Ethereum is down when writing, mirroring the final efficiency throughout the board. The practically 2% drop within the crypto scene is because of the contraction of Bitcoin, Ethereum, and high altcoins. At current, the whole market cap is right down to $2.17 trillion. It might publish much more losses ought to bears press on, reversing the features of September.

Ethereum Underneath Stress, Will $2,350 Supply Assist?

Within the final week alone, CoinMarketCap information shows that Ethereum is down 10%, pushing losses under $2,400, a former assist, now resistance. Whereas it might seem that the sharp dump of the higher a part of this week is discouraging participation, some merchants are accumulating at round spot charges.

Associated Studying

IntoTheBlock data on October 3 exhibits that 1.89 million Ethereum addresses purchased 52 million ETH at across the $2,311 and $2,383 vary. That a considerable amount of consumers select to purchase, on common, at $2,350 means this can be a assist stage that merchants ought to intently watch.

Contemplating the variety of ETH amassed, sellers would wish to exert extra effort to interrupt under this stage, forcing the coin in the direction of $2,100 and August lows. Evaluating merchants’ motion and the September vary, the $2,350 stage falls at round 61.8% and 78.6% Fibonacci retracement ranges.

What’s Subsequent For ETH?

Technically, crypto costs, together with ETH, have a tendency to seek out assist round this Fibonacci retracement zone. Accordingly, how costs react between the $2,100 and $2,350 zone will doubtless form the medium to long-term pattern.

Associated Studying: What’s Holding Bitcoin Back? Analyst Says $71,000 Is The Magic Number

A refreshing bounce round this rising assist and Fibonacci retracement zone can be a large enhance. On this case, ETH might rally, even above $2,800, as bulls goal $3,500.

Conversely, any sharp dump under August and September lows might simply set off panic promoting. Out of this, ETH can droop under $2,100 and $2,000 and will fall to as little as $1,800, confirming losses of early August.

Contemplating the state of value motion, sellers have the higher hand. Over the previous few buying and selling periods, centralized exchanges have had huge outflows.

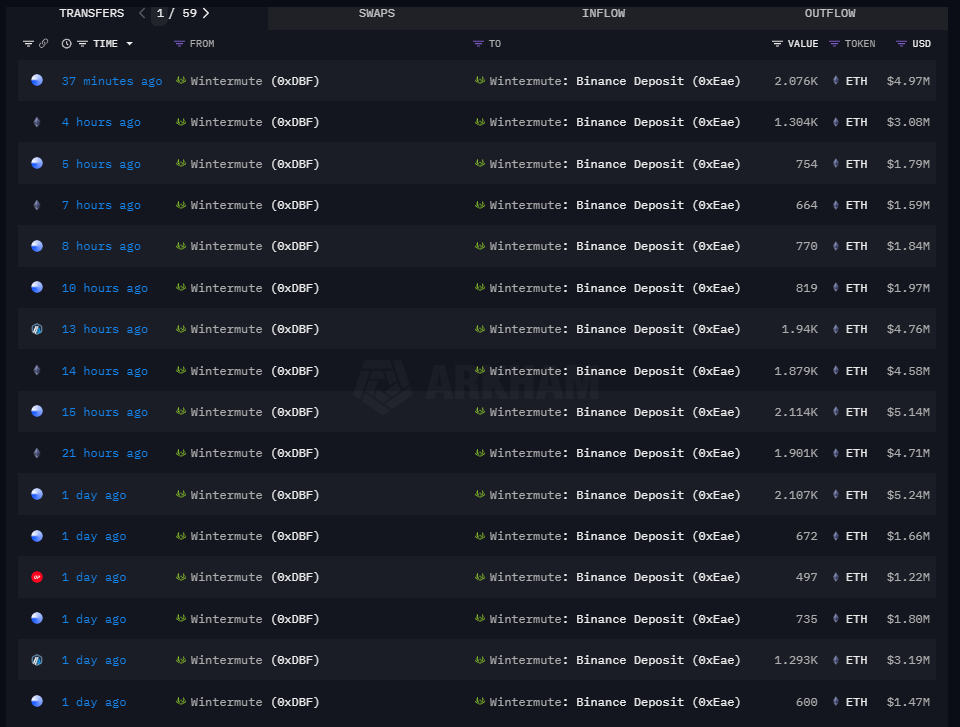

Earlier as we speak, The Knowledge Nerd revealed that Wintermute, a crypto market maker, moved 14,221 ETH to Binance, indicating that they may promote. In August, Wintermute and different main market makers, together with Jump Capital, bought over 130,000 ETH, forcing costs decrease.

Characteristic picture from DALLE, chart from TradingView