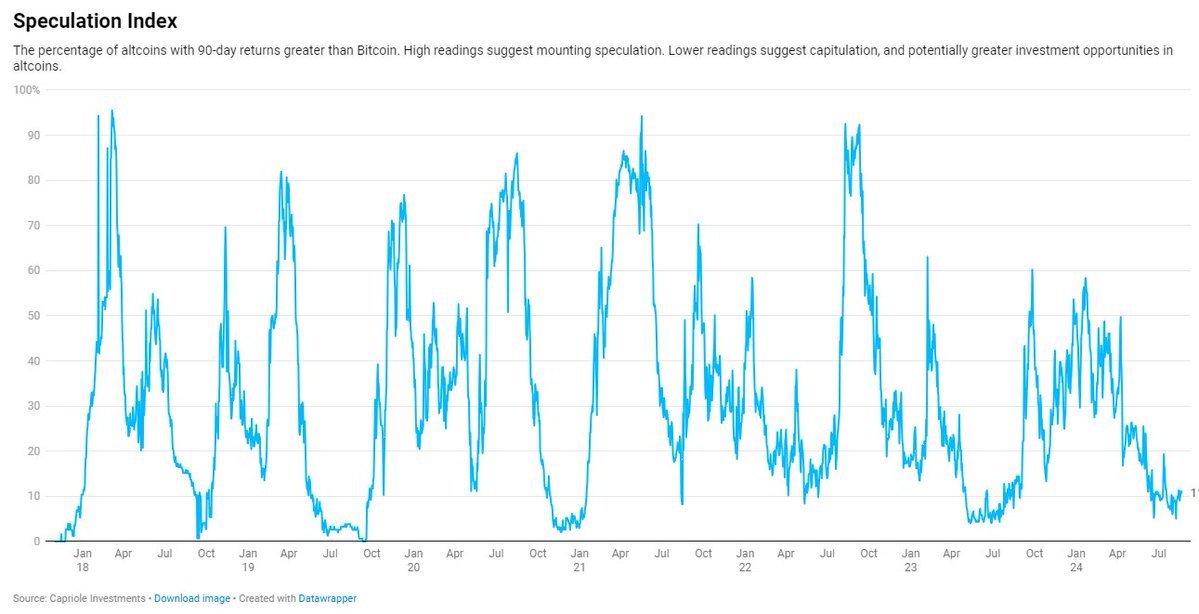

The Altcoin Hypothesis Index

Nevertheless, Bitcoin received’t be the one beneficiary of the Fed’s actions. All the crypto market, together with main altcoins like Ethereum, BNB, Solana and XRP, is more likely to see a lift.

At press time, the Altcoin Hypothesis Index, which is at its lowest level since July 2023, indicated that altcoin costs might have bottomed out. Merely put, this index could also be signalling a possibility for development as USD weakens.

Crypto market RSI heatmap

Right here, it’s value mentioning that the broader crypto market can also be displaying indicators of restoration. The Crypto Market RSI Heatmap not too long ago flipped from oversold to impartial, suggesting that the market could also be poised for a rebound.

Day by day RSI ranges have crossed the 50-level too, indicating wholesome momentum with room for additional positive factors earlier than reaching overbought territory.

Because the Fed strikes in direction of fee cuts and international liquidity strengthens, the stage is ready for Bitcoin and the broader crypto market to rise. It will supply potential positive factors for traders throughout the board.