- The current drop in ETH’s value gave the impression to be a retracement.

- Market sentiment indicated a probable pullback, pushed by weakening shopping for stress.

Over the previous 24 hours, Ethereum [ETH] has entered what is named a retracement—a short lived dip that usually precedes a renewed rally in bullish markets—leading to a 2.70% decline throughout this era.

AMBCrypto stories that the downturn might lengthen additional, doubtlessly reversing the 1.62% achieve ETH recorded over the previous week.

ETH faces continued weak point

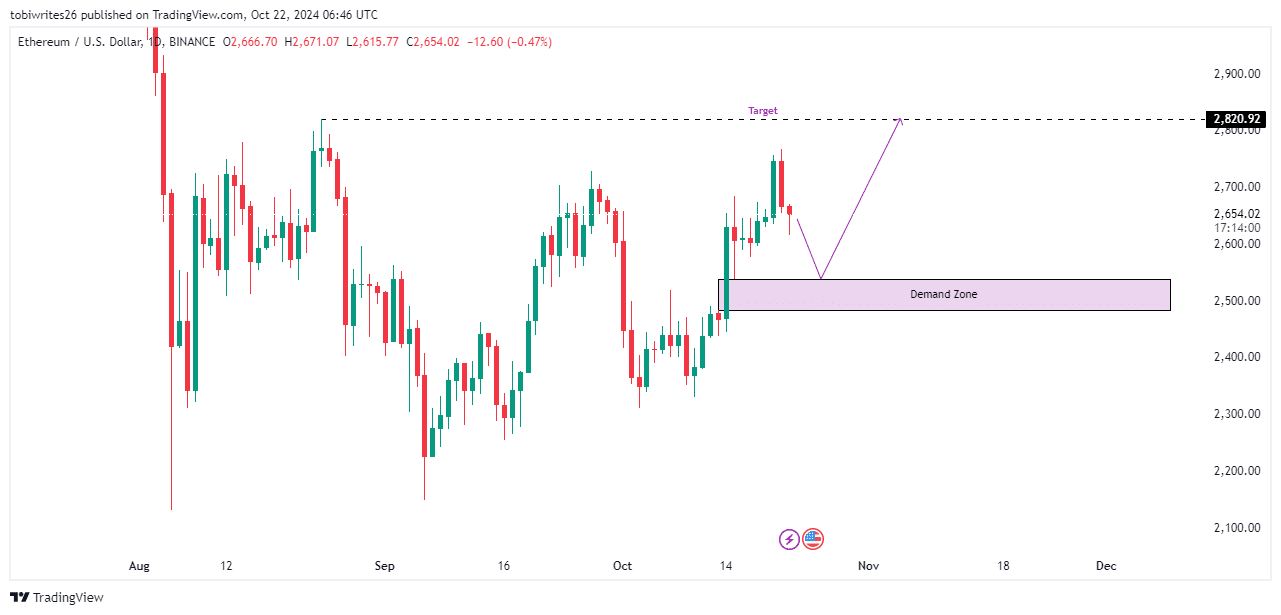

The ETH chart presently lacks bullish alerts, indicating a possible additional decline because it searches for an optimum degree of liquidity to assist a value enhance.

At current, the closest liquidity zone is the demand space spanning between $2,536.47 and $2,484.44. If the value enters this area, it might allow ETH to rally again to $2,820.92, which serves as a key goal.

Nevertheless, if ETH falls beneath this demand zone, it might set off a cease hunt—a tactic the place merchants search further liquidity earlier than making a ultimate rise.

Extended downward motion would recommend that ETH has entered a bearish pattern.

Merchants search momentum in ETH market

Latest buying and selling exercise signifies that the market is in search of momentum, suggesting a possible decline from its present value of $2,654.02.

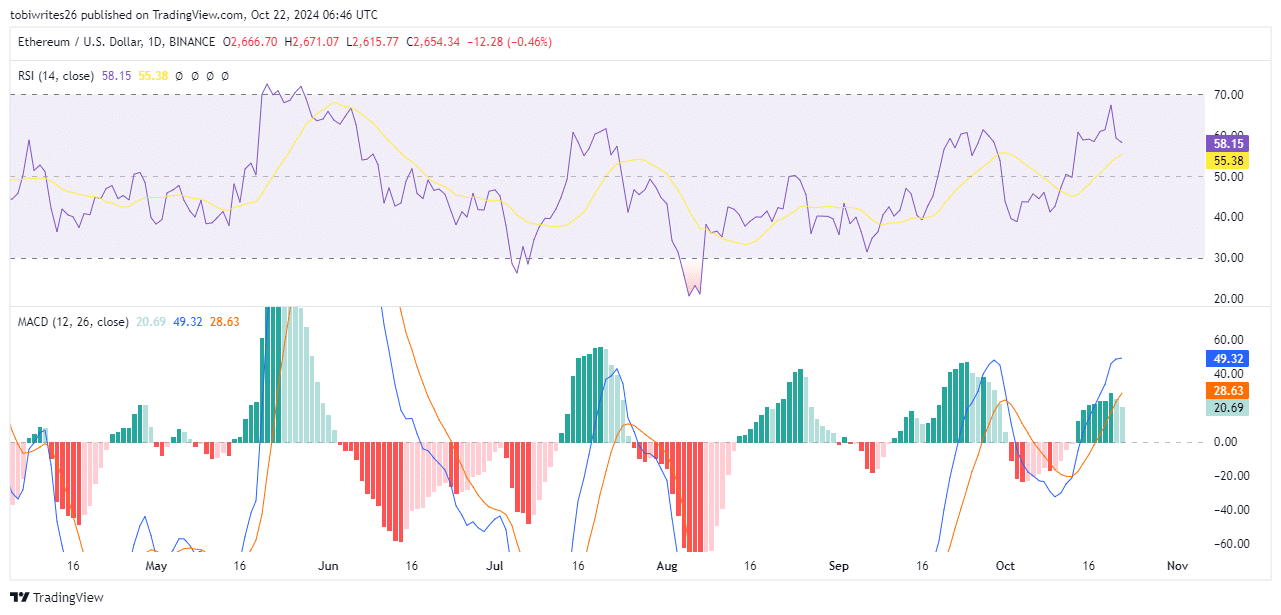

The Relative Energy Index (RSI) operates on a scale from 0 to 100, with 50 representing the impartial level. Readings above 50 signify constructive momentum, whereas values between 50 and 60 point out reasonable shopping for stress.

Conversely, readings beneath 50 replicate promoting stress, with a variety of 30 to 50 signaling reasonable promoting. Values exceeding 70 point out overbought situations, whereas these beneath 30 recommend oversold situations.

At present, ETH has an RSI studying of 58.15, however it’s trending downward, indicating that the value could decline because it seeks a requirement zone, despite the fact that it stays actively bullish.

Equally, the MACD, which stays in constructive territory, has additionally proven a notable decline in momentum, as indicated by the fading inexperienced bars on the chart.

This means that whereas the general market well being is sweet, shopping for stress is progressively diminishing.

Short-term retreat from sellers

Open Curiosity, an indicator used to evaluate dealer sentiment within the present market, reveals that merchants are predominantly positioning themselves to quick the asset.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

In response to Coinglass, Open Curiosity has declined to $13.56 billion, reflecting a 2.89% lower.

If this pattern continues, it means that promoting stress could drive the asset decrease, though it might nonetheless preserve a bullish pattern.