On-chain information reveals the Ethereum investor profitability has seen a pointy turnaround following the newest rally within the asset’s value.

Ethereum Holder Profitability Has Noticed A Dramatic Reversal Just lately

In a brand new post on X, the institutional DeFi options present Sentora (previously IntoTheBlock) has talked about how the profit-loss scenario has modified on the Ethereum community.

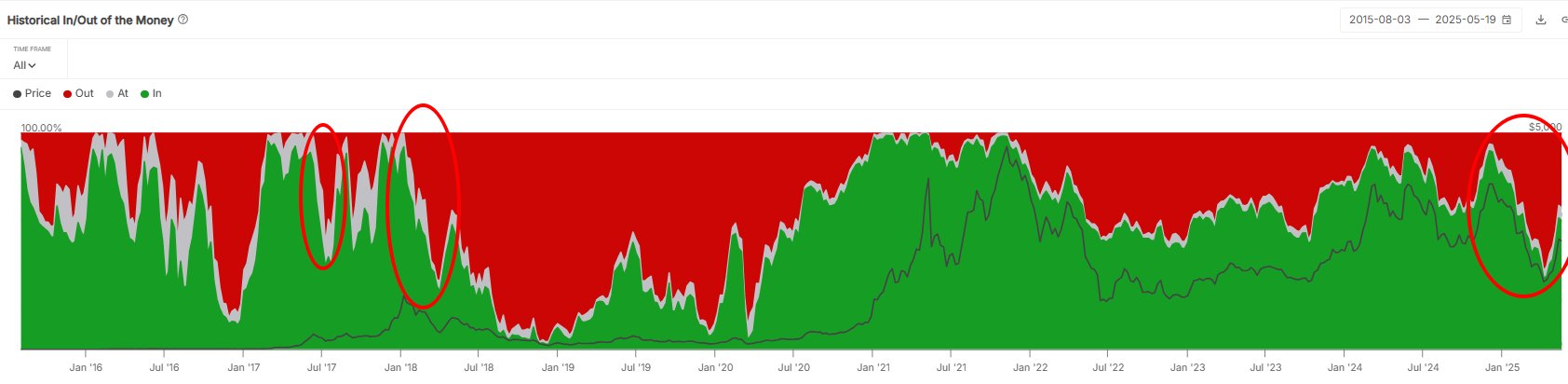

The on-chain indicator of relevance right here is the “Historical In/Out of the Money,” which tells us about what a part of the ETH userbase is in revenue (“within the cash”), loss (“out of the cash”) and simply breaking even (“on the cash”).

The metric works by going via the on-chain historical past of every handle on the community to see what common value it acquired its cash at. If this common value foundation is decrease than the spot value for any pockets, then that exact person is taken into account to be within the cash. Equally, the handle is assumed to be out of the cash within the reverse case and on the cash when the 2 costs are equal.

Now, here’s a chart that reveals the pattern within the Ethereum Historic In/Out of the Cash over the previous decade:

Appears to be like like the quantity of inexperienced traders has gone up in current days | Supply: Sentora on X

As displayed within the above graph, the within the cash Ethereum traders had noticed a steep drop following the selloff that began in December 2024. Previous to this drawdown, the metric was sitting above 90%, implying the overwhelming majority of the customers have been holding unrealized positive aspects. By April 2025, nevertheless, the scenario had utterly flipped for the traders as this worth had come down to only 32%.

Now, one more shift appears to have occurred for the cryptocurrency’s addresses, because the ETH value has this time seen a pointy rally. Nearly 60% of the holders are actually again within the cash, which, whereas nonetheless not fairly close to the identical stage as late final 12 months, is considerably increased than the low.

Within the chart, the analytics agency has highlighted when Ethereum final noticed such sharp swings in profitability. “The asset hasn’t witnessed volatility on this scale because the 2017 cycle,” notes Sentora.

In another information, ETH has reclaimed two vital on-chain ranges following its restoration run, because the analytics agency Glassnode has mentioned in its newest weekly report.

The value of the coin appears to have surpassed the True Market Imply | Supply: Glassnode's The Week Onchain - Week 20, 2025

From the chart, it’s obvious that Ethereum reclaimed the Realized Price early on within the run. The Realized Worth represents the common value foundation of all traders on the ETH community. At present, this stage is located at $1,900, which means that on the present trade charge, the holders could be in notable revenue.

The cryptocurrency has now additionally managed to surpass the True Market Imply positioned at $2,400, which is a mannequin is just like the Realized Worth, aside from the truth that it goals to discover a extra correct common acquisition stage for the market by excluding long-lost dormant supply.

Ethereum now has only one extra stage left to reclaim: the Lively Realized Worth at $2,900, which is once more a mannequin that iterates on the Realized Worth.

ETH Worth

Ethereum has climbed to the $2,660 mark following a rally of about 4% within the final week.

The pattern within the ETH value over the previous 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.