It’s the election season in the United States, and Bitcoin and the broad cryptocurrency trade have by no means been extra concerned within the political panorama. From the brazenly pleasant stance of former President Donald Trump to the comparatively reserved place of Vice President Kamala Harris, there was fairly some drama within the interaction between the crypto market and United States politics.

There have been quite a few discussions in regards to the consequence of the elections and its potential impression on the crypto panorama. QCP Capital, a distinguished buying and selling agency, is amongst the most recent to weigh in on the outcomes of the polls and the impact on crypto, particularly Bitcoin.

QCP Thinks Bitcoin Worth Will Drop Following Election Outcome — Right here’s Why

In a November 2 report, QCP Capital revealed that it expects the US elections to be one other “sell-the-news” motion regardless of the end result. Just like the Nashville Bitcoin convention, the buying and selling agency expects many traders to shut their BTC positions following the election on Tuesday, November 5.

In response to QCP, there was a sustained stage of short-term implied volatility above 72 vols for each Bitcoin and Ethereum within the upcoming elections. Because the identify suggests, short-term implied volatility tracks the market’s expectations of value actions within the close to future.

With this metric as excessive as 72 vols in the mean time, there’s a sense that traders are anticipating main value swings within the Bitcoin and Ethereum markets following the elections. Nevertheless, a rise in put skews that the majority merchants foresee downward value actions.

QCP highlighted that the rise in put skews means that merchants are taking “draw back safety,” with the expectation of a market correction. Finally, this aligns with the “sell-the-news” projection, mirroring the aftermath of the Nashville Bitcoin conference.

After virtually reaching its all-time excessive value within the earlier week, BTC has skilled a notable pullback under $70,000. As of this writing, the premier cryptocurrency stands at round $68,150, reflecting a 2.2% decline up to now 24 hours.

Binance Merchants Go Lengthy On BTC Futures

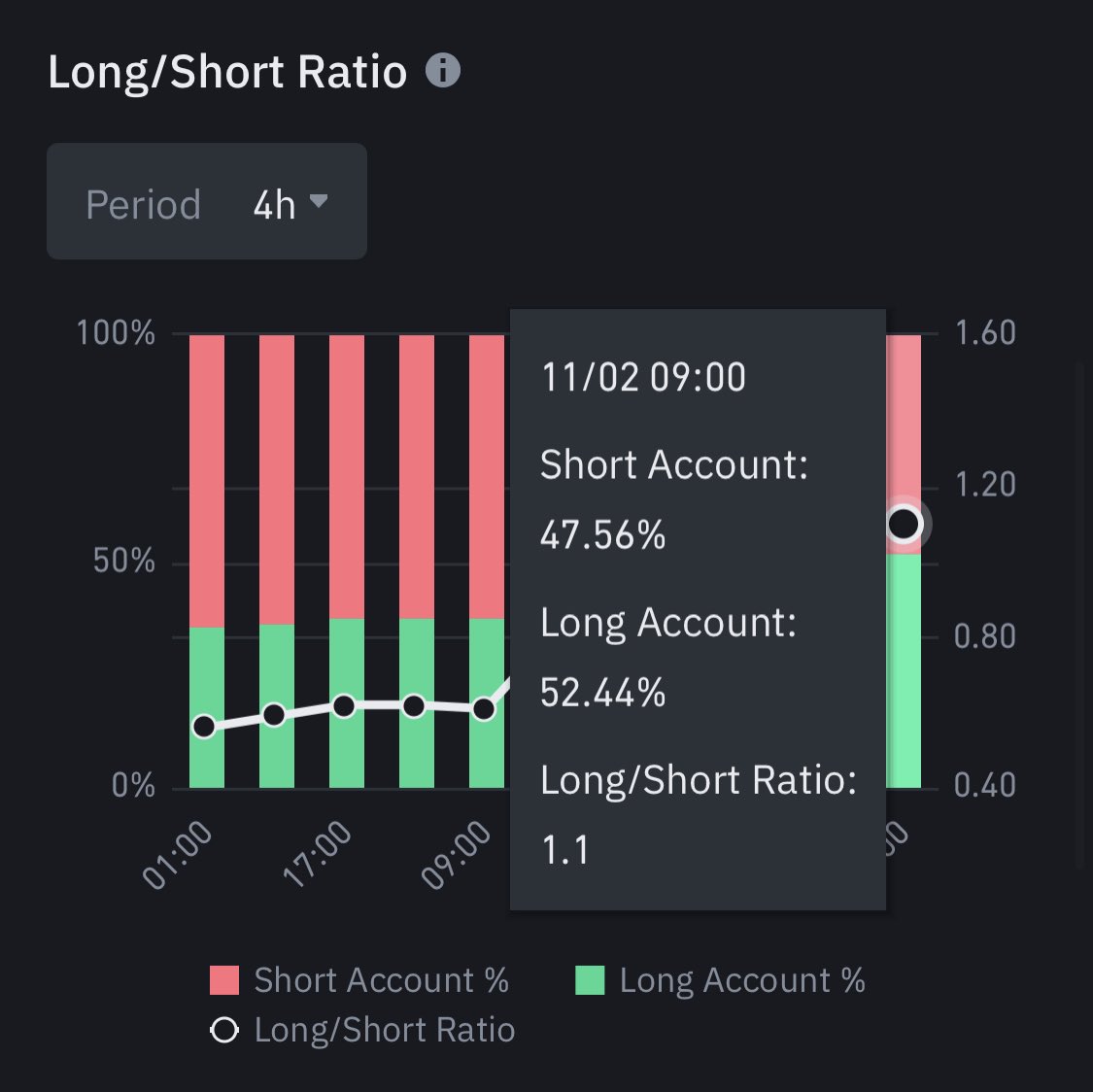

In a latest submit on X, Ali Martinez revealed Bitcoin futures merchants on Binance have begun to shut their quick place. In response to the on-chain analyst, 52.44% of the Binance futures merchants have now gone lengthy on the flagship cryptocurrency.

Supply: Ali_charts/X

A surge in lengthy positions means that extra traders are backing the Bitcoin value to rise within the close to future. Therefore, this newest remark alerts a major shift in sentiment, with the market seemingly leaning in the direction of a extra bullish outlook just a few days earlier than the US elections.

It’s price mentioning that this modification in Binance merchants’ positions could also be a response to the latest dips in Bitcoin value. It’s potential that traders are “buying the dip,” viewing the present value as the right entry level.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView