- Bitcoin’s Giant Holders Netflow fell by 191%, marking a shift in whale conduct and weakening demand help

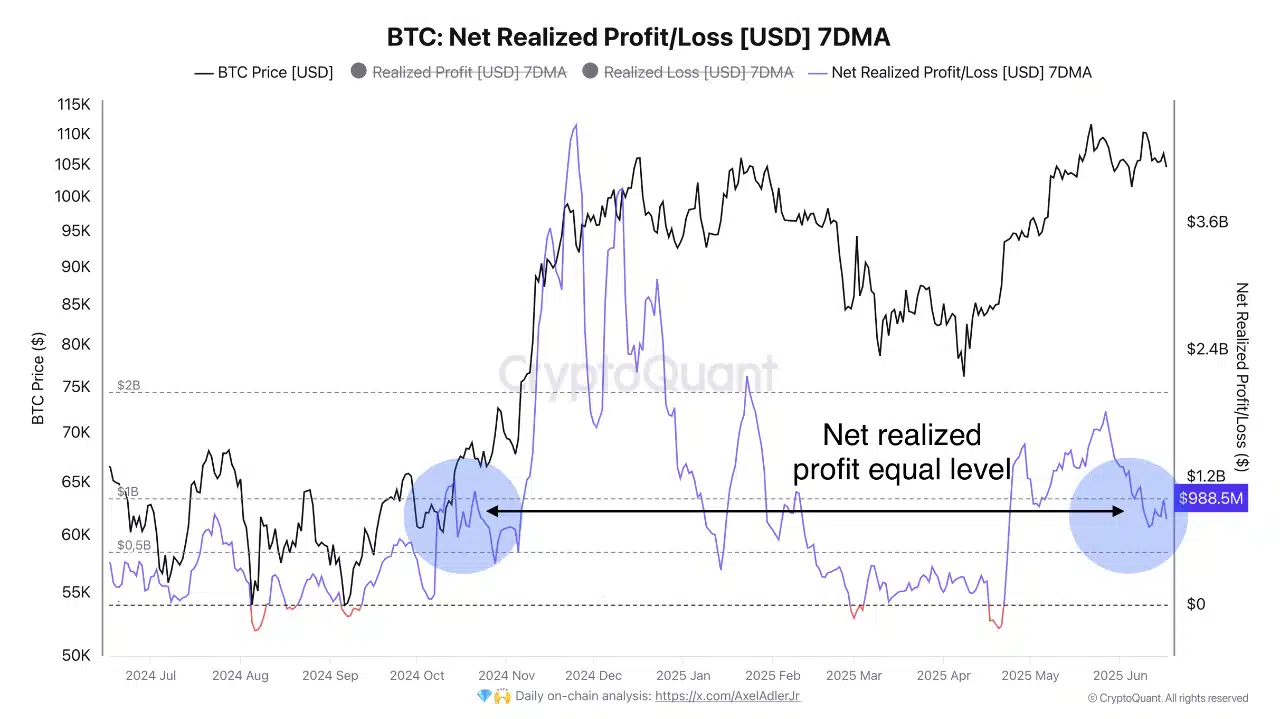

- Realized Earnings dropped under $1 billion, mirroring late-October 2024 ranges

Bitcoin’s [BTC] market has remained in a fragile stability recently. In actual fact, it appeared to be supported by low realized earnings and fading demand alerts that increase the chances of a directional shift quickly.

On the time of writing, BTC was priced round $106,000, with its Realized Earnings (7DMA) hovering slightly below the $1 billion threshold – Ranges not seen since late October 2024.

Regardless of a latest native excessive, nevertheless, profit-taking has remained subdued – In keeping with the low Realized Earnings development.

And but, the backdrop tells a distinct story – One among declining demand and mounting fragility.

Are whales backing out? AMBCrypto’s evaluation breaks it down…

The Giant Holders Netflow metric highlighted a regarding shift although.

During the last seven days alone, netflows fell by a staggering 191.44% – An indication that whales dramatically lowered their accumulation patterns.

All through April and Could, netflows have been comparatively impartial. Nevertheless, June has seen a constant drop thus far. This advised that some massive holders could also be stepping again or distributing cautiously.

With out their regular inflows, Bitcoin will grow to be extra uncovered to draw back threat. Notably if different demand sources proceed to weaken in tandem.

What do detrimental Funding Charges reveal?

Nicely, the image from the derivatives markets entrance hasn’t been reassuring both. In actual fact, persistently detrimental Funding Charges on dYdX revealed that merchants could also be leaning bearish and betting towards a sustained rally.

Each try by longs to regain floor has fizzled out shortly. Even temporary flips into optimistic territory failed to carry.

Except Funding Charges stabilize or flip optimistic for longer durations, patrons will possible battle to regain any management. This would depart Bitcoin weak to speculative sell-offs.

Has Bitcoin’s Unrealized Earnings cushion thinned?

The MVRV Z-score fell to 2.47 from a neighborhood peak of two.97 earlier in June. This drop might trace at thinning unrealized earnings following a pointy Could rally.

With out hefty unrealized earnings to fall again on, holders, and particularly short-term ones, might need much less incentive to remain put.

On the identical time, LTHs have been persevering with to withstand exit triggers, making a gridlock with no clear course.

Are on-chain valuation alerts overstretched?

Lastly, a few of Bitcoin’s on-chain valuation fashions is perhaps flashing purple proper now.

Metrics such because the NVT and NVM ratios surged, rising by 37.78% and 27.45% respectively. These spikes alluded to a rising disconnect between market cap and community utility.

In previous cycles, such divergences have preceded both sharp corrections or extended sideways motion. With the NVT at 45.83 and the NVM at 3.05, BTC may appear overvalued relative to its on-chain exercise.

It’s a warning – Crowd sentiment might drive the value greater than natural development.

Additionally, the Inventory-to-Move (S2F) ratio dropped by 16.66% to 1.060M, indicating a lower in perceived shortage. This metric historically helps bullish narratives round post-halving provide shocks.

Nevertheless, the latest decline advised that both Bitcoin issuance has risen or investor accumulation has slowed down. In both case, the weakening of this shortage sign might undermine long-term bullish expectations.

Can weakening demand help Bitcoin’s place?

Regardless of fragility throughout a number of metrics, Bitcoin has thus far managed to carry its impartial floor. Nevertheless, falling whale exercise, bearish funding charges, and rising valuation metrics are indicators of a fragile state.

If demand continues to deteriorate, this stability is extra prone to break – Probably triggering a transfer away from the present consolidation part.