- Bitcoin retail buyers have been gone as quickly as they arrived.

- BTC has elevated by 3.07% over the previous week.

Since reaching $100k almost three weeks in the past, Bitcoin’s [BTC] has struggled to interrupt this barrier. As such, regardless of the latest worth pump, Bitcoin has continued to commerce sideways.

On the time of writing, Bitcoin was buying and selling at $97,834, marking a 0.31% decline within the every day charts. Earlier than this dip, BTC had been transferring upward, rising by 3.07% within the weekly charts.

This volatility is essentially related to declining retail curiosity because the market seeks stability whereas BTC strikes from weaker arms to stronger ones.

Bitcoin’s retail buyers are gone

In line with CryptoQuant, Bitcoin’s retail buyers disappeared from the market as quickly as they arrived.

Primarily based on the 30-day variation in retail demand, as BTC approached $100k, retail demand variations surged by over 30%.

A surge in retail demand normally indicators heightened curiosity, enthusiasm, or the worry of lacking out amongst smaller buyers.

Traditionally, when retail demand variation exceeds 15%, it typically precedes a neighborhood high. That is what occurred after Bitcoin reached its new ATH of $108k.

After the market reached this degree, a correction ensued, adopted by a 16% decline in retail demand. Retail buyers are recognized for being emotional reactors and shortly exit their positions throughout corrections.

A drop under 10% signifies that retail curiosity has dropped considerably. Nevertheless, this drop creates a shopping for alternative for giant and skilled merchants.

After such declines, the market has incessantly skilled a bullish rebound as weak arms capitulate and stronger arms accumulate.

What it means for BTC

In line with AMBCrypto’s evaluation, Bitcoin is experiencing a shift in market exercise from retail merchants to good cash accumulation.

This drop in retail demand indicators that markets are cooling off after a speculative frenzy. Due to this fact, BTC has moved from weak arms to stronger arms.

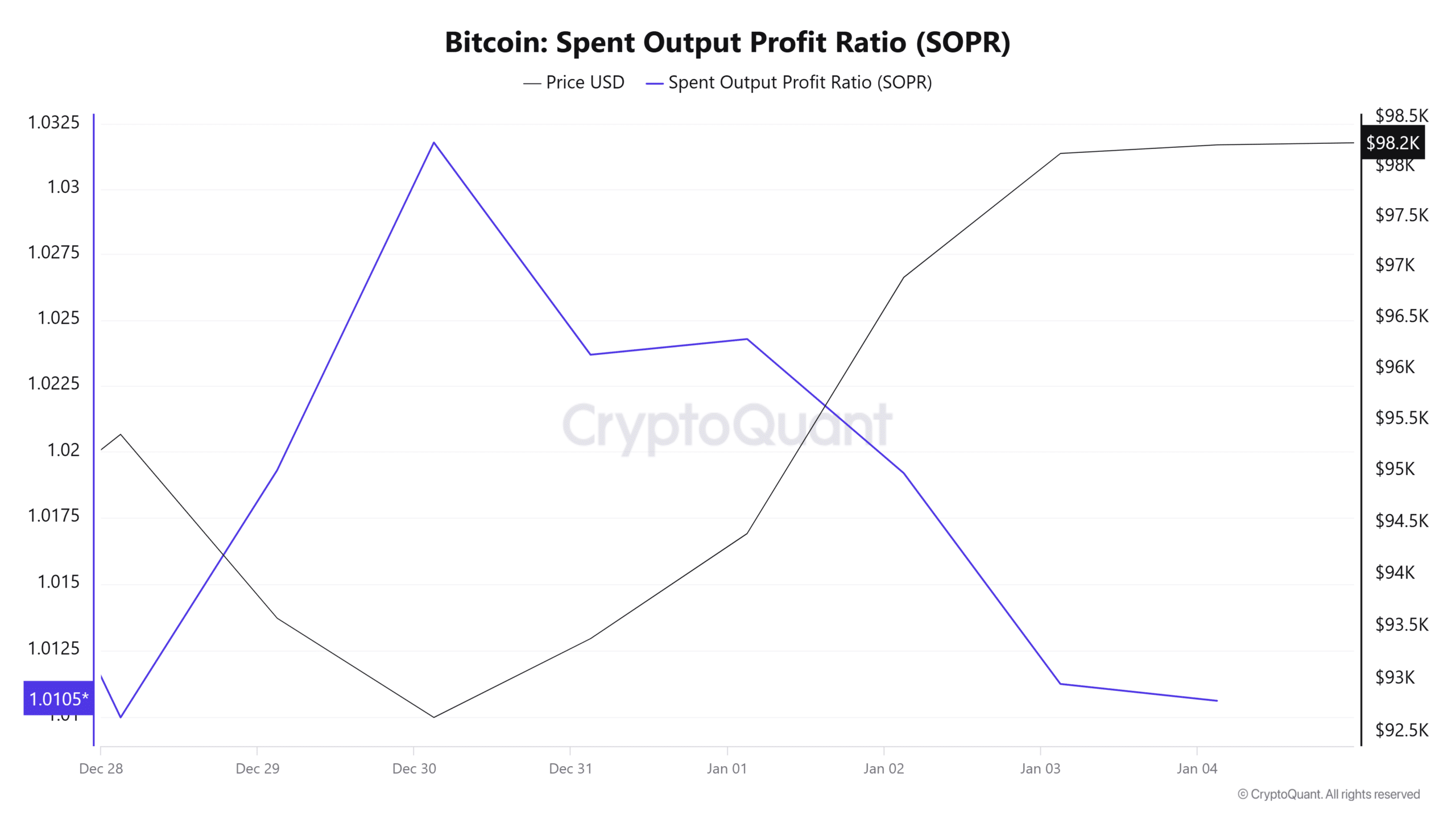

The latest drop within the Spent Output Revenue Ratio (SOPR) signifies a shift in possession and market exercise. Regardless of the decline, the SOPR stays at 1.01, signaling that holders aren’t keen to promote at a loss.

This market habits suggests stronger arms out there, indicating that buyers are assured in holding their positions even throughout market corrections.

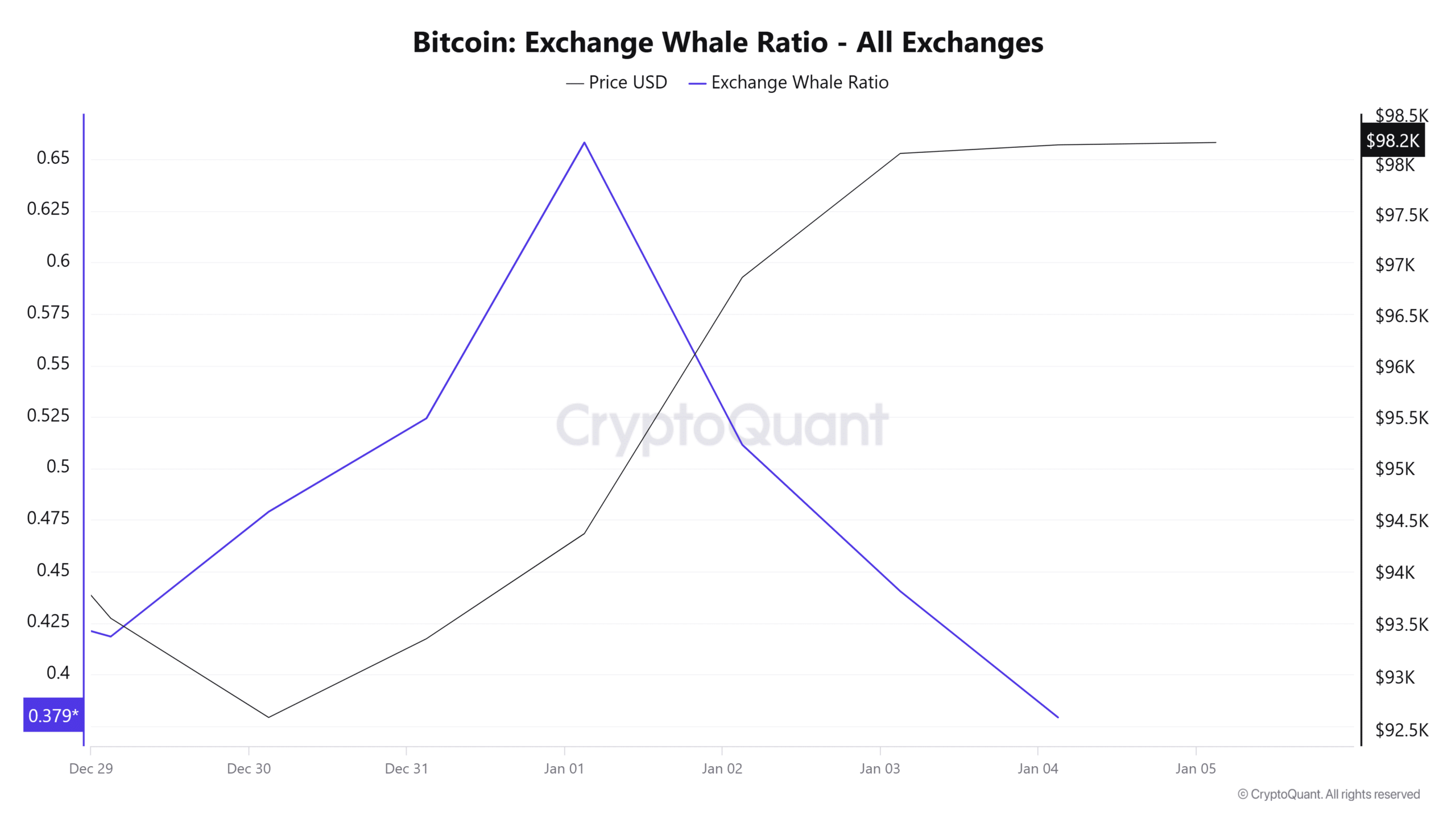

This accumulation development is additional evidenced by the decline within the alternate whale ratio. The whales’ provide to exchanges has dropped to 0.37, signaling HODL habits.

Whales are sending their BTC tokens to non-public wallets, indicating bullish sentiment as they anticipate additional positive aspects.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Merely put, the drop in retail demand has offered giant holders with a chance to build up BTC at decrease costs. These situations place Bitcoin for extra future positive aspects. Due to this fact, if the present market situations maintain, BTC will reclaim $98,700.

A transfer above this degree will strengthen Bitcoin to reclaim $100k. Conversely, one other market correction may see BTC drop to $96,100.