The chief funding officer of the crypto asset supervisor Bitwise says he believes one decentralized finance (DeFi) challenge on the Ethereum (ETH) blockchain is presently undervalued.

Matt Hougan says the market cap of Uniswap (UNI), which is roughly $6 billion, presently “feels too small.”

“[Uniswap] could be the four-hundredth largest monetary companies enterprise on this planet – roughly the identical dimension as Storebrand, a financial savings and insurance coverage enterprise in Norway.”

According to Hougan, regulatory uncertainty could possibly be driving Uniswap’s present undervaluation, however that would change amid the U.S. Securities and Alternate Fee’s (SEC) latest initiatives to offer regulatory readability for crypto property.

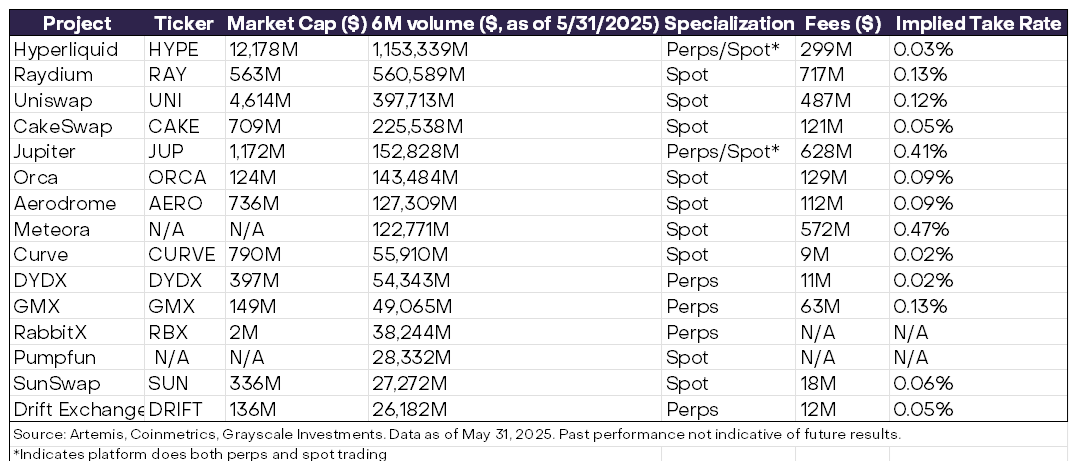

Per a Grayscale Analysis report launched in late June, Uniswap is among the many top-10 decentralized exchanges.

Over six months ending on Could thirty first, Uniswap ranked third when it comes to volumes. Uniswap generated $487 million in charges behind Solana-based decentralized exchanges Raydium, Meteora and Jupiter over that interval.

UNI is buying and selling at $9.89 at time of writing, up by 36% over the previous month and down by round 78% from the all-time excessive reached in Could of 2021.

Turning to Ethereum, Hougan notes that spot exchange-traded funds (ETF) of the second-largest crypto asset by market cap recorded $5.4 billion in web inflows in July, the very best month-to-month web inflows ever.

“When you think about Ethereum is 20% the scale of Bitcoin, the size of these flows actually hits dwelling. Think about if Bitcoin ETFs did $27 billion in a month…”

According to crypto ETFs tracker SoSoValue, the very best web inflows determine for spot Bitcoin ETFs was the $6.49 billion reached in November of 2024.

Observe us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses chances are you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Philipp Tur/Vladimir Sazonov