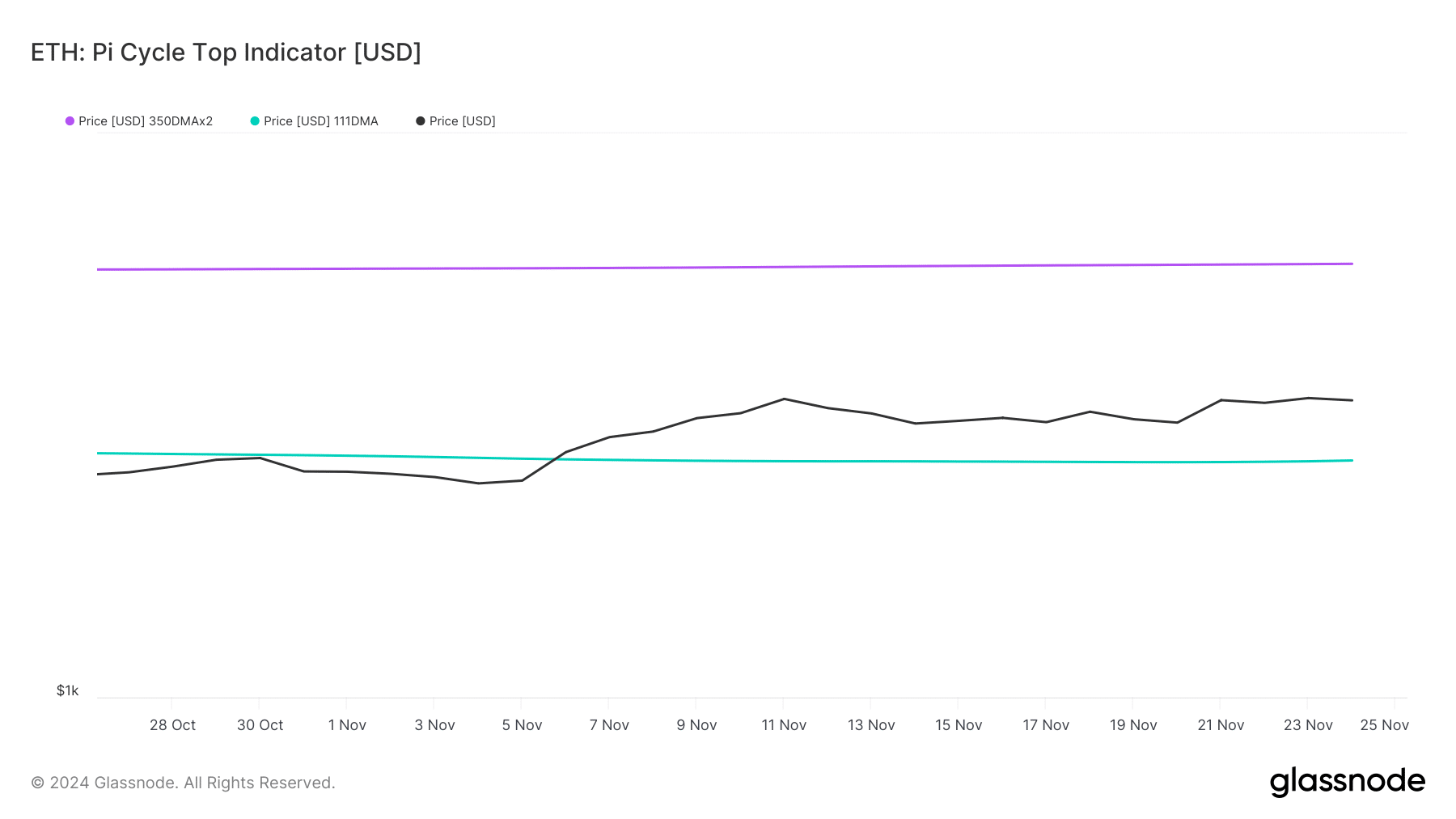

- Ethereum’s Pi Cycle Prime indicator predicted a market prime of over $5k.

- In case of a value correction, ETH may drop to $3.03k once more.

Ethereum [ETH], like most different cryptos of late, have registered promising development. Following the tracks of Bitcoin [BTC], a number of anticipated ETH to additionally contact an all-time excessive within the coming days. Nonetheless, is it a viable end result?

Mapping Ethereum’s path forward

Like BTC, ETH additionally registered a greater than 8% value hike final week. At press time, the king of altcoins was buying and selling at $3,389.53 with a market capitalization of over $408 billion.

This was considerably decrease than the token’s ATH, which it achieved again in November 2021. To be exact, Ethereum’s ATH is almost $4.7k.

Nonetheless, the latest bullish development out there, and within the hope of an altcoin season forward, a number of technical analysts predicted a brand new ATH for ETH. One in every of them was common crypto analyst AlejandroBTC.

The analysts not too long ago posted a tweet mentioning the potential for ETH reaching an ATH by the top of this 12 months.

Going ahead, the analyst additionally predicted that ETH may attain $7k in January 2025 and $14k in March 2025.

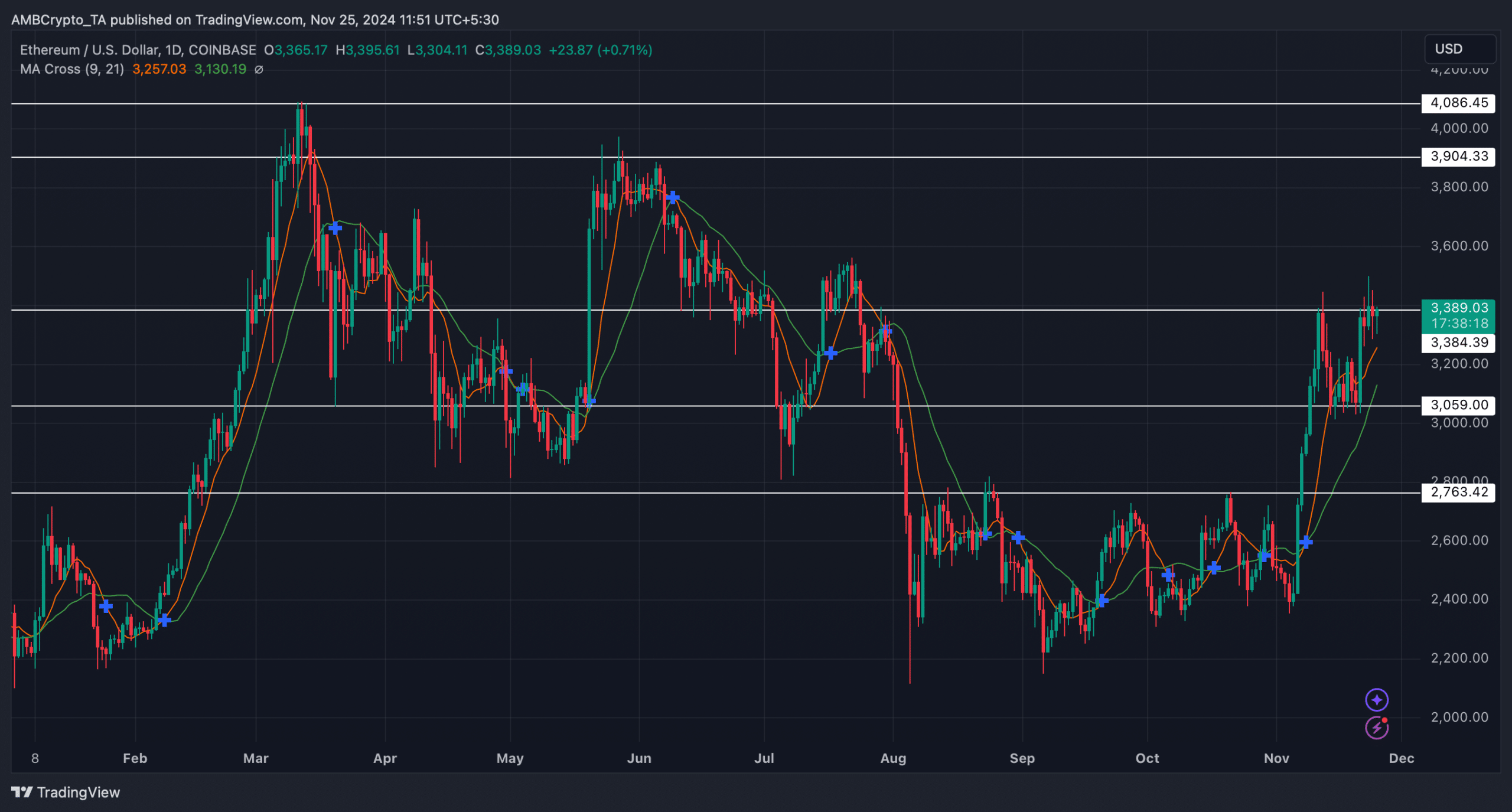

Since these numbers appeared fairly formidable, AMBCrypto dug deeper. We checked Ethereum’s every day chart to search out out upcoming resistance ranges that the token must cross to ensure that it to achieve an ATH. As per our evaluation, ETH at press time was struggling to breach its $3.4k resistance.

Nonetheless, the MA Cross indicator displayed a bullish benefit because the 9-day MA was properly above the 21-day MA. This recommended that ETH can bounce above the resistance within the coming days.

If that occurs, then ETH may subsequent goal $3.9k earlier than it eyes at its March excessive of $4k. A breakout above that mark would open doorways for ETH to retest its ATH once more.

What to anticipate within the short-term?

Notably, anticipating that to occur gained’t be unrealistic. The Pi Cycle Prime indicator, an important metric that maps market tops and bottoms, revealed that ETH had a attainable market prime of $5.8k.

This was properly above its ATH, suggesting a climb in the direction of that mark within the coming days.

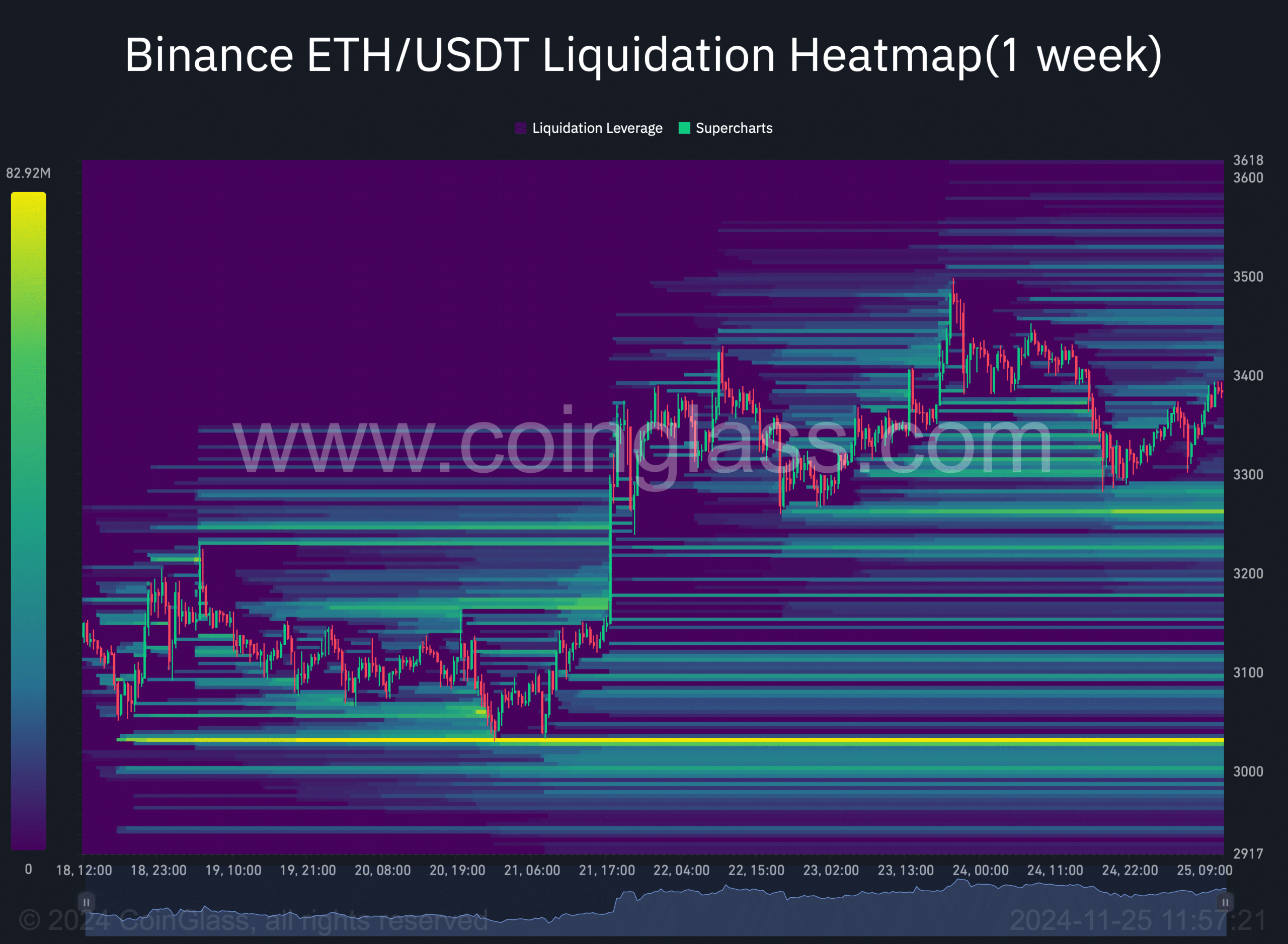

Although the token will witness slight rise in liquidation going ahead, if market sentiment and traders’ confidence don’t dwindle on ETH, this goal is perhaps achievable.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Nonetheless, if the market situation modifications and ETH falls sufferer to a value correction, the king of altcoins may drop to its assist at $3.03k as soon as once more.