Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin dipped marginally after reaching a brand new peak above $97,000 on Could 2. It retreated to simply beneath $94,000, a 3% to 4% decline from its latest excessive. Though short-term value actions are preserving merchants nervous, longer-term on-chain information is starting to exhibit indicators which will affect what occurs subsequent.

Associated Studying

Index Studying Signifies A Potential Early Bull Market

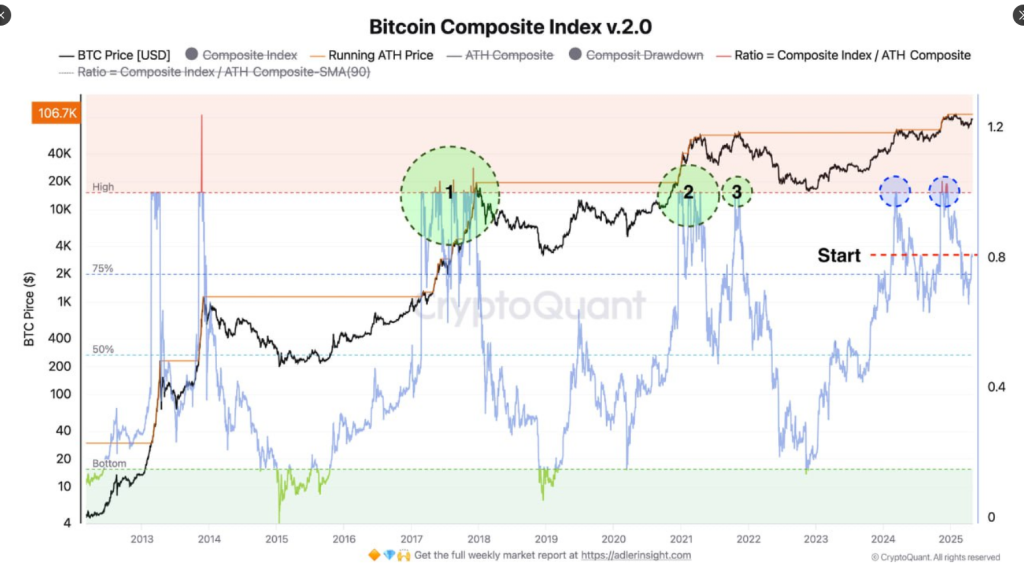

One gauge, which is known as the Bitcoin Composite Index v2.0, is now standing at a studying of 0.8. The index mixes value motion with blockchain exercise and makes an attempt to weigh the place Bitcoin might be going. For analyst Constantin Kogan, a reading on this scale has beforehand appeared forward of some large value rallies, equivalent to in 2017 and 2021.

Kogan described how if this quantity rises to 1.0 and holds, Bitcoin might start to speed up considerably sooner. The index isn’t fairly there now—nevertheless it’s not off course. One of the vital vital parts of the index, the “Working ATH Worth,” has begun trending upward too. This means that further patrons are coming into the market and religion could also be on the rise.

???? The upward momentum in Bitcoin is simply beginning to construct, with on-chain metrics just like the Bitcoin Composite Index signaling the start of a bull market. The index has already reached 0.8 (80%). Listed here are three attainable eventualities:

???? Bullish: BTC might surge to… pic.twitter.com/8bZ4vmr2CH

— Constantin Kogan (@constkogan) May 4, 2025

Worth Goal Could Hit $175K If Momentum Continues

If Bitcoin maintains its momentum and drives the Composite Index to greater than 1.0, analysts predict the value to rise sharply. The goal vary given is between $150,000 and $175,000. That’s if bullish momentum accelerates and previous developments are repeated.

But when the index stays wedged between 0.8 and 1.0, Bitcoin might stall for a bit. Which means a range-bound market, starting from $90,000 to $110,000. Kogan additionally highlighted a 3rd, much less possible route—if the index falls beneath 0.75. Then Bitcoin might appropriate again to $70,000 to $85,000.

Provide Knowledge Reveals The place Consumers Stepped In

The second a part of the puzzle is from the UTXO Realized Price Distribution chart, additionally known as the URPD chart. Offered by analyst Checkmate, it plots the place the holders of Bitcoin final transferred their cash. This offers a way of who bought when—and at what value.

An enormous section of patrons seems to have entered between $93,000 and $98,000. That area is at the moment behaving as a vital provide zone. It’s the area the place buyers have simply purchased Bitcoin and will maintain on or promote primarily based on what follows.

Associated Studying

Market Awaits Clear Transfer From Present Zone

Bitcoin is squarely in the midst of that vary at about $94,000. As Checkmate factors out, the subsequent transfer will rely upon whether or not value breaks out strongly or will get rejected. A robust breakout, evidenced by a strong every day candle, might flip latest provide into revenue and propel costs increased. But when the value can’t rise via this space, it might create a decrease excessive and entice further promoting stress.

For the second, Bitcoin sits in wait mode. Merchants and analysts are monitoring each the Composite Index and provide figures to find out whether or not the present lull turns into the subsequent leg up—or an extra step down.

Featured picture from Gemini Imagen, chart from TradingView