- Key U.S. financial releases this week, together with JOLTS and ADP information, might set off volatility in crypto markets as merchants assess macro traits.

- Stablecoins present resilience with rising inflows, whereas Bitcoin and Ethereum react to tightening liquidity issues.

This week, the U.S. financial calendar is full of vital occasions, together with the discharge of employment information, Fed assembly minutes, and labor market surveys.

These developments may closely affect investor sentiment and drive volatility throughout cryptocurrency markets. Understanding these occasions is crucial for predicting potential market actions as crypto more and more reacts to macroeconomic cues.

Main U.S. financial occasions to observe

The S&P Global Services PMI, launched on Monday, displays the well being of the companies sector, a key driver of the U.S. financial system. A powerful studying may sign financial resilience, probably reinforcing the Federal Reserve’s hawkish stance.

Crypto markets would possibly react negatively to this U.S. financial occasion, as expectations of upper rates of interest may scale back liquidity.

Tuesday’s JOLTS Job Openings report will present insights into labor market demand. An unexpectedly excessive variety of job openings might gasoline fears of additional price hikes, placing downward strain on cryptocurrencies as traders search safer belongings.

The ADP Nonfarm Employment report and the Fed Assembly Minutes will take heart stage on Wednesday. The ADP report previews the official jobs report, whereas the Fed assembly minutes will supply insights into policymakers’ views on inflation and charges.

A hawkish tone may weigh on threat belongings like crypto, whereas a dovish outlook would possibly present aid and help market restoration.

The December Jobs Report, scheduled for Friday, is probably the most influential launch of the week. This report consists of nonfarm payroll information, unemployment charges, and wage progress figures.

A weaker-than-expected report may enhance crypto markets because it raises the likelihood of the Fed slowing down price hikes.

All through the week, eight Federal Reserve speaker occasions will present further clues on the financial coverage outlook. Hawkish remarks may cap any short-term rallies in crypto.

Potential impacts on the Crypto market

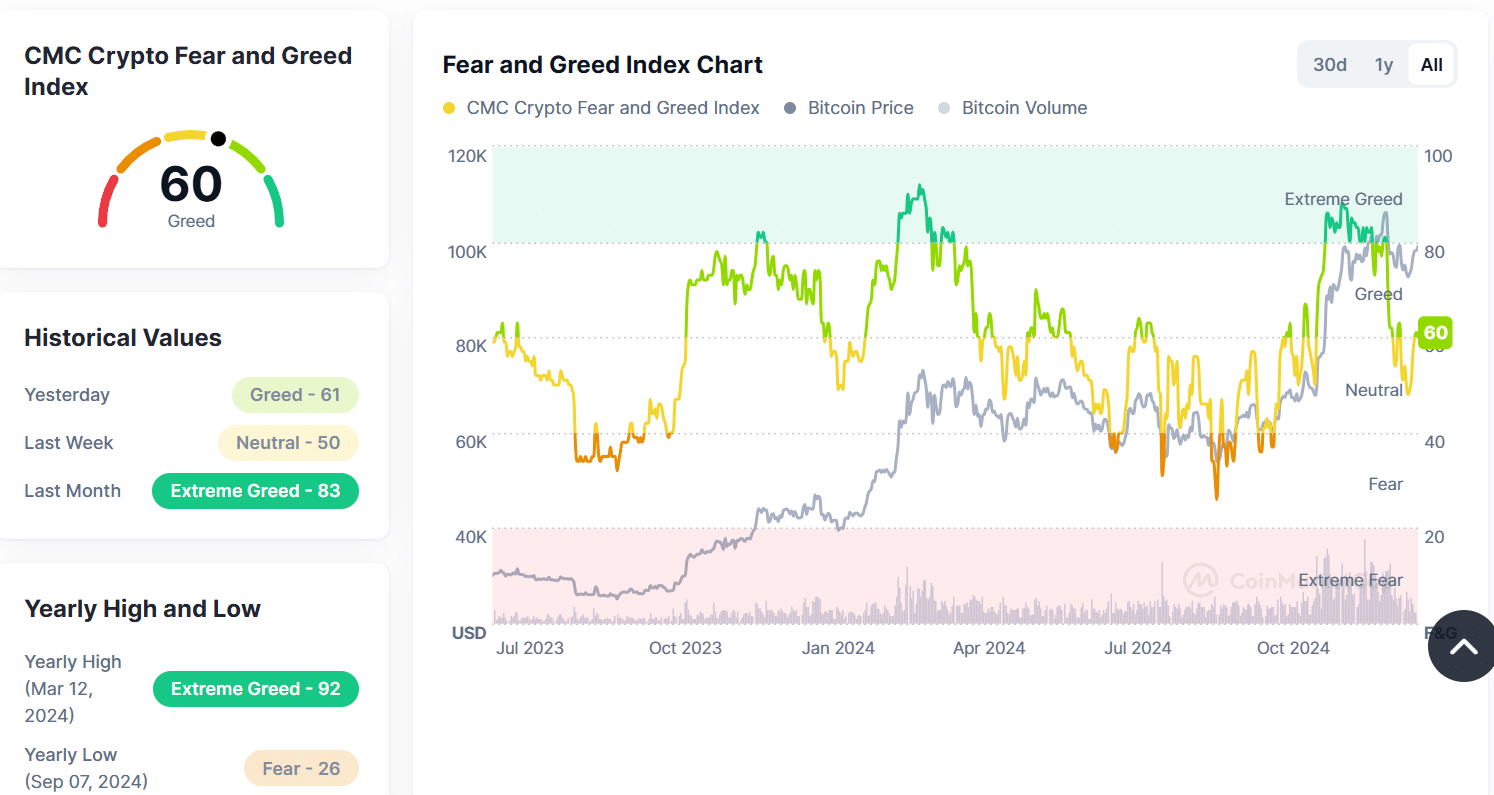

On the time of writing, the Crypto Fear and Greed Index sat at 60 (Greed), reflecting cautious optimism. This marks a shift from Excessive Greed (83) final month and Impartial (50) final week, suggesting a extra balanced sentiment amongst merchants.

This week, Macroeconomic occasions may push sentiment towards greed if dovish alerts emerge or towards concern if stronger information helps aggressive Fed tightening.

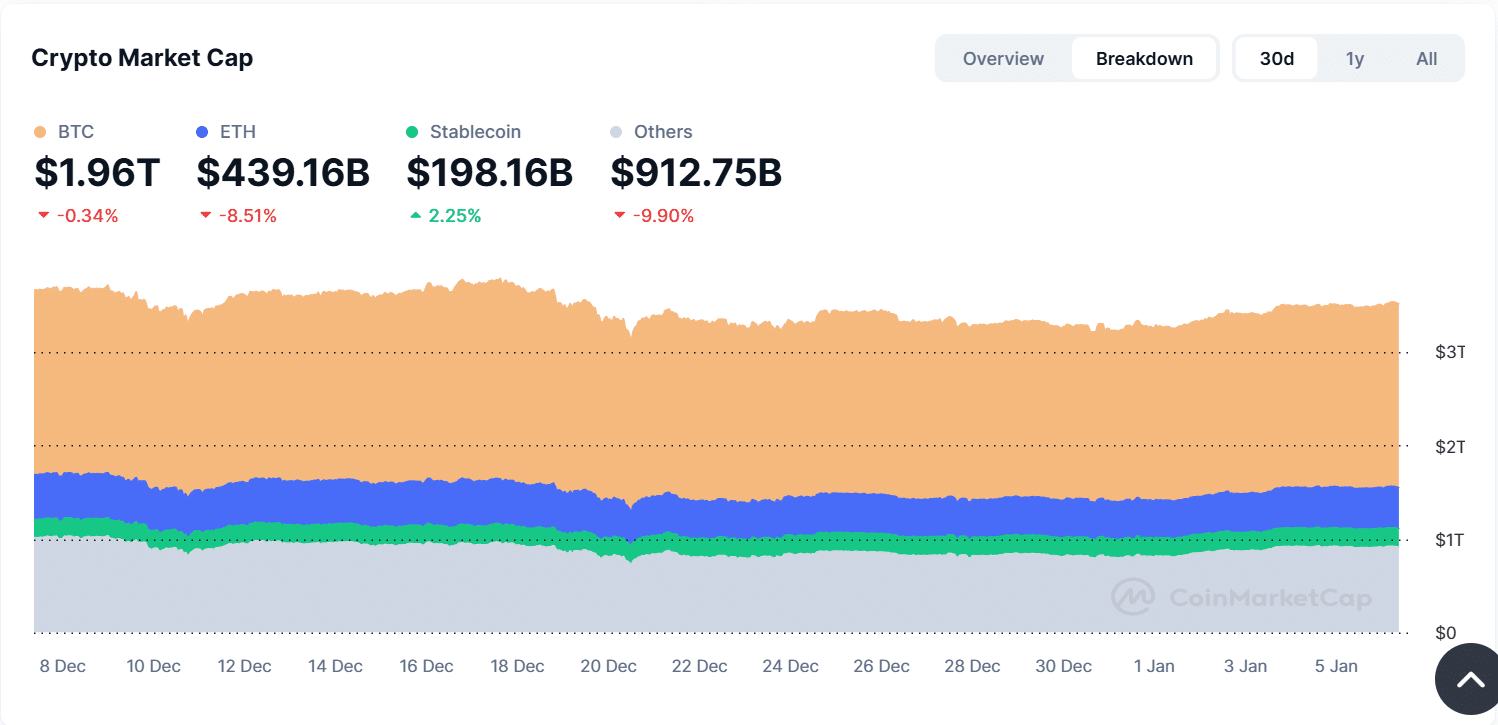

The overall crypto market cap stays at $3.51 trillion, with notable variations throughout asset courses. Bitcoin[BTC] and Ethereum[ETH] have seen declines of 0.34% and eight.51%, respectively, indicating sensitivity to macroeconomic situations.

In the meantime, stablecoins have gained 2.25%, reflecting a cautious pivot towards security. These traits spotlight how crypto traders are reacting preemptively to potential price modifications.

Over the previous 30 days, the crypto market has consolidated, with the overall market cap dipping to $3.28 trillion on December 22 earlier than recovering. This means a “wait-and-see” method as merchants stability macroeconomic uncertainties with potential shopping for alternatives.

Broader implications of those U.S. financial occasions

This week’s U.S. financial occasions may considerably affect the crypto market. Robust financial information might help additional rate of interest hikes, lowering liquidity and weighing on crypto costs.

Dovish alerts or weaker employment information may bolster threat urge for food, prompting renewed curiosity in cryptocurrencies. Stablecoins might proceed to see inflows if threat aversion persists, whereas altcoins may face additional sell-offs.

The underside line

As crypto markets proceed to reflect broader financial traits, this week’s U.S. financial occasions will present crucial alerts for merchants.

Whether or not it’s the labor market’s well being or the Federal Reserve’s coverage trajectory, these occasions will probably set the tone for the subsequent part of market sentiment and value motion in cryptocurrencies.

![Security alert [11/24/2016]: Consensus bug in geth v1.4.19 and v1.5.2 11 Security alert [11/24/2016]: Consensus bug in geth v1.4.19 and v1.5.2](https://dollar-bitcoin.com/wp-content/uploads/2025/02/1739641424_eth-org-120x86.jpeg)