- Ethereum energetic addresses up 36%, signaling natural demand and stable community exercise.

- Breaking $4,100 resistance may propel ETH in the direction of its all-time excessive of $4,891.

Ethereum [ETH] skilled a serious surge earlier this month, briefly touching the $4,000 mark earlier than coming into a consolidation part. Whereas worth motion has cooled in latest days, analysts stay optimistic, pointing to robust indicators that Ethereum’s bullish momentum is way from over.

For the reason that US elections on fifth November, ETH has seen a exceptional 70% worth improve, fueled by natural demand, as evidenced by a major rise in energetic addresses.

This surge, pushed by actual community exercise, means that Ethereum’s rally may very well be sustainable, with the potential for continued development within the months forward.

Ethereum worth motion post-US elections: A deep dive

Ethereum’s worth trajectory post-US elections has been nothing in need of explosive, with the asset rallying 70% since fifth November.

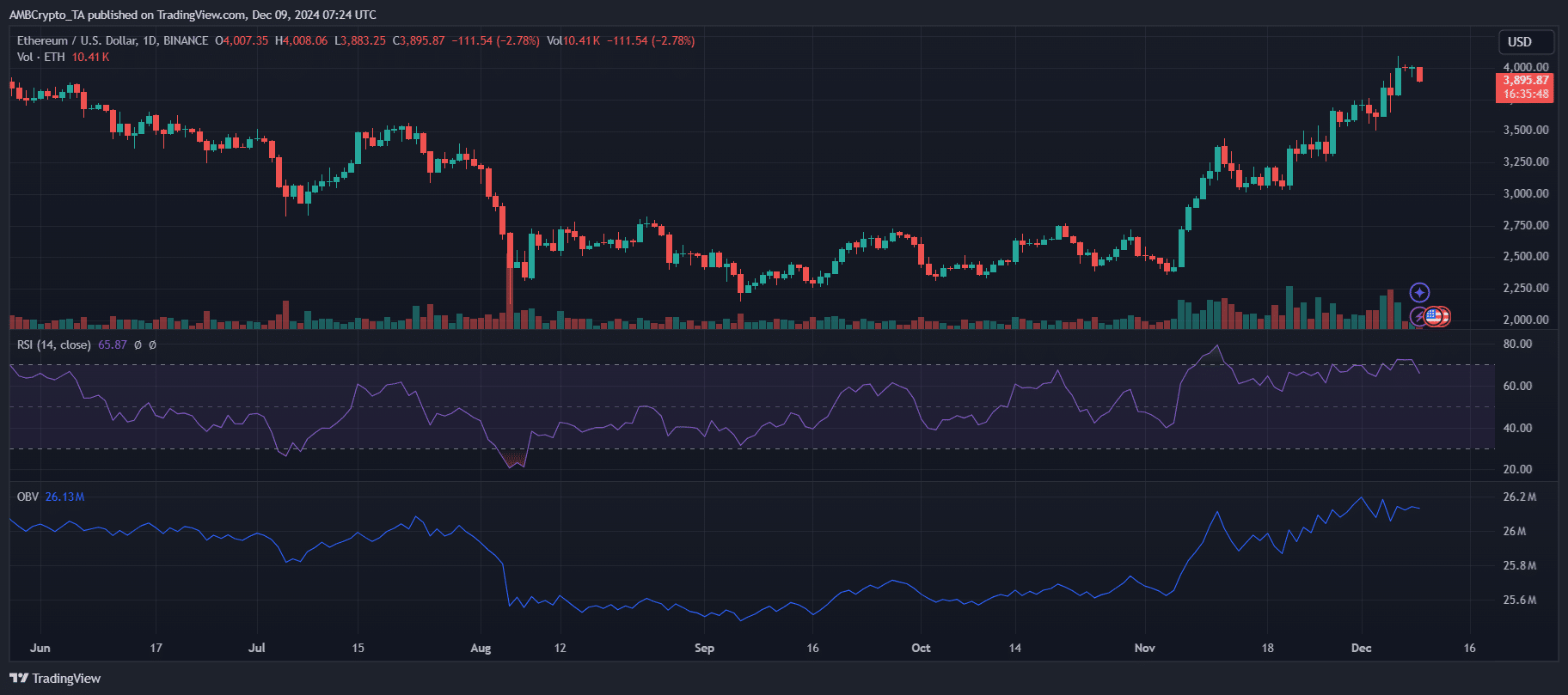

The breakout above the $3,500 resistance signaled a shift in market sentiment, catalyzed by elevated institutional exercise and DeFi resurgence. TradingView information highlights sturdy quantity accumulation alongside bullish worth motion, evidenced by a rising OBV metric.

This exhibits robust purchaser curiosity, not merely speculative hype. Moreover, the RSI stays beneath overbought territory, suggesting room for continued upside.

Analysts attribute this momentum to Ethereum’s dominance in Layer-2 scaling options and its rising function in facilitating decentralized functions.

Surge in ETH energetic addresses

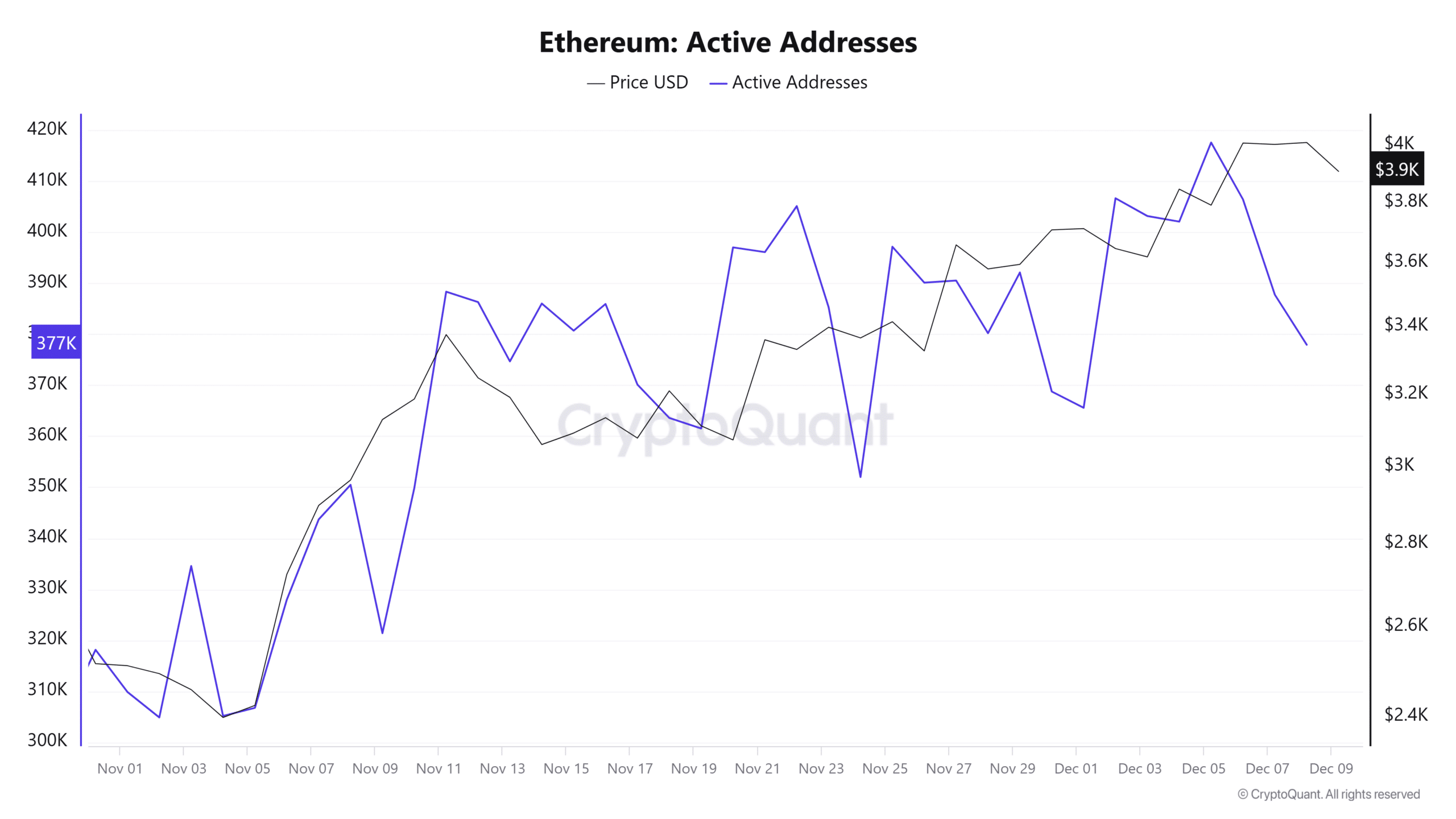

Ethereum’s community exercise has seen a considerable uptick for the reason that November 5 elections, with energetic addresses climbing by over 36% to 417,000.

This surge highlights natural demand somewhat than speculative buying and selling, underscoring a “wholesome and sustainable” rally, based on CryptoQuant analyst Burak Kesmeci.

The rise in energetic addresses displays heightened investor curiosity and broader blockchain utilization. This metric, typically thought of a proxy for actual community exercise, lends credence to Ethereum’s present rally as being grounded in robust fundamentals.

Analysts recommend this development may sign a continued upward trajectory, notably with Ethereum’s increasing function in DeFi and NFTs, reinforcing its place because the main altcoin amidst an evolving market panorama.

Ethereum’s $4,000 consolidation: Bullish or bearish?

Ethereum’s consolidation part at $4,000 comes with blended sentiments concerning its subsequent transfer. Whereas some foresee a possible pullback, Kesmeci stays optimistic, citing wholesome fundamentals.

In line with him, breaking the $4,100 resistance may propel Ethereum towards its all-time excessive of $4,891. Key indicators, corresponding to rising energetic addresses and sustained quantity accumulation, recommend bullish momentum stays intact.

Nonetheless, the $4,100 stage presents a psychological barrier. Analysts additionally spotlight the potential for exterior elements, like macroeconomic circumstances or regulatory developments, influencing Ethereum’s trajectory.

For long-term traders, Ethereum stays worthwhile, with beneficial properties of over 39% up to now month, positioning it as a cornerstone of the altcoin rally.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum’s rising institutional adoption is clear from the rising inflows into spot ETFs, which now boast a cumulative web influx of $1.41 billion.

The timing of those inflows aligns with Ethereum’s latest rally, amplifying bullish sentiment across the asset.