- Bitcoin flashes a number of indicators indicating that it’s again on a bearish leg at the least within the quick time period.

- Can Bitcoin align with market expectations regardless of kicking off October with some profit-taking?

Bitcoin [BTC] buyers have exhibited plenty of optimism about BTC in October, to the purpose that Uptober has been trending. This will should do with a number of elements comparable to decrease rates of interest, historic efficiency in October and BTC’s newest bullish efficiency.

Though the bullish expectations for Bitcoin in October are excessive, there are indicators that issues may end up totally different. For instance, a recent CryptoQuant analysis means that BTC’s newest highs noticed in direction of the top of September may mark its newest native excessive.

The evaluation was based mostly on BTC’s NVT golden cross and its current push above 2.2. One other evaluation means that Bitcoin will probably wrestle to take care of bullish momentum in October based mostly on historic efficiency.

In keeping with the analysis, Bitcoin rallied for 2 weeks after a serious charge minimize in 2019, adopted by two months of bearish efficiency.

These observations counsel that Bitcoin should be topic to promote strain regardless of the prevailing. That is already evident in BTC’s newest efficiency.

The cryptocurrency has already given up a few of its September positive aspects, indicating that some buyers have been taking income.

Bitcoin promote strain accelerates

Bitcoin lately threatened to dip beneath $60,000 on 1 October. It exchanged fingers at $61,430 at press time. It has to this point tanked by 7.8% from its highest worth in September.

This implies it’s on monitor to fall to the $59,580 and $57,940 worth vary as per the Fibbonacci retracement.

The pullback is sufficient indication that the post-rate minimize announcement hype has run its course. Nevertheless, this raises extra questions than solutions. Will demand resume if worth retests the Fibonnacci stage?

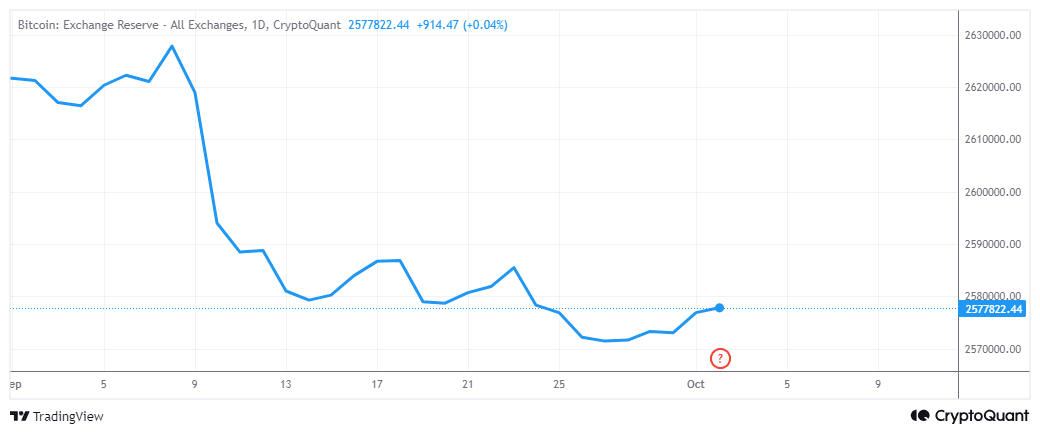

On-chain knowledge introduced data that was in line with the bearish consequence. For instance, Bitcoin trade reserves have maintained an general downtrend for the previous few months with slight upticks right here and there.

The Bitcoin trade reserves concluded September with a little bit of an uptick. This confirms that some cash have been shifting from non-public wallets to exchanges. Usually, that is in line with a resurgence of promote strain in the previous few days.

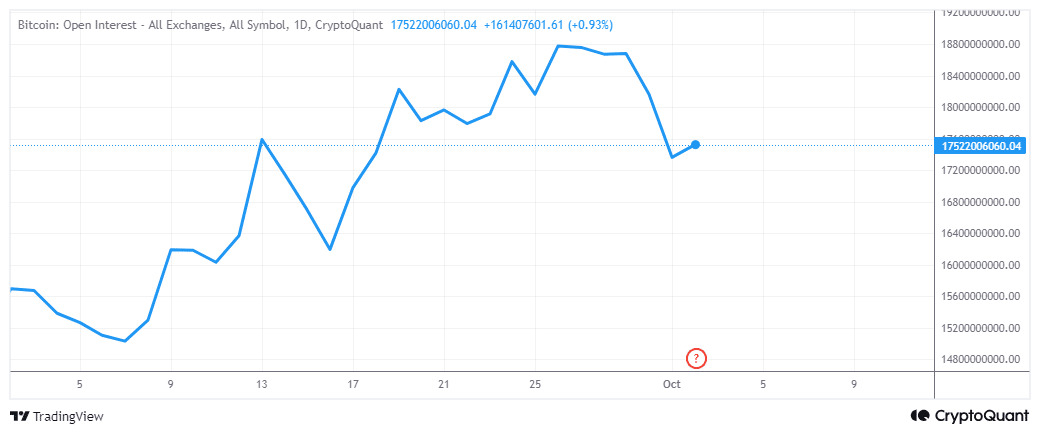

The trade reserve uptick was additionally in line with a dip in Bitcoin open curiosity since twenty sixth September. This confirms that the demand for Bitcoin within the derivatives section additionally slowed down.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The findings counsel a major chance that BTC might face extra promote strain within the quick run. As is at the moment the scenario however this doesn’t essentially present a transparent timeline.

It may very well be a quick pullback or change into an extended one relying on how issues will unfold.