- Is a surge incoming for Bitcoin earlier than the upcoming U.S. elections?

- BTC might rally to $70K by the tip of October.

On the 14th of October, Bitcoin [BTC] rallied 5% and retested $66K as analysts linked the upswing to imminent U.S. elections.

Quinn Thompson, founding father of crypto hedge fund Lekker Capital, termed the most recent rally a “Trump bump,” citing growing odds of Trump profitable the U.S. elections.

However Kamala Harris’s current pledge to help a crypto regulatory framework has made some pundits consider that the 2024 elections might be a win-win for the business.

U.S. election issue

On its half, crypto buying and selling agency QCP Capital believed the rally was a part of historic tendencies forward of the U.S. elections.

“The timing forward of the U.S. elections mirrors historic patterns. In each 2016 and 2020, #BTC surged simply three weeks earlier than #Election2024 Day.”

In 2016, BTC hiked from $600 three weeks earlier than the U.S. elections and doubled by January 2017. Equally, BTC exploded from $11K earlier than the 2020 elections and hit $42K by January 2021.

Will the development repeat in 2024? AMBCrypto requested Bitget Analysis’s chief analyst, Ryan Lee, what his ideas had been,

Lee stated that BTC has remained resilient regardless of the strengthening U.S. greenback. This might sign a bullish part for the asset within the medium time period.

He projected BTC might stay range-bound or explode above $70K by the tip of October.

“Volatility within the crypto market will doubtless enhance forward of key occasions — the following November Fed assembly and the US elections on the similar time. BTC worth fluctuations might vary from $58,000 to $69,000.”

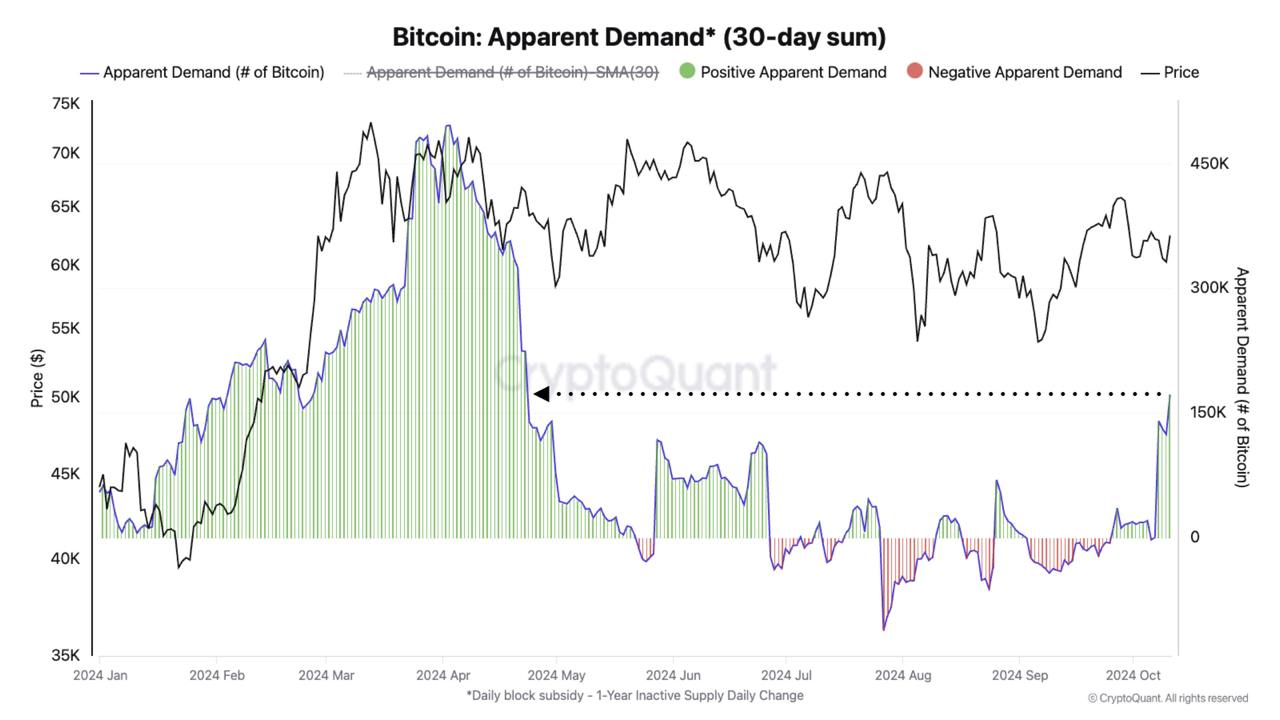

That stated, the demand for BTC has elevated up to now 30 days, hitting ranges final seen in April. This was a whole turnaround from the low demand in Q2/Q3, 2024.

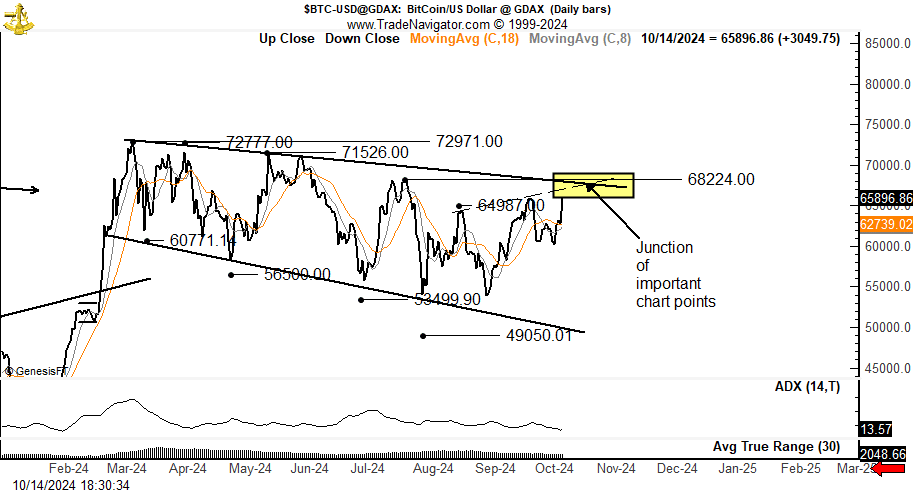

Apart from, the current BTC hike confirmed a better low development that might sign a possible market construction shift and an finish to the re-accumulation part witnessed since March.

However, famend analyst Peter Brandt believed a market construction shift might occur provided that BTC surged above $68.2K.

At press time, BTC was valued at $65.6K, about 12% beneath its ATH of $73.7K.