- Promoting stress on Bitcoin was rising.

- A value correction can push BTC right down to $95.8k once more.

After crossing a historic $100k mark, Bitcoin [BTC] witnessed a pullback and dropped close to the $98k vary. Slowly, the king coin was once more approaching the triple digit mark.

Nonetheless, BTC has to face just a few obstacles going ahead, which might set off a value correction.

Bitcoin inches in the direction of $100k once more, however…

Bitcoin value consolidated within the final 24 hours as its value moved marginally. On the time of writing, the king was buying and selling at $99.6k with a market capitalization of over $1.97 trillion.

Nonetheless, this sluggish method to $100k may not be a profitable try as a key metric was rising.

IntoTheBlock, an information analytics platform, lately posted a tweet spotlight BTC’s MVRV ratio. As per the tweet, Bitcoin’s MVRV was shifting nearer to historic peak ranges.

Usually, when MVRV rises, it’s typically adopted by value corrections.

Traditionally, BTC witnessed comparable pullbacks in 2018, 2021, 2022, and 2024. If historical past repeats, then BTC traders ought to put together themselves to witness a value correction quickly.

Is a value correction inevitable?

Not solely did the MVRV ratio flag a pink sign, just a few different on-chain metrics additionally painted the same image. For example, BTC dominance has been declining of late.

The ratio dropped from 53.7% to 51% final week — an indication of a brand new altcoin season.

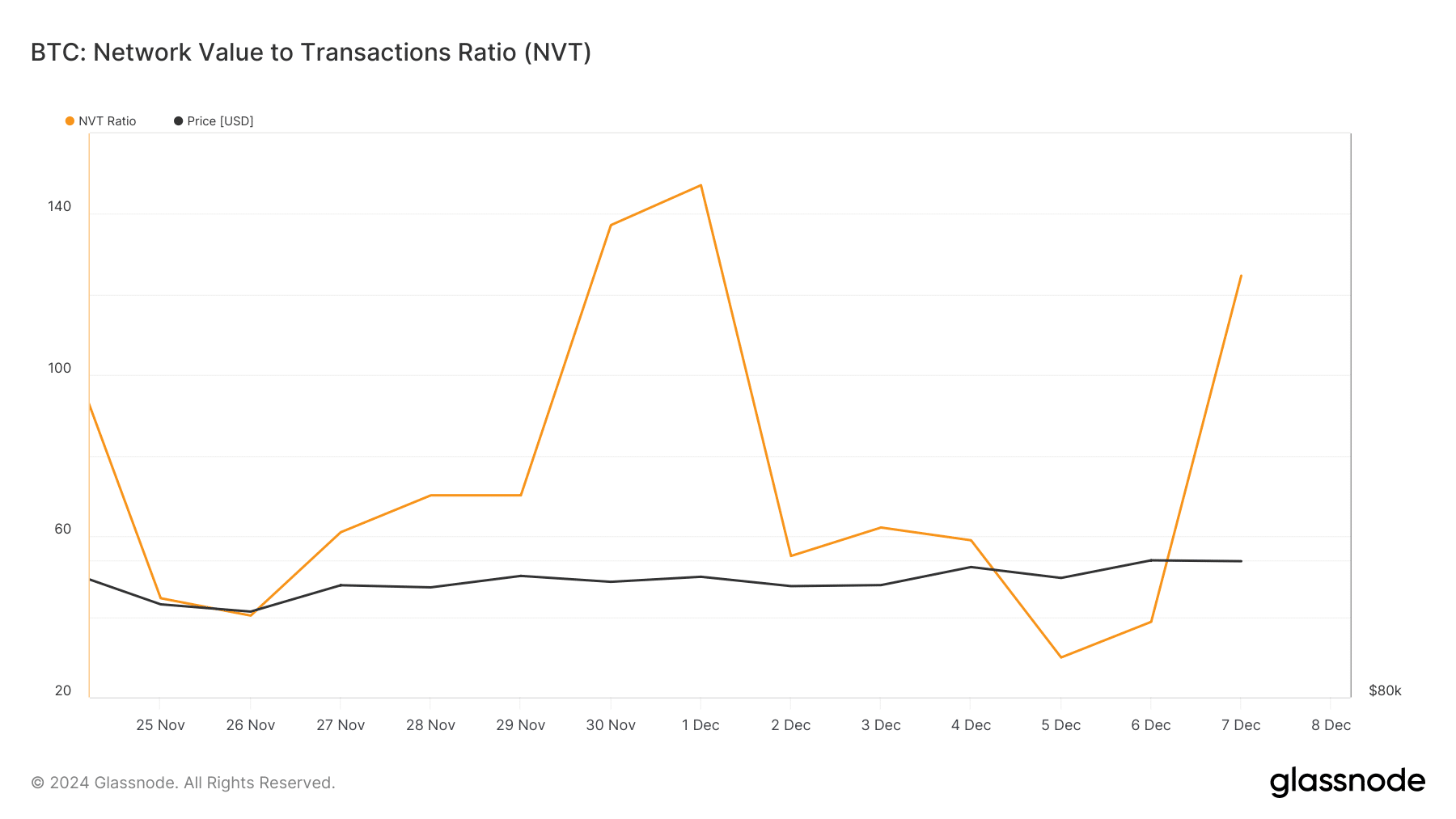

Glassnode’s information revealed that Bitcoin’s NVT ratio registered a pointy uptick. At any time when the metric rises, it signifies that an asset is overvalued, hinting at a value correction going ahead.

CryptoQuant’s data additionally identified just a few bearish metrics. BTC’s internet deposit on exchanges have been excessive in comparison with the previous seven days’ common. It is a clear signal of rising promoting stress on the king coin.

Moreover, the aSORP turned pink, which means that extra traders are promoting at a revenue. In the course of a bull market, it will possibly point out a market high.

Aside from that, AMBCrypto reported earlier that miners have been displaying much less confidence in BTC as they have been promoting their holdings.

To be exact, over the previous 48 hours, BTC miners have bought off an unimaginable 85,503 BTC, bringing miner balances right down to about 1.95 million BTC — the bottom degree in months.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

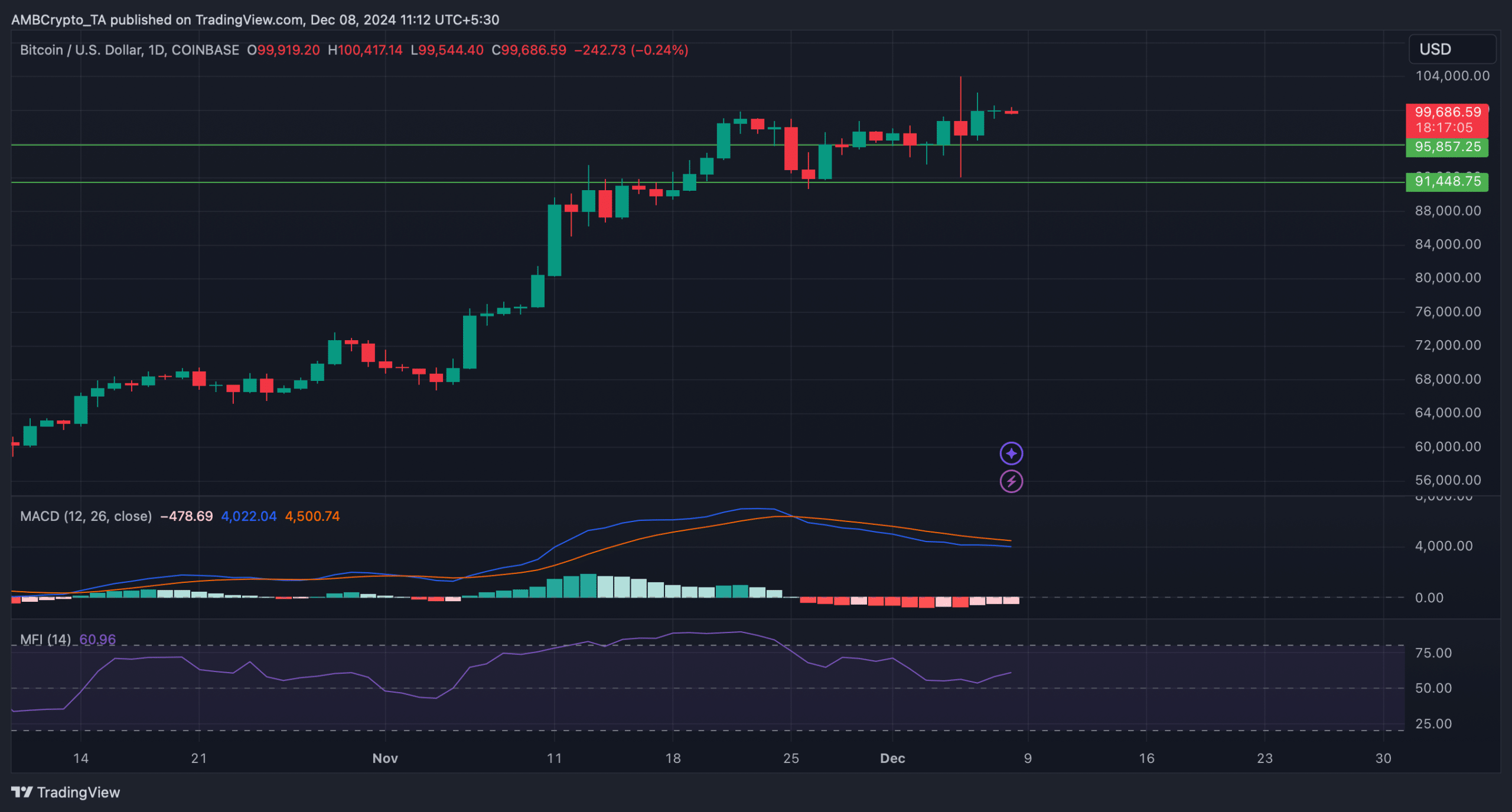

The technical indicator MACD displayed a bearish benefit available in the market. Within the occasion of a value correction, BTC may quickly drop to its assist close to $95.8k. A slip underneath that would push BTC right down to $91k once more.

Nonetheless, the Cash Move Index (MFI) registered an uptick, hinting at a continued value rise. This will push BTC above $100k once more within the coming days.