- Trump has maintained a lead over Kamala throughout all prediction websites and fashions.

- BTC choices merchants had been closely bullish on the election consequence expectations.

All prediction websites and high fashions revealed that pro-Bitcoin [BTC] candidate Donald Trump has the next probability of profitable the upcoming US presidential elections.

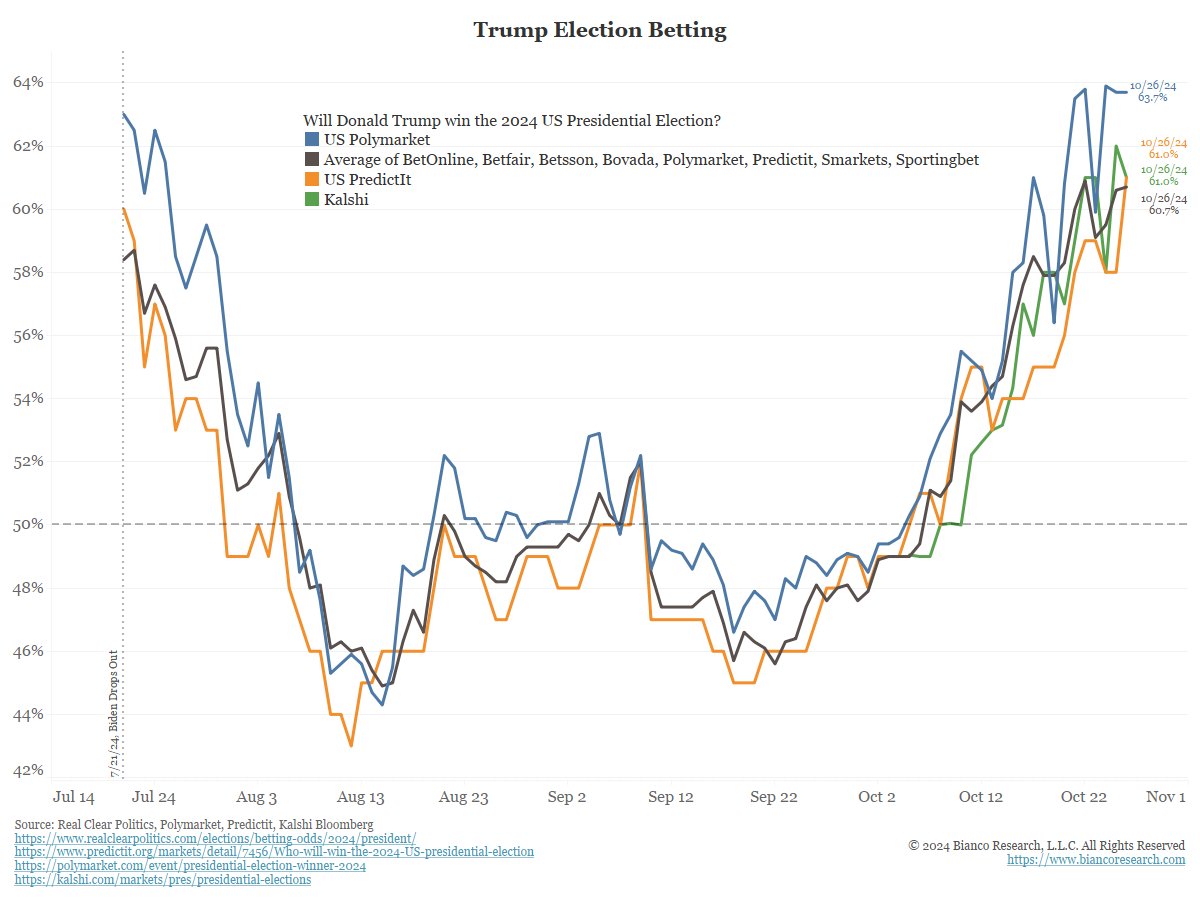

In response to the most recent review by analyst Jim Bianco of Bianco Analysis, prediction websites like Polymarket, Kalshi, PredictIt, and others had been polling a +60% probability of Trump profitable.

Potential affect on BTC

Though some platforms like Polymarket have lately confronted criticism of alleged manipulation, different dependable fashions leaned in the direction of Trump.

Bianco famous that high election fashions, akin to Silver Bulletin and two different in style fashions, additionally confirmed a excessive chance of +50% of a Trump win.

“Silver will not be the one one with an election mannequin. Silver Bulletin, FiveThirtyEight, Economist Journal. All of them have Trump in an uptrend of over 50%.”

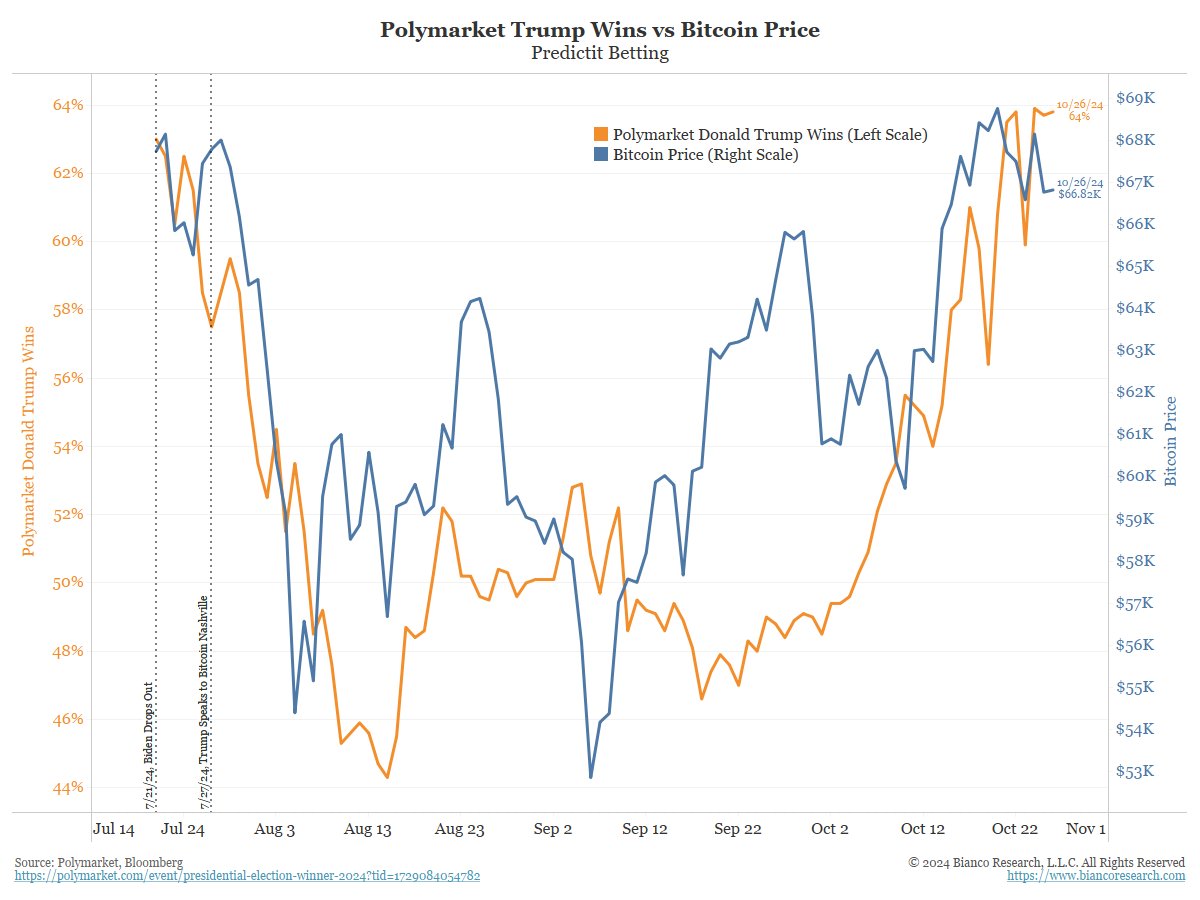

This above expectation has been deemed bullish by speculators in BTC markets.

Notably, BTC exploded up to now few weeks as Trump’s odds surged and crossed 60% on Polymarket. It pushed BTC to just about $70K. Commenting on the correlation, Bianco termed it an ‘election play,’

“And one other election play, though this relationship is perhaps “fraying” in latest days.”

Market positioning

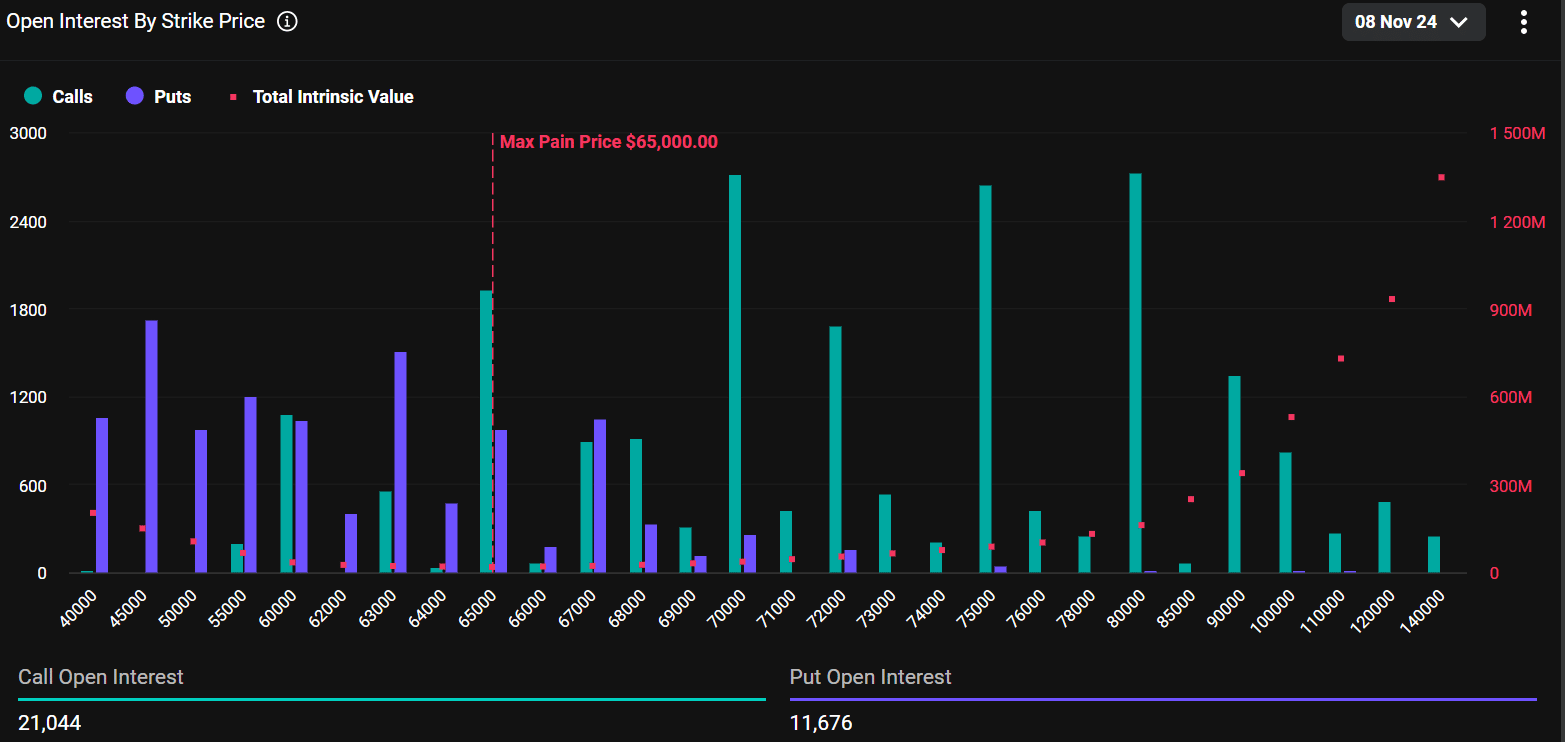

Maybe probably the most evident affect of the above bullish expectation on Trump’s win was within the BTC choices market. Final week, choices merchants had been pricing a 20% probability of BTC hitting $80K by the top of November.

The sentiment was unchanged at press time. In response to Deribit data, there was almost twice as a lot Open Curiosity in name choices (betting value rally) than in put choices (value decline) for contracts expiring by eighth November.

Moreover, the put/name ratio (PCR), which tracks choices market sentiment, was at 0.55.

For context, if the ratio is above 1, then there are extra put choices than calls, a bearish sentiment. Alternatively, a worth beneath 1 means dominance of name choices, underscoring bullish sentiment.

That stated, the 0.55 PCR studying painted an especially bullish sentiment within the choices market, maybe attributable to speculators’ assumption that Trump was more likely to win.

Nonetheless, given Harris’s more and more pro-crypto stance too, BTC choices merchants had been assured that the asset may hit a brand new all-time excessive (ATH) no matter who wins the US elections.

Within the meantime, BTC was valued at $67K at press time, about 9% away from its ATH of $73.7K.