- Bitcoin’s value corrected beneath $100K, declining practically 8% from its latest all-time excessive.

- Analysts famous that long-term holders confirmed no indicators of promoting, signaling new market cycles forward.

Bitcoin [BTC] is at the moment going through a notable correction, after its value fell from as excessive as above $109,000 final week to now buying and selling as soon as once more beneath the $100,000 value mark as of right this moment.

Significantly, on the time of writing, BTC has dropped by practically 5% previously week to its press time buying and selling value of $99,986—bringing the worth to 7.9% lower any from its all—time excessive achieved final week.

Main market gamers present restraint

Amid the continuing correction, a CryptoQuant analyst has highlighted an intriguing pattern in long-term holder (LTH) habits.

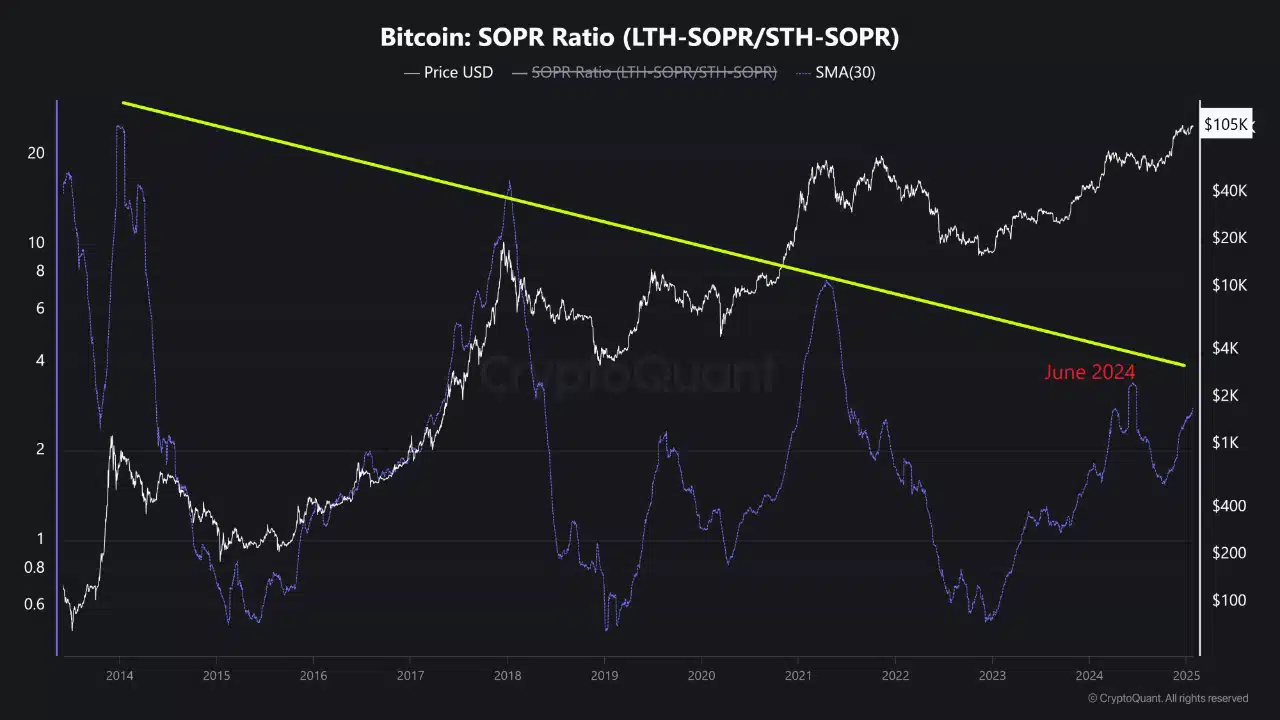

In a submit on the CryptoQuant QuickTake platform titled “Main Market Gamers are Reluctant to Promote,” the analyst famous that the SOPR Ratio (LTH SOPR/STH SOPR), was displaying slower progress within the present bull run in comparison with earlier cycles.

This ratio, which measures long-term holders’ realized earnings relative to short-term holders, stays decrease than ranges seen throughout Bitcoin’s value run-up in mid-2024.

The analyst additionally steered that as Bitcoin matures, long-term holders have more and more adopted a extra measured method, distancing themselves from speculative actions.

Institutional participation additionally seems to have reshaped market dynamics.

With extra buyers viewing Bitcoin as a long-term retailer of worth reasonably than a buying and selling instrument, the capital flowing into exchanges has decreased.

Consequently, many long-term holders are opting to maintain their Bitcoin in portfolios reasonably than cashing out.

The implication is that, whereas the market might expertise corrections, new cycles will possible emerge during which Bitcoin is held for prolonged durations, decreasing speculative promoting and probably stabilizing the market.

On-chain information gives further insights

Along with inspecting long-term holder habits, it’s vital to think about different key metrics to get the entire image of what’s ongoing behind the scenes of BTC and the place the asset is probably going headed within the short-term.

Notably, data from CryptoQuant on BTC’s MVRV ratio revealed that this metric has to date been on a rise together with BTC’s latest value motion.

This enhance introduced BTC’s MVRV ratio from 2.2 as of January 9 to as excessive as 2.52 on the twenty first of January.

Though, as of the twenty sixth of January, there was a slight lower to 2.4, the general pattern of this metric remains to be fairly in an uptrend.

It’s price noting that the continued enhance in MVRV ratio factors to a constructive sentiment amongst holders and buyers.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

A better ratio sometimes signifies that the market remains to be keen to worth Bitcoin at ranges above its realized value, which might sign resilience and potential for restoration.

Nonetheless, the slight pullback in MVRV is also a cautionary signal, suggesting that the market is perhaps approaching a interval of consolidation.