- MicroStrategy and BTC topped 2024 world asset performers.

- Will the agency’s daring BTC technique repay once more in 2025?

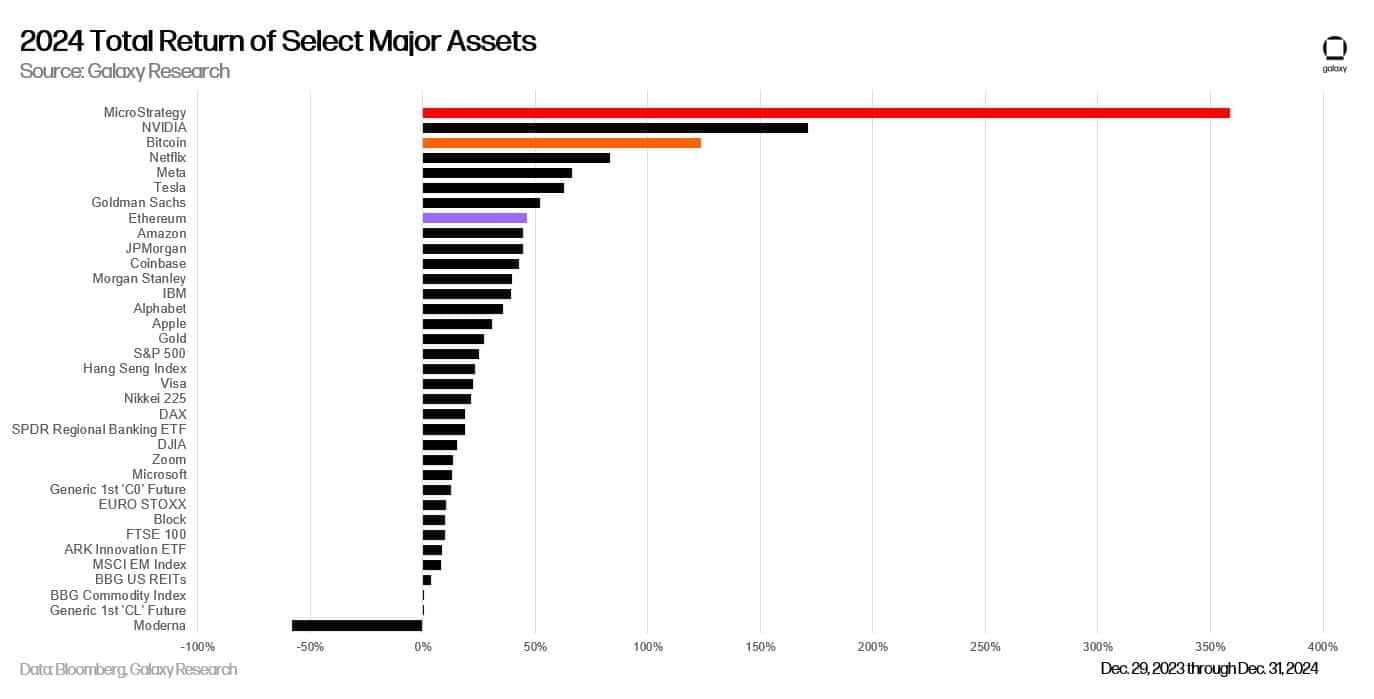

MicroStrategy’s aggressive Bitcoin [BTC] shopping for spree in 2024 appears to have paid off. In accordance with Galaxy Analysis, the agency’s inventory, MSTR, topped 2024 world asset performers with 358% yearly beneficial properties.

MSTR shared the primary spot with Palantir Applied sciences [PLTR], a software program firm that additionally provides information analytics options to cryptocurrency corporations.

BTC ranked third, whereas Nvidia got here in second. Alex Thorn, head of firmwide analysis at Galaxy Digital, famous that the highest two performers have been associated to BTC. He mentioned,

“Even on a risk-adjusted foundation (sharpe), MSTR completed 1st and BTC was third. 2 of high 3 property in 2024 have been Bitcoin-related.”

MicroStrategy’s BTC guess

MSTR’s exceptional yearly efficiency was no shock. The agency’s founder and former CEO, Michael Saylor, is a BTC maxi who believes that the cryptocurrency will all the time outperform most U.S. shares.

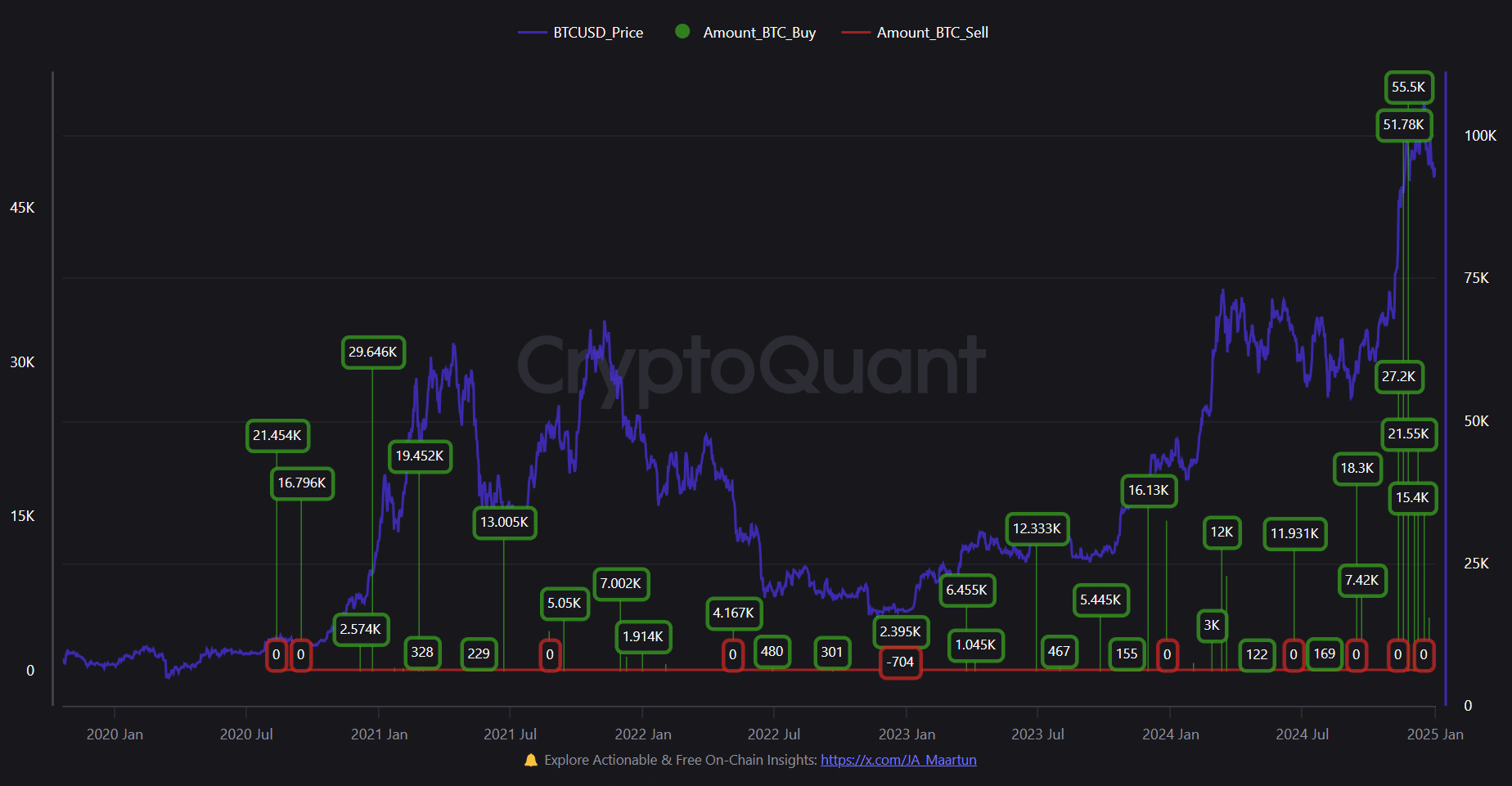

To capitalize on BTC’s development, the agency acquired a considerable quantity of the cryptocurrency (446.4K BTC) and now controls 2.2% of the full provide as of late 2024.

Curiously, probably the most aggressive shopping for spree occurred in This autumn 2024. In November alone, the agency acquired over 107K BTC, price over $10B, in two transactions.

Whereas the tempo of acquisition slowed in December, the agency is ready to launch an enormous fairness issuance program to speed up its BTC technique. It lately announced plans to extend MSTR’s share rely to over 10 billion to attain its targets.

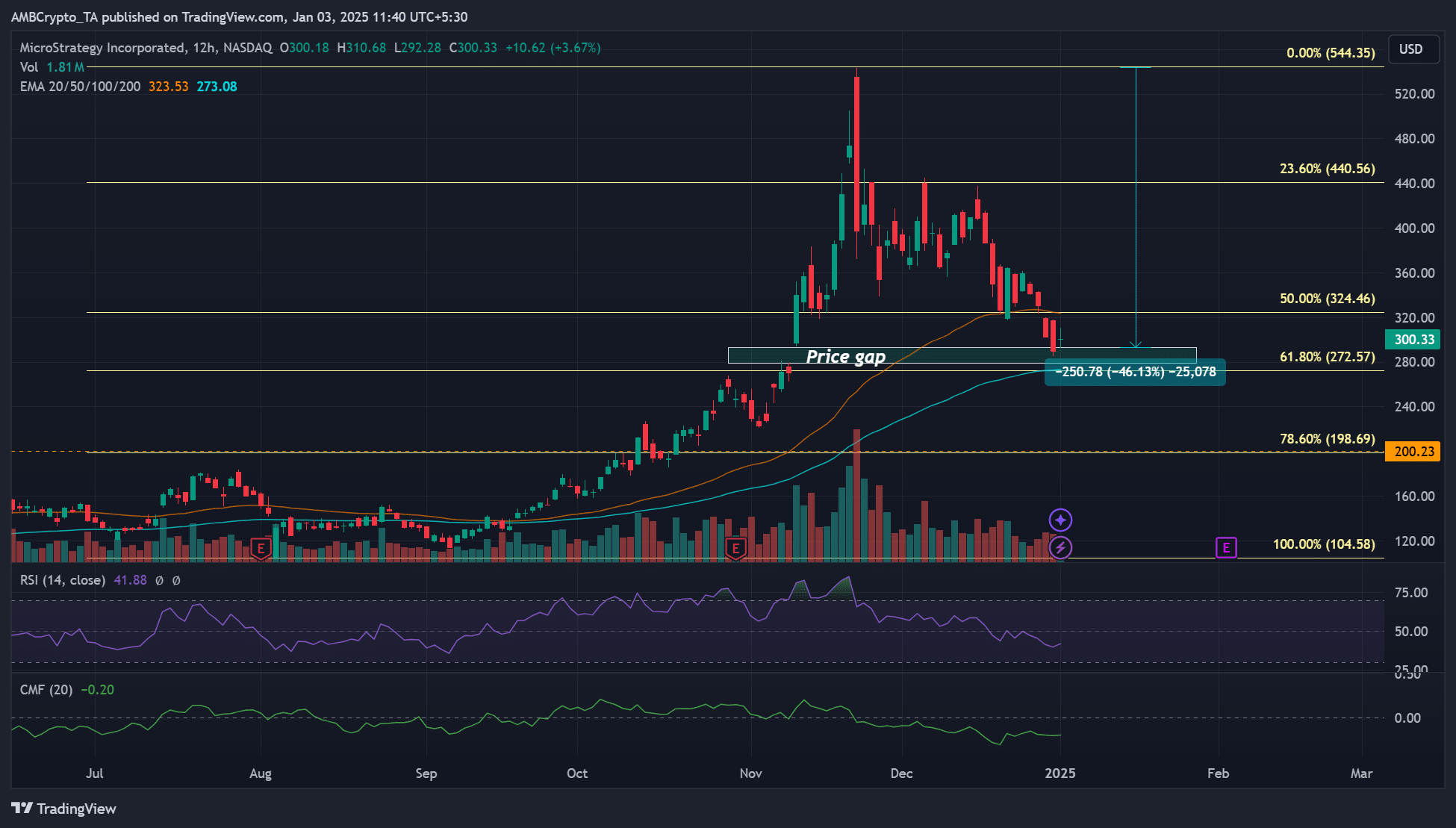

It stays to be seen if MSTR’s daring guess on BTC will repay once more in 2025. Within the meantime, the inventory was down 46% following an enormous BTC sell-off throughout the vacation season.

Over the identical interval, BTC dropped from $108K to a low of $92K earlier than trying a rebound to $97K in early January.

Nonetheless, the MSTR decline eased on the confluence of a value hole and the golden ratio 61.8% Fibonacci degree (close to $300).

Some market commentators imagine the current low and weak sentiment might present the perfect low cost for purchasing MSTR.