Dogecoin (DOGE) is buying and selling at key demand ranges after two weeks of intense promoting stress, with bears driving DOGE down over 30%. The broader crypto market has confronted a chronic correction that began in mid-January, however meme cash have been probably the most impacted. Because the market chief within the meme coin sector, Dogecoin has suffered excessive volatility, testing decrease assist ranges as investor sentiment stays bearish.

Associated Studying

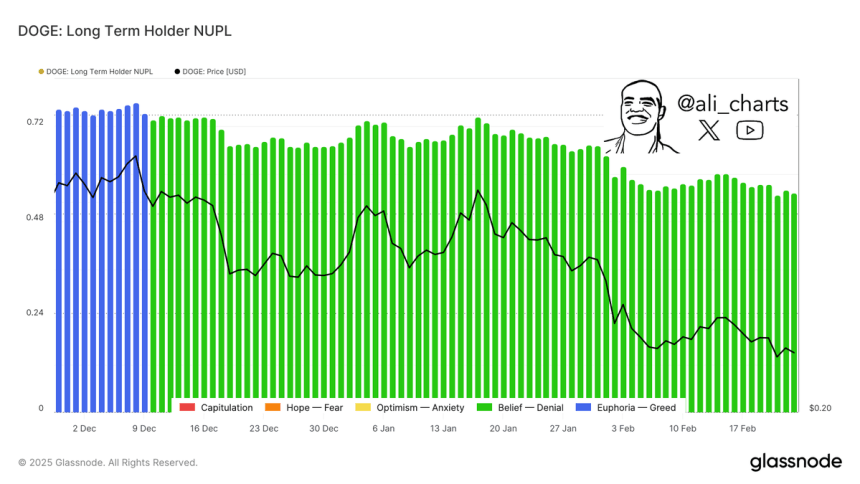

Glassnode’s on-chain metrics reveal that long-term Dogecoin holders are in “denial”, signaling rising uncertainty amongst those that have held DOGE for prolonged intervals. The DOGE Lengthy-Time period Holder Web Unrealized Revenue/Loss (NUPL) indicator has been in a declining development, which means that many long-term holders are seeing diminishing unrealized earnings and even slipping into losses. This development means that holders who as soon as remained assured in Dogecoin’s long-term potential at the moment are going through market doubt and should think about promoting if circumstances don’t enhance.

As DOGE trades close to essential assist, the following few days might be vital for figuring out whether or not bulls can reclaim management and push for restoration or if promoting stress will proceed, forcing DOGE into deeper correction territory. Bitcoin and the whole market are setting contemporary lows, and this week might be essential for bulls to defend key demand at these ranges.

Dogecoin Crashes: Can Bulls Regain Management?

Dogecoin has skilled a large sell-off, plunging greater than 59% from its December excessive of round $0.48 to a current low of $0.19. This dramatic decline has fueled panic throughout the market, with sentiment deteriorating additional as many analysts start calling for the beginning of a bear market. The downturn has weakened traders’ confidence, and meme cash—as soon as the most popular sector out there—at the moment are going through the harshest corrections.

Regardless of the continuing decline, on-chain knowledge suggests not all hope is misplaced for DOGE. Crypto analyst Ali Martinez shared Glassnode metrics indicating that long-term Dogecoin holders are in “denial”, in keeping with the DOGE Lengthy-Time period Holder Web Unrealized Revenue/Loss (NUPL) indicator.

This knowledge means that many long-term traders are nonetheless holding onto their DOGE regardless of the downturn however are beginning to develop bored with the extended downtrend. Traditionally, such “denial phases” can precede both a remaining capitulation or a powerful rebound if bulls reclaim management.

Associated Studying

The upcoming week might be essential in figuring out whether or not Dogecoin can bounce again from present ranges or if sellers will proceed to dominate. If DOGE manages to carry key assist ranges and reclaim momentum, a aid rally may very well be in sight. Nonetheless, if promoting stress persists, the value might proceed trending downward, extending the correction additional.

Dogecoin Worth Struggles After 19% Drop

Dogecoin is buying and selling at $0.21 after a pointy 19% drop since Monday, persevering with its downward trajectory amid broader market weak spot. The meme coin sector has been one of many hardest hit in current weeks, with DOGE struggling to seek out sturdy assist as promoting stress stays dominant.

Bulls now face a vital check as holding above present ranges is crucial to keep away from additional draw back. To provoke a restoration rally, DOGE must reclaim the $0.24 mark, a key resistance degree that would sign the beginning of an uptrend. Nonetheless, market sentiment stays cautious, and worth motion means that DOGE might enter a consolidation section beneath this degree earlier than any significant restoration begins.

Associated Studying

If Dogecoin fails to carry above $0.21, bears might proceed pushing the value decrease, probably revisiting earlier assist ranges. Nonetheless, if patrons step in and DOGE stabilizes, it might construct momentum for a future push towards greater costs. Within the brief time period, merchants ought to carefully watch whether or not bulls can defend present demand ranges and reclaim key resistance ranges to substantiate a possible reversal in worth motion.

Featured picture from Dall-E, chart from TradingView