Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain information exhibits Dogecoin is the one cryptocurrency among the many high 10 the place buyers are at the moment realizing extra losses than income.

Dogecoin Traders Realized $124 Million In Loss Over The Final 24 Hours

In a brand new post on X, the on-chain analytics agency Glassnode has shared how the foremost cryptocurrencies examine in opposition to one another by way of the Realized Loss and Realized Profit metrics.

Associated Studying

These indicators measure, as their names already suggest, the quantity of loss/revenue that the buyers on a given community are realizing via their transactions proper now.

The metrics work by going via the switch historical past of every coin being bought to see what value it was moved at previous to this. If this earlier worth is lower than the value that the coin’s now being bought at, then the token’s sale is resulting in revenue realization. However, it being larger suggests loss realization.

The Realized Revenue sums up the distinction between the 2 costs concerned in all gross sales of the previous sort, whereas the Realized Loss does the identical for the latter ones.

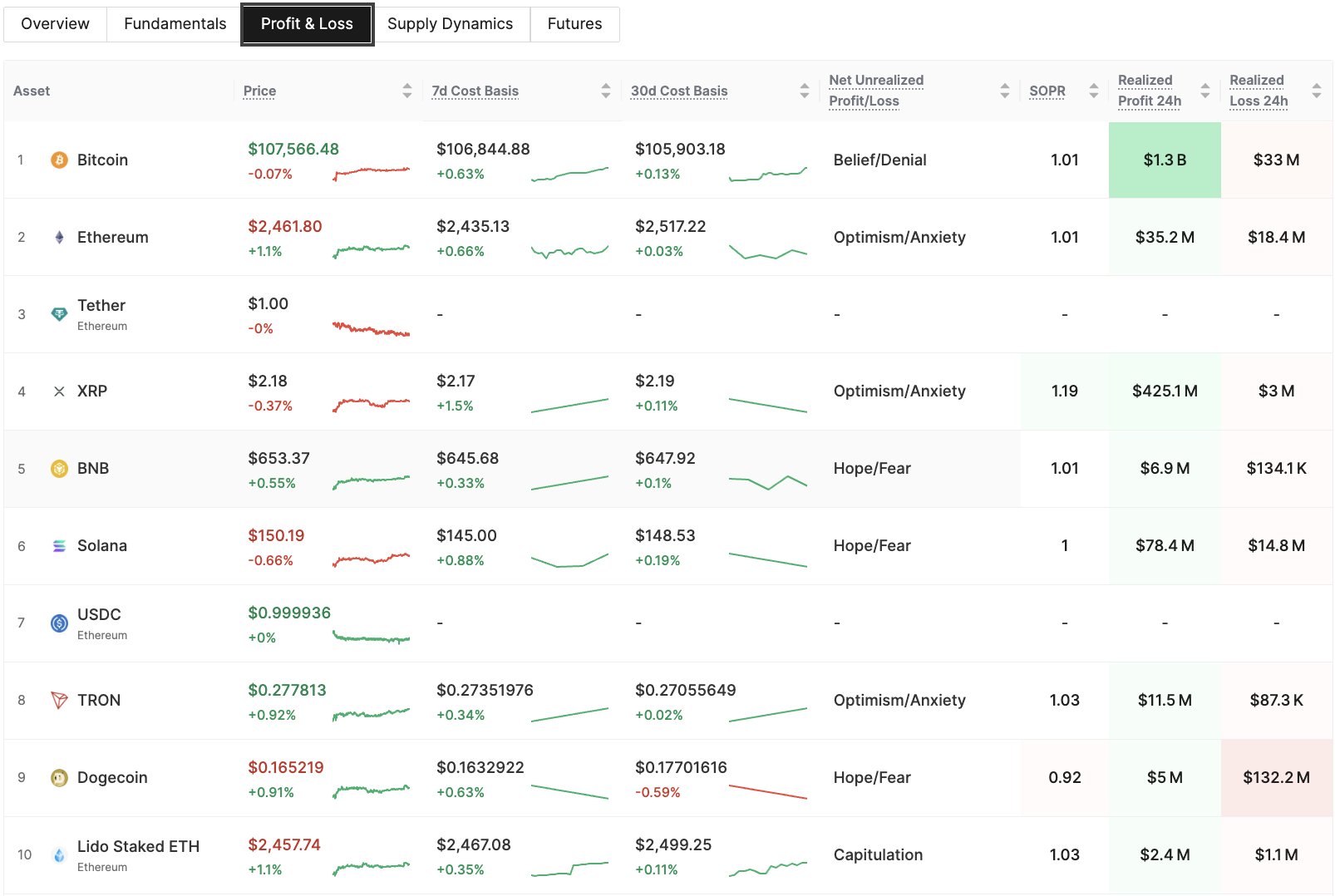

Now, right here is the desk shared by the analytics agency that exhibits how the 24-hour values of the 2 metrics at the moment stack up for the highest 10 cash by market cap:

As is seen above, the size of the Realized Loss and Realized Revenue differs enormously between the totally different belongings, however one sample is constant: the latter outweighs the previous, implying a pattern of web profit-taking from the buyers.

One asset, nonetheless, doesn’t match the mildew: Dogecoin. The 24-hour Realized Loss for the memecoin stands at round $132 million, whereas the Realized Revenue is way decrease with a worth of simply $5 million.

As such, it might seem that whereas the individuals in the remainder of the sector have been harvesting good points, DOGE holders have been panic capitulating at a loss as an alternative.

Amongst these high cash, the buyers of Bitcoin have realized the most important revenue, with the indicator’s worth sitting at a whopping $1.3 billion. The Realized Loss can be restricted to only $33 million for the primary cryptocurrency, indicating promoting has been closely lopsided towards profit-taking.

Associated Studying

Issues are extra balanced for Ethereum, the digital asset ranked quantity two. Its Realized Lack of $18.4 million is roughly half that of its Realized Revenue of $35.2 million.

The truth that revenue realization is so dominant for the likes of Bitcoin, nonetheless, would possibly really be a bearish signal. Traditionally, such market situations have made tops extra probably. A dominance of loss-taking, alternatively, can facilitate reversals to the upside. As such, whereas not a given, Dogecoin will not be in a foul place, not less than on this regard.

DOGE Value

Dogecoin touched the $0.170 mark through the weekend, however the memecoin has seen a retrace beneath $0.165 to kick off the week.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com