The Ethereum value may face some turbulence, as Justin Sun, the founding father of Tron (TRX), has unstaked a whopping $209 million from Lido Finance, a liquid decentralized staking platform for Ethereum. In comparison with prime cryptocurrencies like Bitcoin (BTC) and Dogecoin (DOGE), the Ethereum value has had a comparatively muted efficiency, skyrocketing to $4,000 earlier than consolidating and struggling to maneuver greater. With the potential for extra sell-offs, Ethereum could see its price crashing down if Solar decides to dump extra cash.

Justin Solar Dumps ETH

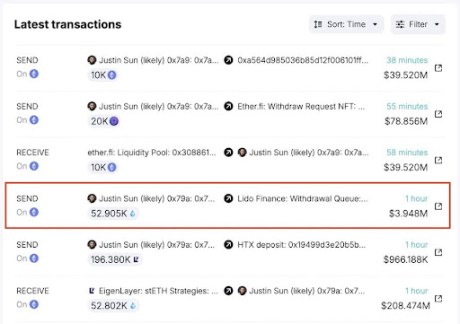

New reports from Spot On Chain, an AI-driven crypto platform, revealed that Solar lately utilized to withdraw a staggering 52,905 ETH tokens price about $209 million from Lido Finance. In keeping with the on-chain information, this huge withdrawal was a part of the ETH stash Solar allegedly amassed between February and August 2024.

Spot On Chain has revealed that the overall quantity of Ethereum Sun bought inside this era amounted to 392,474 ETH tokens, valued at $1.19 billion. All of those tokens have been bought by way of three pockets addresses at a mean value of $3,027. Presently, the overall revenue the Tron founder has acquired since his buy is as much as $349 million, representing a 29% enhance from its buying value.

Curiously, on October 24, Solar had unstaked an enormous 80,251 ETH tokens, price over $131 million, from Lido Finance. 4 days later, he transferred your complete quantity to Binance, the world’s largest crypto trade. This notable transfer befell simply earlier than the value of Ethereum had dropped sharply by 5% in mid-October, which may have resulted in a loss for Sun.

Unsurprisingly, this isn’t the primary time Solar has dumped Ethereum. Spot On Chain revealed earlier this month that the Tron Founder had been cashing in his Ethereum holdings in the course of the market rally.

In November, Solar deposited 19,000 ETH price $60.83 million to HTX, a crypto trade. Moreover, he transferred 29,920 ETH valued at $119.7 million to HTX once more after its value surpassed $4,000 over the previous week. These are just some transactions the Tron founder has made with ETH over the previous month.

Given Solar’s historical past of large-scale asset actions, additional sell-offs may affect the already fragile Ethereum market. Nonetheless, the lingering query stays whether or not the Tron founder will proceed his Ethereum dumping spree.

Ethereum Value Crash Forward?

Whereas Solar has not publicly commented on his current large-scale Ethereum withdrawals, the dimensions and timing of those transactions may pose an issue for the altcoin’s future trajectory. Traditionally, giant ETH liquidations have triggered a value crash because of increasing selling pressures.

Associated Studying

With the value of Ethereum nonetheless unstable and aiming for a stronger upward rally, additional large-scale ETH dumps may exacerbate market volatility, particularly if different buyers or whales observe swimsuit. For now, the value of Ethereum appears to be performing well, recording a greater than 7% enhance within the final seven days and a 28% surge over the previous month, in response to CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com